Public and non-public societies: concepts and signs. Public Joint Stock Company (PJSC) is a competent replacement of the form of organization of activities in the form of OJSC

Paragraph 2 of Chapter 4 of the Civil Code contains general rules about business partnerships and companies. The general rules are contained in Articles 66-68, these articles have been amended from 01.09.14. Article 66 establishes the legal definition economic society- is a corporate commercial organization with a charter capital divided into shares; the property created at the expense of the founders' contributions belongs to him on the basis of the right of ownership.

Features of a business entity:

- 1. Availability of membership.

- 2. Availability authorized capital divided into a certain number of shares or shares.

- 3. Ownership of property by the society.

- 4. Members of the company have corporate rights in relation to the company.

- 5. Management is carried out by forming a general meeting, decisions are made by voting.

- 6. General legal capacity of a business entity.

Article 66.3 - public and non-public companies.

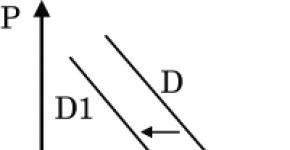

A new classification for Russian law into public and non-public societies is introduced. The meaning of the classification: to protect joint stock companies, whose shares are not publicly placed, from excessive regulation of joint stock legislation.

Criteria for classifying a business entity as public:

- 1. The presence in the company name of an indication of the publicity of the company.

- 2. Public placement of the company's shares on the stock exchange; public offering of securities convertible into shares.

These criteria are to be applied to those JSCs that were created before 09/01/14 and meet the criteria of publicity. The law established that only JSCs can be public, limited liability companies and JSCs can be non-public. The nature of legal regulation within public and non-public societies should differ significantly.

Public companies place shares on the stock exchange by open subscription, they have the opportunity to attract any third parties to participate in the society, which means that their actions can violate the rights and interests of an indefinite circle of persons. To prevent such violations, the rules regarding the regulation of corporate relations in public companies should be stricter.

Non-public societies involve close or predetermined circle of people to participate. The Civil Code in the new edition allows non-public companies to change the general rules established by law by special legislation, such changes are made in the constituent document - the charter. The decision to establish rules other than those provided for by the Civil Code must be taken by all members of the company unanimously. The Civil Code only defines the scope of the dispositiveness.

The Civil Code provides for the possibility for non-public companies to change the competence of the general meeting of participants - it can be both narrowed, i.e. some of the issues that are considered by the general meeting by law can be transferred to the management of a collegial management body (board of directors), or expanded, that is, issues that are not considered by the general meeting can be referred to the general meeting. The Civil Code has established a number of issues that cannot be referred to another body. Issues that the general meeting always decides:

- 1. Introduction of amendments to the charter.

- 2. Reorganization and liquidation.

- 3. Formation of management bodies (collegial and executive)

- 4. Determination of the number of par value of the category of declared shares, as well as determination of the rights that are granted by shares.

- 5. Increase of the authorized capital, disproportionate to the shares of the participants or at the expense of third parties.

- 6. Approval of internal documents that are not constituent documents.

Article 66.3 does not include the distribution of profits and losses in the list of issues that relate to the consideration of the general meeting. There is no clear-cut opinion in the literature regarding the possibility of transferring the issue of distribution of profits and losses to another authority. The Civil Code contains Article 67.1, Clause 2, and establishes the exclusive competence of the meeting of participants in a business company: exclusion of a participant from the company, distribution of profits and losses. The lecturer believes that here it should be said that there is a contradiction between norms 66.3 and 67.1.

The Civil Code allows the refusal to create a collegial body, provided that all the functions of such a body will be transferred to the collegial management body. In a non-public society, it is possible to exclude the audit commission from the body. The Civil Code allows you to establish a different procedure for preparing, convening and holding a general meeting of participants and shareholders.

Attention! Each electronic lecture notes are the intellectual property of their author and are published on the site for informational purposes only.

Ten key differences between a public JSC and a non-public JSC

Concepts of public and non-public societies

The concepts of public and non-public companies are enshrined in Article 66.3 of the Civil Code.

Public joint stock companies- these are societies that are based on shares (securities) with a large-scale free market. These are societies with an unlimited and dynamically changing membership.

Non-public joint stock companies- these are business entities based on shares that do not enter the organized circulation market.

Urgent message for a lawyer! The police came to the office

We have presented the main differences between public and non-public JSCs in a convenient table

№ |

The difference |

Public JSC |

Non-public JSC |

Norm of legislation |

| 1 | Placement and circulation of shares - the main difference | Shares and securities that are convertible into shares are placed by open subscription and publicly traded in accordance with the legislation on securities | Shares and securities cannot be placed by open subscription, they are not publicly traded |

|

The usual abbreviation OJSC began to disappear into oblivion - according to Federal Law No. 99 of 05/05/14, this organization is being replaced by public joint stock companies. It is worth figuring out if there are any differences in OJSC and PJSC, what are the characteristic features of this form of organization of activities and who can now become a shareholder. And today we will talk about the number of participants in a public joint stock company, governing bodies, as well as how to open a public joint stock company (it).

Public joint stock company as a type of legal entity

Concept and essence

In fact, PJSC is a complete analogue of an open joint-stock company - now it is a more precise form of organization of activities, indicating the degree of publicity.

PJSC (Public Joint Stock Company) may differ:

- Choice of activity.

- The number of shareholders.

- Management organization.

In all other cases, all PAOs have similarities. The signs that characterize a public joint-stock company are quite specific; they cannot be confused with other forms of organization of activities.

Read about the joint stock company below.

The video below talks about how joint stock companies are being replaced by PJSCs and similar organizations:

Characteristics

The first thing that distinguishes PJSC from, and several other forms of organization of activities, is the presence of shares. At the same time, it also has them, but here too, the PJSC has its own characteristics.

Two characteristic features PJSC:

- Free sale of shares.

- Unlimited number of shareholders.

Has a public joint stock company (PJSC) also has its pros and cons:

The disadvantages of this form are the liability for the obligations of personal property for the debts of the joint-stock company and the need for one external audit of activities every year. It is important to know that personal responsibility directly depends on the size of the block of shares.

There are much more advantages to this form of organization - in fact, any shareholder is a co-owner of the business. Anyone can become a member of a PJSC with a small investment, while not having any entrepreneurial skills.

For the main initiators of the creation of a public joint-stock company, such an approach to organizing activities makes it possible to attract additional material resources to the business, maximizing the chances for the successful development of the enterprise.

A public joint stock company is somewhat different from other forms of entrepreneurship in its management bodies. These companies have additional opportunities.

Governing bodies

The supreme governing body is the general meeting of shareholders. At PJSCs, their meetings are now forced to be attended by registrars or notaries. Depending on the type of activity, the size of the company and the availability subsidiaries different structure of governing bodies is possible.

The basis of the management structure looks like this:

- General Meeting of Shareholders

- Supervisory Board (directors)

- General director

- Executive Directorate

- Audit committee.

The structure can be more ramified - several directors are allowed by law. It is also possible to participate in the management bodies legal entities.

Now the number of members of the collegial management body cannot be less than five members. All members of the board cannot participate with their shares during the decision-making at the general meeting of members of the PJSC. These aspects are usually reflected in the incorporation documents.

About the constituent documents for a public joint-stock company, the number, composition and responsibility of participants, read below.

A specialist will tell you about registration of a PJSC in the video below:

Constituent documents and participants

In the documents of the PJSC and its corporate name, the need to indicate the publicity of the organization is legally enshrined. The main constituent document of a PJSC is the charter of the organization, which determines the full and abbreviated name of the company, the rights of shareholders, the size of the authorized capital, the management structure and much more.

Previously, OJSC participants had the opportunity to preferentially purchase shares by persons who were already their holders. Public joint-stock companies are now guided only by federal laws; now they cannot provide for such specific features of the purchase in their charters. This makes it possible for anyone to purchase shares without regard to the existing shareholders.

PJSC shareholders have the same rights as participants in open joint stock companies. This does not depend on the size of the block of shares. They can:

- Receive dividends

- Examine a number of documents

- Be one of the governing bodies

- Dispose of your own shares

- Participate in the general meeting of shareholders

- In the event of liquidation of the PJSC, claim part of the property.

Along with this, the participants also have responsibility - the debts of the PJSC are distributed to its participants according to the volume of their block of shares. Members of the organization are responsible with their personal funds if the property of the PJSC is not enough to pay off debt obligations. At the same time, the personal obligations of shareholders do not play a role for the joint-stock company, the PJSC is not responsible for the debts of its members.

Read about the minimum size of the authorized capital of a public joint stock company below.

Capital formation

The capital of a PJSC is provided by its shareholders in different proportional shares. For a public joint-stock company, the minimum authorized capital is set at 100,000 rubles. Property contributions are also acceptable - their cost is assigned by an independent appraiser.

The capital of a PJSC is provided by its shareholders in different proportional shares. For a public joint-stock company, the minimum authorized capital is set at 100,000 rubles. Property contributions are also acceptable - their cost is assigned by an independent appraiser.

According to the changes from 2014, now 3/4 of the authorized capital must be paid before registration of the PJSC. The rest is paid throughout the year.

Public Joint Stock Company replaced OJSC. In this organizational form of activity, new nuances have appeared, but the principle has remained the same - shareholders form capital, have the right to vote and the opportunity to receive dividends. They also retained the responsibility to repay the debt obligations of the joint-stock company. The governance structure has been bifurcated, and data openness has become even more public.

Until the full amount of the authorized capital is paid for, it is impossible for a PJSC to organize an open sale of its shares.

What joint stock companies can hide, this video will tell:

Since September 1, 2014, changes have taken place in the Civil Code of the Russian Federation, approved on May 5, 2014 by federal law No. 99-FZ. According to this document, in Chapter 4 of the Civil Code of the Russian Federation, amendments are made regarding the organizational and legal status of joint stock companies. Namely, such forms of organizations as OJSC and CJSC are excluded from civil legislation. As an innovation, public and. During the transition period, joint-stock organizations open type should receive public status, and closed JSCs should be transformed into an unincorporated form.

What is a public company?

Public companies are joint stock companies whose securities are freely traded on the stock market. Such organizations are required to disclose information on owners and affiliates, as well as on material facts that may affect the issuer's activities. This is necessary in the interests of potential shareholders to increase the transparency of the process of investing in the securities of the firm.

Public societies are characterized by the following features:

- the company's shares can be purchased and sold freely by an unlimited number of persons;

- information on the structure of ownership and the results of the economic activity of the joint-stock company is in open sources;

- securities of a public company are placed on a stock exchange or sold by open subscription, including with the use of advertising;

- data on transactions with the company's shares (their quantity and price) are available to all market participants and can be used to analyze the dynamics of the value of securities.

Conditions for classifying a company as a public company

According to the new rules (Art. 66.3. No. 99-FZ), a joint-stock company is recognized as public in 2 cases:

- The company issues its shares for free circulation by public subscription or placement on the stock exchange, in accordance with the law "On the Securities Market".

- The name and charter indicate that the organization is public.

If an already operating company has signs of an open joint-stock company, it receives public status, regardless of whether it is mentioned in the name of the company. CJSC and other organizations that do not have the indicated signs are recognized as non-public.

From the moment of assignment of the status, the activities of public companies in Russia are regulated by the laws on joint stock companies (No. 208-ФЗ dated December 26, 1995) and on securities (No. 39-ФЗ dated April 22, 1996).

Consequences of acquiring public status

The publicity of a society implies increased responsibility and stricter regulation of its functioning, since it affects property interests a large number shareholders.

- According to clause 7 of Article 3 of Law No. 99-FZ, the names and constituent documents of legal entities must be brought in line with the new edition of the Civil Code. This means that open joint stock companies operating as of September 1, 2014 must register in the Unified State Register of Legal Entities changes in their corporate name, including an indication of publicity. At the same time, there is no need to make adjustments to the documents of title, if they do not contradict the norms of the Civil Code - this can be done when the constituent documents of the JSC are changed for the first time.

- From the moment of fixing the publicity status in the name of the organization in the Unified State Register of Legal Entities, it acquires the right to place its shares on the securities market.

- A public company must have a collegial management body of at least 5 members.

- The maintenance of the register of shareholders of a public JSC is transferred to an independent licensed company.

- The organization does not have the right to interfere with the free circulation of its shares: to impose restrictions on the size and value of the block in the hands of one investor, to give individuals a pre-emptive right to purchase securities, to prevent in any way the alienation of shares at the request of the shareholder.

- The issuer is obliged to post information on its activities in the public domain:

- annual report;

- annual accounting statements;

- list of affiliated persons;

- JSC charter;

- decision on the issue of shares;

- notification of the meeting of shareholders;

- other data provided by law.

In fact, the changes in the legislation do not materially affect those joint-stock companies that were open in their legal form and in essence. Until September 2014, the majority of CJSCs and OJSCs that did not place their securities on the stock market, but placed them among a circle of limited persons, existed as joint stock companies only “on paper”. In fact, they were limited liability companies, where, instead of shares in the authorized capital, the participants acquired shares. Now this position of non-public organizations is reinforced de jure.

The abbreviations CJSC and OJSC are familiar even to those who are not related to business, so their decoding is not difficult. This is different shapes joint stock companies (JSC) - closed and open, differing from each other in the ability to sell shares and manage the company. Several years ago, a legislative reform was carried out, giving more correct names to these business entities.

What is NAO

In 2014, the definitions concerning the organizational and legal forms of legal entities were revised. Federal Law No. 99 of 05/05/2014 amended the legislation and abolished the concept of CJSC. At the same time, a new division was introduced for business entities, distinguishing them by the criterion of openness to third parties and the possibility of third-party participation.

Article 63.3 of the Civil Code (CC) defines new concepts. According to the article, business companies are:

- Public (software). These are companies whose shares are freely tradable in accordance with Law No. 39 of 22.04.1996 "On the Securities Market". An alternative requirement for categorizing an organization as a software is the publicity in the title.

- Non-public (BUT). All others that are not public.

The legislative formulation does not give a clear definition of a non-public society, and relies on the exclusionary principle (everything that is not software is a non-software). Legally, this is not very convenient, because it creates a heap of wording when trying to define terms. The situation is similar with the establishment of the value of a non-public joint stock company (NAO). It can only be defined by analogy (NAO is an AO with signs of OI), which is also uncomfortable.

But the legal procedure for the transition to new definitions is simple. Law No. 99-FZ recognizes as public joint stock companies all JSCs created before September 1, 2014 and meeting the qualification criteria. And if such a company as of July 1, 2015 has an indication of publicity in its charter or name, and in fact is not a PJSC, then it is given five years to start an open circulation of securities or re-register the name. This means that July 1, 2020 is the final date when, according to the law, the transition to the new wording should be completed.

Organizational and legal form

Public and non-public joint stock companies are distinguished according to article 63.3 of the Civil Code. The defining feature is the free circulation of the company's shares, therefore it would be a mistake to mechanically translate the old definitions into new ones (for example, to assume that all OJSCs automatically become PJSCs). According to the legislation:

- Public joint stock companies include not only OJSCs, but also CJSCs that have openly placed bonds or other securities.

- The category of non-public JSC includes joint stock companies closed type, plus - JSCs that do not have shares in circulation. At the same time, the category of NO will be even wider - in addition to NAO, this also includes LLC (limited liability companies).

Taking into account the specific nature of a closed joint-stock company, which simplifies the task of concentrating assets in the hands of a group of persons, its unification into one group with an LLC is quite logical. The legislative need for the creation of a category of non-governmental organizations becomes extremely clear - this is the unification of business entities into one group, excluding outside influence. At the same time, a non-public limited liability company can be transformed into an NAO without any special difficulties (the reverse process is also possible).

The difference between a public joint-stock company and a non-public one

Comparing PJSC and NAO with each other, it is important to understand that each of them has its own advantages and disadvantages, depending on specific situation... For example, public joint stock companies provide more opportunities for attracting investment, but at the same time they are less stable in corporate conflicts than non-public joint stock companies. The table shows the main differences between the two types of business entities:

| Characteristics | Public JSC | Non-public JSC |

| Name (until 07/01/2020, the previous wording will be recognized by law) | A mention of public status is mandatory (for example, PJSC "Vesna") | An indication of the lack of publicity is not required (for example, JSC "Leto") |

| Minimum size authorized capital, rubles | 1000 minimum wages (minimum wages) | |

| Number of shareholders | Minimum 1, maximum unlimited | Minimum 1, when the number of shareholders starts to exceed 50 people, re-registration is required |

| Stock trading on the stock exchange | ||

| Possibility of open subscription for the placement of securities | ||

| Preferential acquisition of shares | ||

| Presence of a board of directors (supervisory board) | You can not create |

Characteristics and distinctive features

From the point of view of legislation, a non-public joint stock company is a special category of business entities. The main distinguishing features are:

- Restrictions on the admission of participants. It can only be founders. They are the only shareholders, since the company's shares are distributed only among them.

- The authorized capital has a lower limit of 100 minimum wages, which is formed by depositing property or Money.

- The registration of a non-public JSC is preceded by the preparation of not only the company's charter, but also a corporate agreement between the founders.

- The management of the NAO is carried out by means of a general meeting of shareholders with a notarial fixation of the decision.

- The amount of information that a non-public JSC must post in the public domain is much less than that of other types of JSC. For example, non-public joint stock companies, with a few exceptions, are exempted from the obligation to publish annual and accounting reports.

Disclosure of information about activities to third parties

The principle of publicity implies the posting of information about the company's activities in the public domain. Some of the information that a public company must publish in print (or on the Internet) includes:

- Annual report of the company.

- Annual reporting of the accounting department.

- List of affiliated persons.

- Statutory documentation of a joint stock company.

- Decision on the issue of shares.

- Notification of the meeting of shareholders.

For non-public joint stock companies, these disclosure obligations apply in an abbreviated form and apply only to organizations with more than 50 shareholders. In this case, the following is published in publicly available sources:

- Annual report;

- Annual financial statements.

Certain information about a non-public JSC is entered into the Unified State Register of Legal Entities (USRLE). These data include:

- information on the value of assets as of the last reporting date;

- information on licensing (including suspension, re-issuance and termination of a license);

- notification of the introduction of supervision as determined by the arbitration court;

- subject to publication in accordance with Articles 60 and 63 of the Civil Code of the Russian Federation (notification of the reorganization or liquidation of a legal entity).

The charter

In connection with the legislative changes caused by the emergence of new organizational and legal forms (public and non-public joint stock companies), JSCs must carry out a reorganization procedure with amendments to the charter. For this, a shareholders' council is convened. It is important that the changes you make do not contradict Federal law No. 146 of 27.07.2006 and necessarily contained a mention of the non-publicity of the organization.

The typical structure of the charter of a non-public joint-stock company is determined by Articles 52 and 98 of the Civil Code of the Russian Federation, as well as by Law No. 208 of December 26, 1995 "On Joint Stock Companies". The mandatory information that must be indicated in this document includes:

- the name of the company, its location;

- information about placed shares;

- information about the authorized capital;

- the amount of dividends;

- the procedure for holding a general meeting of shareholders.

Organization management and governing bodies

In accordance with current legislation, the charter of a joint stock company must contain a description organizational structure companies. The same document should consider the powers of the governing bodies and determine the procedure for making decisions. The organization of management depends on the size of the company, it can be multilevel and has different types:

- General Meeting of Shareholders;

- supervisory board (board of directors);

- collegial or sole executive body (board or director);

- audit committee.

Law No. 208-FZ defines the general meeting as the highest governing body. With its help, shareholders exercise their right to manage the joint-stock company by participating in this event and voting on agenda items. Such a meeting can be annual or extraordinary. The charter of the company will determine the boundaries of the competence of this body (for example, some issues can be resolved at the level of the supervisory board).

Due to organizational difficulties, the general meeting cannot resolve operational issues - a supervisory board is elected for this. Some of the issues that this structure addresses include:

- determination of priorities for the activities of a non-public joint stock company;

- recommendations on the amount and procedure for the payment of dividends;

- increasing the authorized capital of a joint stock company through the placement of additional shares;

- approval of major financial transactions;

- convocation of a general meeting of shareholders.

The executive body can be sole or collegial. This structure is accountable to the general meeting and is responsible for the improper performance of its duties. At the same time, the competence of this body (especially in a collegial form) includes the most difficult questions current activities of a non-public joint stock company:

- development of a financial and business plan;

- approval of documentation on the company's activities;

- consideration and decision-making on the conclusion of collective agreements and agreements;

- coordination of internal labor regulations.

Issue and placement of shares

The process of registering a joint stock company is accompanied by the introduction of special securities into circulation. They are called shares, and according to Law No. 39-FZ, they give the owner the right to:

- receive dividends - part of the company's profits;

- participate in the management process of a joint stock company (if the security is voting);

- ownership of part of the property after liquidation.

Putting securities into circulation is called an issue. In this case, shares may have:

- documentary form, confirming ownership with a certificate;

- uncertified, when an entry about the owner is made in a special register (in this case, the concepts of "securities" and "issue shares" are conditional).

The issue is followed by the distribution (placement) of shares among the owners. The process is fundamentally different for PJSC and NAO, implementing different ways making a profit from these companies. A wide distribution channel for securities in the first case implies a more thorough control of activities by government agencies... The table shows the differences between public and non-public joint stock companies in the placement of shares:

| Public JSC | Non-public JSC |

|

| Registration of the issue of shares | It is necessary to register a public prospectus for the issue of securities (a special document with information about the issuer and the issue of shares). | Requires charter and agreement of founders |

| Circle of shareholders | Is not limited | No more than 50 people |

| Placement of shares | Publicly on the stock exchange and other securities markets | Among shareholders (or under their control), there is no open subscription and free circulation on exchanges |

| Shareholder's ability to alienate (sell) shares | Under the control of other members of the JSC | Free |

Certification of JSC decisions and keeping the register of shareholders

The general meeting of shareholders is the highest board of the company, which determines further development organizations. At the same time, the legally correct drawing up of the protocol and certification of decisions taken, relieving the participants, board members and the manager from mutual claims and disputes about forgery. According to Law No. 208-FZ, the protocol documentation must contain:

- time and place of the general meeting of shareholders of a non-public JSC;

- the number of votes held by the holders of voting shares;

- the total number of votes of shareholders who participate;

- indication of the chairman, presidium, secretary, agenda.

Using the services of a notary will make the protocol more secure and increase the level of reliability of this document. This specialist must personally attend the meeting, and record:

- the fact of making specific decisions specified in the minutes of the meeting;

- the number of non-public JSC shareholders present.

An alternative to contacting a notary will be the services of a registrar who maintains a register of shareholders. The procedure and order of confirmation in this case will be similar. According to the legislation, since October 1, 2014, maintaining the register of shareholders has become possible only on a professional basis. To do this, joint stock companies must turn to the services of companies with a specialized license. Self-maintenance of the register is punishable by a fine of up to 50,000 rubles for management, and up to 1,000,000 rubles for legal entities.

Change of organizational form

The reform of joint stock companies, which began in 2014-2015 by Law No. 99-FZ, should be completed in 2020. By this time, all official company names must be re-registered in the form prescribed by law. Depending on the availability of publicity, the former CJSC and OJSC are transformed into PJSC and JSC. Indication of non-publicity is not mandatory by law, therefore, the abbreviation NAO may not be used in the official details of the company, and the presence of shares in free circulation makes it possible to dispense with the reduction of PJSC.

The legislation allows changing the form of ownership from PJSC to NAO and vice versa. For example, in order to transform a Non-Public JSC, it is necessary:

- Increase the authorized capital if it is less than 1000 minimum wages.

- Conduct inventory and audit.

- Develop and approve a modified version of the charter and related documents. If necessary, the organizational and legal form is renamed to PJSC (according to the law, this is not mandatory if there are shares in free circulation).

- Re-register.

- Transfer property to a new legal entity.

Preparation of constituent documents

Special attention when re-registering NAO, attention should be paid to the correct preparation of documentation. Organizationally, this process falls into two stages:

- Preparatory part. It implies filling out an application in the R13001 form, holding a meeting of shareholders and preparing a new charter.

- Registration. At this stage, the details of the company are changed (a new seal and forms will be required), which should be warned about the counterparties.

Advantages and Disadvantages

If we compare the capabilities of PJSC and NAO, then each of them has its pros and cons. But, depending on the specific business situation, this or that option will be suitable. Non-public joint stock companies have the following advantages:

- The minimum size of the authorized capital is 100 minimum wages for NAO (for a Public JSC, this figure is 10 times higher). But this plus immediately becomes a minus when compared with a similar indicator for an LLC - 10,000 rubles, which makes the form of a limited liability company more accessible for small businesses.

- A simplified form of purchasing shares. State registration of the purchase and sale agreement is not required, you only need to make changes to the register.

- Great freedom in company management. This is a consequence of the limited circle of shareholders.

- Disclosure Restrictions. Not all shareholders want information about their share in the authorized capital or the number of shares to be available to a wide range of people.

- Less risky investments for investors than in the case of a public joint stock company. Absence open bidding shares are good protection from the unwanted possibility of buying a controlling stake by a third party.

- Lower costs of office work than PJSC. The requirements for non-public documentation are not as serious as for the one to be made public.

If we compare it with a public joint-stock company, then non-public joint-stock companies have a number of disadvantages. These include:

- The closed nature greatly limits the possibilities for attracting third-party investments.

- The process of creating a company is complicated by the need for state registration of the issue of shares (this additionally leads to an increase in the authorized capital).

- The decision making process can be in the hands of a small group of people.

- Restrictions on the number of shareholders at 50 compared to the unlimited number of a public JSC.

- Difficulties with the withdrawal from the membership and sale of their shares.

Video