Increase in the minimum wage from 01.07. Minimum wage

minimum wage ( minimum size wages)- the most important indicator on which the payments to employees depend, it directly affects the calculation of salaries and benefits to employees.

The article will help you learn how to take into account surcharges, allowances for an employee's salary when checking whether his salary is in line with an increase in the minimum wage.

to the menu

Minimum wage for 2019 by region: table

In addition to the federal minimum wage, the regions set their own indicator. Make sure that the salaries in the organization are not lower than the regional minimum wage. For violation of the labor inspectors of the organization and the head.

The values of the regional minimum wage for the North-Western, Southern, North Caucasian, Ural, Siberian, Far Eastern, Central federal districts are given.

See the minimum wage in your area

in .PDF format 232 KB as of 11/26/2018

- on 14.08.2018

- on 25.07.2018

- as of 06/20/2018

- as of 09.06.2018

- as of 01.05.2018

to the menu

Minimum wage Moscow 2019

Minimum wage in Moscow reviewed quarterly and subject to size. If it decreases, then the size of the minimum wages is kept at the same level. If it increases, then from the first day of the month following the month when the Moscow government decree on the establishment of a living wage for the able-bodied population comes into force, the minimum wage also increases. This is stated in paragraphs 3.1.1 and 3.1.2 of the Decree of the Government of Moscow dated December 15, 2015 No. 858-PP “On the draft Moscow tripartite agreement for 2016-2018 between the Government of Moscow, Moscow associations of trade unions and Moscow associations of employers”.

- From January 1, 2011, the minimum wage = 10 400 rubles

- From July 1, 2011, the minimum wage = 11 100 rubles

- From January 1, 2012 - 11300 rubles,

- from July 1, 2012 - 11700 rubles.

- from July 1, 2013 - 12,200 rubles.

- from January 1, 2014 - 12600 rubles.

from July 1, 2014 - 12850 rubles. - from June 1, 2014 - 14,000 rubles.

- from January 1, 2015 - 14500 rubles.

- from April 1, 2015 - 15,000 rubles.

- from June 1, 2015 - 16500 rubles.

- from November 1, 2015 - 17300 rubles.

- from October 1, 2016 - 17561 rubles.

- from July 1, 2017 - 17642 rubles.

According to the Decree of the Government of Moscow dated 13.06.17 No. 355-PP and the tripartite agreement between the Government of Moscow, the Moscow Association of Trade Unions and the Moscow Association of Employers dated 15.12.15 No. 858-PP, - from October 1, 2017 - 18742 rubles.

Decree of the Government of Moscow dated September 12, 2017 No.

From October 1, 2017, the minimum wage in Moscow will increase by 1,100 rubles - from 17,642 rubles to 18,742 rubles. This is provided for by the draft tripartite agreement between the Government of Moscow, the Moscow Association of Trade Unions and the Moscow Association of Employers of December 15, 2015 No. 858-PP and the Decree of the Moscow Government of September 12, 2017 No. 663-PP.

How the minimum wage is related to the living wage

The minimum wage in Moscow is tied to the subsistence level. If the cost of living becomes higher, then from the next month the minimum wage also increases (clauses 3.1.1, 3.1.2 of the Decree of the Government of Moscow of December 15, 2015 No. 858-PP). The cost of living in the II quarter of 2017 in Moscow was equal to 18,742 rubles - Decree of the Government of Moscow dated September 12, 2017 No. 663-PP. In this regard, from October 1, 2017, the minimum wage is 18,742 rubles.

What does the metropolitan minimum wage include

The new minimum wage from October 1 (18,742 rubles) should already include all types of bonuses and additional payments to employees, except for additional payments:

- for work with harmful and hazardous conditions labor

- for overtime work;

- for work at night;

- for work on weekends or holidays;

- for the combination of professions.

It is also important that with the new Moscow minimum wage from October 1, 2017, you need to compare the amount before deducting personal income tax. That is, if the employee worked the full norm of working hours for October. This means that he will receive at least 16,305.54 rubles “in his hands”. (18,742 rubles - (18,742 rubles x 13%).

How to apply the new minimum wage

Any subject of the Russian Federation (including Moscow) may set its own minimum wage. But it cannot be lower than the minimum wage approved by federal law (Article 133.1 Labor Code RF). From July 1, 2017, the federal minimum wage is 7,800 rubles.

If the salary in Moscow for accrual for October, November and December 2017 turns out to be lower than the minimum wage (18,742 rubles), then the employee must be paid extra. And since October 1, 2017. There are two ways to set up a surcharge:

- increase salary;

- establish in a local act (for example, a separate order or Regulation on wages) an additional payment to the minimum wage. That is, to directly prescribe that employees are given an additional payment up to the regional minimum wage. Then there is no need to revise salaries and change employment contracts.

An employee whose salary in Moscow is less than the new minimum wage may demand:

- additional payment for the period of validity of the new minimum wage from October 1, 2017;

- compensation for delayed payment from October 1, 2017 (Article 236 of the Labor Code of the Russian Federation).

The minimum wage in Moscow since October 1, 2017 does not affect the amount of benefits. Benefits are calculated from the federal, not the regional minimum wage.

If the salary is less than 18,742 rubles

If the Moscow salary for October, November and December 2017 is lower than the minimum wage, then the employer may be held administratively and criminally liable. A fine in the amount of 1,000 to 5,000 rubles can be imposed on an individual entrepreneur or director of an organization, and from 30,000 to 50,000 rubles on an organization. (part 1 of article 5.27 of the Code of Administrative Offenses of the Russian Federation).

For a repeated violation, directors can be fined from 10,000 to 20,000 rubles. or be disqualified for a period of one to three years. Penalty for individual entrepreneurs for repeated violation: from 10,000 to 20,000 rubles, for a company - from 50,000 to 70,000 rubles. (part 4 of article 5.27 of the Code of Administrative Offenses of the Russian Federation).

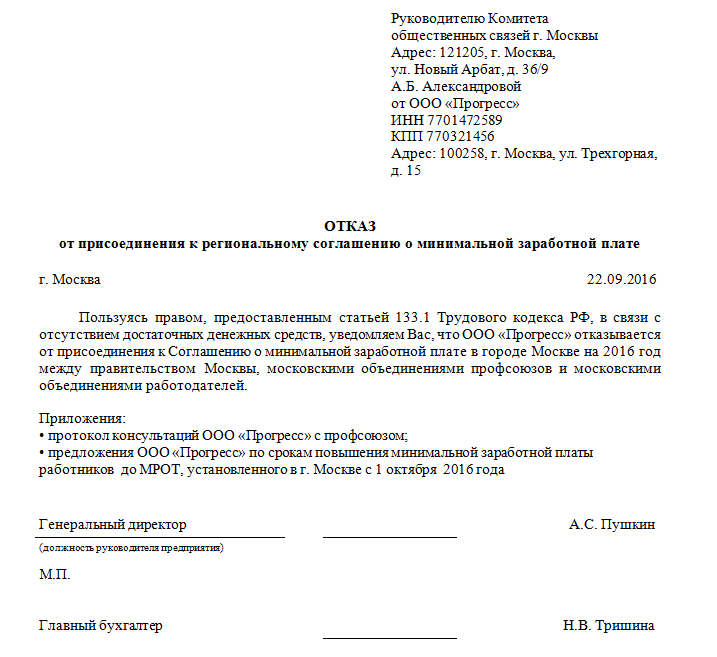

Refusal of the employer from the new minimum wage

Any employer has the right to refuse the application of the Moscow minimum wage. To do this, you need to draw up and send a reasoned refusal to the local branch of the Committee on Labor and Employment. The term is 30 calendar days from the date of publication of the tripartite agreement on the regional minimum wage (Article 133.1 of the Labor Code of the Russian Federation).

At the same time, the refusal must be motivated, that is, you will need to indicate the reasons why your organization does not want to pay its employees the regional “minimum wage”. As such reasons, one can indicate, for example, “crisis”, “few orders”, “risk of mass dismissal of employees”. In Moscow, you need to send a refusal to the tripartite commission at the address: 121205, Moscow, st. New Arbat, 36/9.

An employer who refuses the minimum wage in Moscow in time has the right to adhere to the federal minimum wage. Now it is 7800 rubles.

However, please note that paragraph 8 of Article 133.1 of the Labor Code of the Russian Federation obliges the employer to attach a set of documents to the refusal, among which are proposals on the timing of raising the minimum wage of employees to the amount stipulated by the agreement. That is, even a timely refusal does not mean that you will not have to pay the new minimum wage, established from October 1, 2017. The employer simply has the right to delay its introduction.

Also, Article 133.1 of the Labor Code of the Russian Federation gives the Moscow authorities the right to invite representatives of an employer who has refused to accept a new minimum wage from October 1, 2017, for consultations. That is, the rejection of the Moscow minimum wage threatens to clash with administrative resources.

What approved minimum wage is valid from July 1, 2017 in Russia? How will the new minimum wage affect benefits and wages? Will the benefits change from July 1, 2017? You will learn the new size of the minimum wage from this article.

Minimum wage from July 1, 2017

Since July 1, 2017, the minimum wage in Russia has increased and its size is 7,800 rubles. This is provided for by the Federal Law of December 19, 2016 No. 460-FZ

"On Amendments to Article 1 federal law"On the Minimum Wage".

Note that the last time the minimum wage was increased from July 1, 2016 to 7,500 rubles (Federal Law, Article 1 of Federal Law No. 164-FZ of June 2, 2016). Here is a table with an increase in the minimum wage in recent years:

Minimum wage from July 1, 2017 and wages

The minimum wage is the minimum wage that an organization or individual entrepreneur (employers) must accrue to employees for a month they have fully worked (Article 133 of the Labor Code of the Russian Federation). However, keep in mind that an employee can receive less than the minimum wage “on hand” - minus personal income tax and other deductions, such as alimony. Accordingly, from July 1, 2017, it is impossible to pay less than 7,800 rubles.

At the same time, it is worth noting that the salary of employees from July 1, 2017 may be less than 7800 rubles. After all, the total salary cannot be less than the minimum wage, which includes (Article 129 of the Labor Code of the Russian Federation):

- remuneration for work;

- compensation payments, including surcharges and allowances;

- incentive payments (bonuses).

Minimum wage in the regions from July 1, 2017

It is worth recalling that from July 1, 2017, regional authorities can establish in a special agreement their own minimum wage that exceeds the federal minimum wage (Article 133.1 of the Labor Code of the Russian Federation). However, the regional minimum wage can be waived. For these purposes, it will be necessary to issue a reasoned refusal and send it to the local branch of the Committee on Labor and Employment.

In accordance with Part 1 of Art. 133.1 of the Labor Code of the Russian Federation in a constituent entity of the Russian Federation, a regional agreement may establish a different amount of the minimum wage. It should not be lower than the minimum wage approved by federal law (part 4 of article 133.1 of the Labor Code of the Russian Federation).

Employers are considered to have acceded to the regional agreement on the minimum wage if, within 30 calendar days from the date of its publication, they have not sent a written reasoned refusal to join it to the Ministry of Labor of Russia. In this case, the organization is obliged to comply with all the provisions of the regional agreement (part 8 of article 133.1 of the Labor Code of the Russian Federation). This means that the minimum wage set by the regional agreement is mandatory for the employer.

Minimum wage from July 1, 2017 for benefits

From July 1, 2017, to calculate benefits, take into account the federal minimum wage -7800 rubles. This minimum wage affects the amount of benefits in two cases:

- the work experience of the employee is less than six months;

- the employee's salary is below the minimum wage.

If the salary is below the minimum wage: consequences

If, from July 1, 2017, the salary of employees turns out to be less than the minimum wage (7,800 rubles), then the employer may be held liable in the form of fines. A fine for an organization can range from 30,000 to 50,000 rubles, and in case of repeated detection - from 50,000 to 70,000 rubles. For a director or chief accountant, the responsibility may be as follows: in the event of a primary violation, they may issue a warning or fine from 1,000 to 5,000 rubles, and if repeated, a fine of 10,000 to 20,000 rubles. Moreover, they can be disqualified for a period of one to three years (Article 5.27 of the Code of Administrative Offenses of the Russian Federation).

The Ministry of Labor submitted to the government a bill to raise the minimum wage to the living wage. “Now the law on raising the minimum wage has been submitted by the Ministry of Labor to the government, so we will discuss it now,” Deputy Prime Minister Olga Golodets told reporters.

The head of the Ministry of Labor Maxim Topilin explained that it is planned to increase the minimum wage in two stages: from January 1, 2018 - to 90% of the subsistence level of the able-bodied population, from January 1, 2019 - to 100%. To implement the first stage in 2018, employees of state institutions will need 25 billion rubles from the federal budget.

“If we go at a rate of 90% from January 1, 2018, then the federal budget is 25 billion (rubles) for federal institutions,” Topilin said.

The Ministry of Labor estimated business expenses at the first stage at 43.9 billion rubles. Another almost 56 billion rubles. will need to be allocated from regional and municipal budgets.

“Expenses of employers in the real sector of the economy are projected at the level of 43.9 billion in 2018,” the press service of the Ministry of Labor said in a statement.

“The increase in the minimum wage will require funds from the budgets of all levels. If the bill is adopted, the additional costs of increasing the minimum wage, according to the Ministry of Labor of Russia, will be in 2018: for employees of federal state institutions - 24.6 billion rubles, for employees of state institutions of the constituent entities of the Russian Federation and municipal institutions - 55.7 billion rubles. , - noted in the department.

The Ministry of Finance, which began preparing the draft federal budget for 2018 and 2019–2020, did not promptly respond to Gazeta.Ru's request.

Prime Minister Dmitry Medvedev gave instructions to prepare a draft law on raising the minimum wage to the subsistence level of the able-bodied population to the heads of the ministries of labor, finance and economic development in early May following the discussion in the State Duma of the report on the results of the cabinet's work in 2016. He later confirmed that this task must be completed.

“In the next two years, I have set a task, now the project is being prepared, we will fully bring the minimum wage to the level of the subsistence level. This must be done without fail,” Medvedev said, in particular, at a recent meeting with workers at the Nevsky Plant in St. Petersburg.

From July 1, this figure rises to 7.8 thousand rubles. In April, by its decree, the government set the subsistence minimum at the level of 9691 rubles. In particular, the subsistence minimum for an able-bodied Russian was set at 10,466 rubles, for pensioners - 8,000 rubles, for children - 9,434 rubles. Over the past two quarters, this indicator has decreased by 265 rubles, or 2.7%, despite the fact that prices have not stopped rising all this time.

Since the beginning of this year, Deputy Prime Minister Olga Golodets has repeatedly expressed her concern about the situation of poor working Russians.

According to Rosstat, the number of people with cash income below the subsistence level in 2016 amounted to 19.8 million, i.e. 13.5% of the total population of Russia.

Medvedev previously called raising the minimum wage to the subsistence level as a task for the next few years. Minister of Labor and social protection Maxim Topilin also argued that in order to equalize the minimum wage and the subsistence minimum, it may take about three to five years.

About 5 million people in Russia receive a salary at the level of the minimum wage, Deputy Prime Minister Olga Golodets reported in February. According to her, low level wages is associated with the unwillingness of businesses to invest in innovative technologies.

Poverty level in Russia in last years is growing. In total, according to Rosstat, 19.1 million people, or 13.3% of Russians, had incomes below the subsistence level in 2015, which is a record figure since 2006.

According to Golodets, about a quarter of all poor Russians, 4.9 million people, are busy people with a very low salary, on which it is virtually impossible to live.

The subsistence minimum is set quarterly, based on the results of the previous period, and varies from region to region, where it is calculated, in turn, on the basis of the subsistence minimum established in Russia. The cost of living is also different for three groups of the population: the able-bodied population, children and pensioners. In general, in Russia per capita in the third quarter of last year, it amounted to 9.9 thousand rubles.

What was the minimum wage approved from January 1, 2017 in Russia? How will the new minimum wage affect benefits and wages? Will the benefits change from January 1, 2017? Let's figure it out.

Minimum wage from January 1: size

The minimum wage from January 1, 2017 in Russia will not be increased. Officials considered that it was not necessary to change the minimum wage from the beginning of the year. Note that many accountants are accustomed to the fact that the minimum wage increases from the beginning of the year. So, for example, in 2016, the minimum wage will increase from January 1 and amounted to 6204 rubles (Article 1 of the Federal Law of December 14, 2015 No. 376-FZ). However, from 2017 there will be no increase.

The last time the minimum wage was increased from July 1, 2016 to 7,500 rubles (Federal Law, Article 1 of Federal Law No. 164-FZ of June 2, 2016). In this regard, in particular, the amount of benefits has also changed. Cm. " ".

Since January 1, 2017, the minimum wage (SMIC) has not changed. Therefore, the amount of benefits will remain at the same level.

Keep in mind that from July 1, 2017, the minimum wage will increase by 300 rubles and its amount will be 7800 rubles. The indexation of the minimum wage by 4% is due to the forecast indicators of inflation, which should be 4% in 2017. This is provided for by the relevant bill.

It was originally planned that the minimum wage from January 1, 2017 would be 8,800 rubles. However, later the officials refused the new size of the minimum wage and left it at the same level. Cm. " ".

Minimum wage from January 1, 2017 and salary

The minimum wage is the minimum wage that an organization or individual entrepreneur (employers) must accrue to employees for a month they have fully worked (Article 133 of the Labor Code of the Russian Federation). However, keep in mind that an employee can also receive less than the minimum wage “on hand” - minus personal income tax and other deductions, such as alimony. Accordingly, from January 1, 2017, I cannot pay less than 7,500 rubles.

After all, the total salary cannot be less than the minimum wage, which includes (Article 129 of the Labor Code of the Russian Federation):

- remuneration for work;

- compensation payments, including surcharges and allowances;

- incentive payments (bonuses).

Regional minimum wage from January 1, 2017

It is worth recalling that from January 1, 2017, regional authorities can establish in a special agreement their own minimum wage that exceeds the federal minimum wage (Article 133.1 of the Labor Code of the Russian Federation). However, the regional minimum wage can be waived. For these purposes, it will be necessary to issue a reasoned refusal and send it to the local branch of the Committee on Labor and Employment. Cm. " ".

Minimum wage from January 1, 2017 for calculating benefits

From January 1, 2017, to calculate benefits, take into account the federal minimum wage -7500 rubles. This minimum wage affects the amount of benefits in two cases:

- the work experience of the employee is less than six months;

- the employee's salary is below the minimum wage.

Salary below the minimum wage: responsibility in 2017

If, from January 1, 2017, the salary of employees turns out to be less than the minimum wage (7,500 rubles), then the employer may be held liable in the form of fines. A fine for an organization can range from 30,000 to 50,000 rubles, and in case of repeated detection - from 50,000 to 70,000 rubles. For a director or chief accountant, the responsibility may be as follows: in the event of a primary violation, they may issue a warning or fine from 1,000 to 5,000 rubles, and if repeated, a fine of 10,000 to 20,000 rubles. Moreover, they can be disqualified for a period of one to three years (Article 5.27 of the Code of Administrative Offenses of the Russian Federation).