Which banks are not visible to bailiffs? Which banks do not work with bailiffs

January 2019

In the life of almost every person there are situations when financial problems arise - no one is immune from this. As a result, various debts may appear, be it overdue loan payments, unpaid utility bills, traffic police fines, and so on. Bailiffs do not sleep in such cases and collect funds directly from the card or from the debtor’s current account. And this happens, as a rule, at the most inopportune moment. Is there any way to protect yourself from sudden debits from your bank card? This question worries many citizens who have outstanding debt obligations. In today’s article we’ll talk about which cards are not blocked by bailiffs, and how to avoid the seizure of your own funds with the maximum probability.

Which bank cards are not blocked by bailiffs in 2019?

It is not possible to unequivocally answer the question posed in the subtitle. The thing is that the bailiffs entered into an agreement on electronic document management with all banks operating in the Russian Federation. Now absolutely every banking organization undertakes to provide bailiffs with all the information they are interested in (regarding the availability of open accounts with the debtor in a given bank).

At first glance, everything seems hopeless and it seems that there is no way to save your money, but this is not entirely true. After all, bailiffs manually search for all the necessary information and send relevant requests to different banks - all this is not done automatically.

And this is where the human factor comes into play. You need to understand that bailiffs cannot seize an account that they have not found. This leads to the following basic rule: in order to minimize the possibility of the card being seized by bailiffs, you should not keep your funds in large financial institutions with large authorized capital, and even more so in banks with state participation.

It is best to have a plastic card from a not particularly large non-state commercial bank. And the smaller the bank, the correspondingly lower the likelihood that the bailiffs will find an account there and seize it. However, you should not think that having received a card from some seedy bank with a meager authorized capital, you can be 100% confident in the safety of your savings. Bailiffs write off funds from cards/accounts of absolutely any banks operating in the Russian Federation, but under one condition - the bailiff must find the debtor’s active account.

In each specific situation, the outcome will depend on the persistence of the individual bailiff - how long and diligently he will be willing to conduct the search. It is important to note that there are three main banking institutions that cooperate most closely with bailiffs - these are Sberbank, VTB and Gazprombank (this is where bailiffs send their requests in the first place). Only a miracle can save you from writing off debt obligations from the cards of these banks.

Now it’s time to talk about where it’s better to apply for a card and at the same time be as calm as possible about the safety of the funds in your account. Below are the three most optimal offers offered by the organizations that are most loyal to their customers.

“Benefit” card from Home Credit Bank

Judging by the reviews, the bank is quite loyal to its users. Here is a debit card with the following characteristics:

- The card provides cashback - up to 20% for purchases in partner stores, 3% for purchases in the categories “Cafes”, “Gas Stations” and “Pharmacies”, for purchases in the category “Clothing and Shoes” 10% will be returned, as well as 1% for any other purchase;

- annual interest on the account balance - up to 10% (as part of a promotion for new clients);

- you can withdraw up to 100 thousand rubles per month without commission at any ATM (if the card is a salary card, then this restriction is removed);

- with a constant account balance of 10 thousand rubles or a monthly purchase amount of 5 thousand - free card maintenance.

Attention, promotion! Those who apply for a card using the link below before December 30, 2019 will receive 10% per annum on the account balance for the first 90 days from the date of conclusion of the agreement.

Apply for a card

Universal card "CASHBACK" from MTS Bank

The bank has pretty good reviews regarding the likelihood of its accounts being seized - bailiffs write off funds from this card really infrequently. The plastic presented by the bank is a universal card - this means that a credit limit is set on the card. “CASHBACK” also has the functionality of a full debit - you can deposit your own funds into your account, pay with them in stores or on the Internet, and withdraw through any ATMs.

Since the card fully combines two banking products - credit and debit, bailiffs may have significant difficulties in writing off funds from it. After all, executors do not have the right to seize credit funds. It should also be noted that the card is not personalized - the owner’s name and surname are not printed on the front side of the card. Other significant characteristics of plastic are:

- The card can be issued from the age of 20 (no need to confirm income);

- maximum credit limit - 299,999 rubles;

- grace period - up to 111 days;

- cashback for purchases from partners - up to 25%, for purchases in special categories - 5%, for everything else - 1%;

- You can withdraw your own funds from ATMs of any banks without commission;

- cost of issue - 299 rubles, annual maintenance of plastic - 0 rubles;

- Free delivery of the card by courier is possible.

Apply for a card

An organization that is part of QIWI Bank and conducts exclusively remote activities, presents to its customers one of the most profitable debit cards today.

The main advantages of debiting:

- completely free issuance and servicing of the card (and for free servicing you do not need to fulfill any requirements, as is often the case with products of other banks);

- free courier delivery to 29 cities;

- commission-free cash withdrawal through ATM devices of any banks in the amount of up to 150 thousand rubles per month (if the card acts as a salary card, the limit increases to 300 thousand per month);

- free transfers to cards of third-party banks (up to 30 thousand rubles per month);

- up to 10% cashback for purchases in “Favorite Places” and 1% for all other purchases;

- income on the account balance is 5% per annum (calculated for any amount, paid monthly).

Apply for a card

What to do if the card is seized by bailiffs?

A bank card can be seized for many reasons. The most basic ones are an outstanding debt to the bank, non-payment of utilities, or a simple mistake on the part of the bank.

Be that as it may, if the card is seized, a certain sequence of actions must be performed.

One of the main tools for collecting overdue debts is civil proceedings. Banks often take debtors to court. After a decision is made, the case is transferred to the service , whose employees initiate enforcement proceedings (Article 30 FZ-229), within the framework of which they describe and seize the property, as well as the personal savings of the debtor. Let's figure out what to do if the bailiffs seized the account?

Important! You can view the list of property subject to seizure in this .

The bailiffs seized the account, guided by Federal Law 395-1 (on banks and banking activities), Art. 27 and Art. 81 Federal Law 229 (On enforcement proceedings). Unlike, for example, customs or tax authorities, when a bank account is arrested by FSSP officers, all operations on it are immediately stopped. Further, if the debtor does not repay the debt voluntarily, then the money is transferred to the plaintiff.

Important! If the defendant does not make demands for the return of funds from the FSSP accounts within three years, the money is transferred to the federal budget.

Also, if the defendant has a spouse who keeps money in the bank, then they can also be arrested and half the amount written off as the joint property of the spouses.

If the debtor receives a salary on a bank card, it will also be seized and all money received on it will be written off. The debtor must independently write a statement to the FSSP employees with a request to withhold only 50% of the salary.

Important to remember:

- If the debtor believes that the bailiffs seized money kept in the bank illegally, and he has evidence of this, then their actions can be appealed.

- If the court proceeded unilaterally, that is, without the participation of the borrower, then the court order can be canceled. In this case, the seizure of the savings is removed.

Important! It is very easy to cancel a court order. You can read how to do this in this.

Bailiffs have seized my credit account, what should I do?

When FSSP employees receive a writ of execution, the first thing they do is send requests to all Russian banks to identify the debtor’s accounts. This procedure takes one day, and if the defendant keeps money in a financial institution, the bailiff will immediately know about it.

If the account is a credit account, the bank will note this in its response to the request. Such funds are not subject to seizure. Sometimes it happens that bank employees forget to note that the account was opened in accordance with the terms of the loan agreement. The bailiff seizes it and the money is blocked.

Such collection actions are easy to challenge or cancel: it is enough to bring the loan agreement to court, or simply write an application to the FSSP to unblock the funds.

If the debtor is a pensioner, then his pension in the Pension Fund is seized. Typically, the FSSP withholds 50% of the pension amount. A competent lawyer will help you change this amount, up to 30%. You can also always transfer your income to a third-party bank.

But sooner or later, FSSP employees will find out exactly where your money is and will take it away again.

Which bank should I open an account in so as not to be arrested by bailiffs?

Bailiffs are looking for debtors' funds in the largest and most widespread banks. Therefore, if you contact a small financial institution that opened not long ago, you can be sure that the money will not be touched.

In fact, any bank must provide information about the accounts of its clients at the request of the FSSP, but if you check all the banks for each defendant, this will take a lot of time. Considering the workload of the collection service, this is not possible.

You can safely open an account in a small commercial bank. For example, any regional.

Any seizure of income involves writing off only half of the funds received. But this can only be achieved by writing an appropriate statement. You must come to your appointment, bring proof of your source of income, and fill out an application.

You can also cancel the court order and demand that the FSSP fully return the written-off amount. This can be done in one day and without the help of lawyers. Read a detailed description of the process.

Bailiffs seized disability pension

A disability pension is the same source of income as a salary or old-age pension. Consequently, only part of the monthly accruals can be written off, which is 50%. But they won’t do this without a statement. Therefore, you will have to come to the reception and explain the situation.

You need to write an application to write off half of the proceeds. Only then can you count on the fact that part of the money will remain for you to live on.

Important! Regardless of how many creditors you have, the amount of funds transferred to the FSSP should not reach 50%.

The arrest is lifted upon completion of enforcement proceedings (Article 47 of Federal Law 229):

- the debtor paid the debt.

- the judgment was overturned.

- declaring the debtor bankrupt.

- impossibility of collecting other property.

The defendant always has the option of dismissing the proceedings. For a detailed review of your situation and development of a legal defense strategy, contact your lawyer.

Video - comments from a lawyer regarding the seizure of money by bailiffs:

Bottom line

If the bailiffs have seized the account, then this decision can always be challenged in court. Fight for your rights.

If you have any questions or require advice, leave a comment on the article or contact the site’s duty lawyer in the form of a pop-up window. We will definitely answer and help.

Many people face a problem when their money on their salary card becomes unavailable for use due to arrest by bailiffs. Let’s now try to understand in more detail the question of how legal such actions are.

Reasons why an account may be blocked

In most cases this is:

- Unpaid administrative fine,

- Overdue loan debt,

- Debt for housing and communal services,

- Debt of alimony.

If there is enforcement proceedings open against you, the bailiff can seize your bank accounts, as well as send a writ of execution to your employer to collect the debt.

You should understand that when your employer receives a writ of execution for debt collection, he will not be able to withhold more than 50% of your income. The percentage of recovery may vary, depending on the article of recovery.

However, the most common case is when a writ of execution reaches a banking institution. The bank does not have the legal right to track and transfer to third parties information about the source of origin of your funds in open accounts. But he can block or write off money to pay off the debt.

The first thing bailiffs do when opening a case is to ask banks for information about the availability of the debtor’s accounts, seizing them in the amount of the debt. Bailiffs are vested with this right in accordance with Part 2 of Article 81 of the Law “On Enforcement Proceedings”.

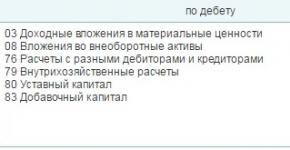

The legal concept of “salary card” or “salary account” does not exist. This is a simplified, popular concept. It is these common names that mislead citizens. Current accounts are opened for all citizens who are not engaged in entrepreneurial activities. You can get acquainted with the list of all types of bank accounts in more detail by carefully studying the Bank of Russia instruction No. 153-I dated May 30, 2014.

The Federal Law on Enforcement Proceedings does not give bailiffs the obligation to find out the history of the origin of funds accrued when seizing bank accounts. In other words, the bailiff does not have any information at all into which specific account, be it salary or otherwise, he imposes restrictions and writes off money from it.

How much money can they hold?

The Federal Law “On Enforcement Proceedings” gives bailiffs the authority to write off funds from the debtor’s salary account in full. The only exception is the last periodic payment. The rules regarding the maximum withholding amount of 50 percent apply to him.

Guided by the court decision, the bailiffs can legally either seize the account or even collect the funds available on it. Article 99 of the Federal Law “On Enforcement Proceedings” states that more than 50% of the amount of his income cannot be withheld from the debtor’s accounts. The withholding of funds will stop only after all requirements are met (more details about them are indicated in the bailiff's writ of execution).

There are cases to which these restrictions do not apply:

- When collecting alimony;

- When claiming compensation for damage as a result of damage to a person’s health;

- If it is necessary to compensate for harm, the result of which led to the death of the family breadwinner;

- When compensating for material damage or reimbursing stolen funds as a result of the commission of a crime.

In any case, the withheld percentage can be reduced to 30% at the request of the debtor if the family is raising children under the age of majority. Or up to 25% if only one of the parents is raising the child.

What to do if your salary card is seized

It is worth remembering that there are still legal restrictions on collecting debt from wages. But, as mentioned earlier, the bailiff does not know the origin of the money in your account. In this regard, it is necessary to provide evidence confirming the fact that the blocked account is a salary account. To do this you need to do the following:

- If you do not know the reason for the seizure of your account, ask the bank for information about collections and seizures. On what date, and on the basis of what documents was the arrest imposed, by what authority, including full name. the official who issued this document - all this information is contained in the table provided. We also recommend checking your debt information online.

- Now you know exactly what restrictions are imposed on your account and by whom. Request an extended statement from your bank. In addition to this, you need to take a certificate from your place of work confirming that your wages were actually transferred to the exact account that was seized by the bailiff.

Download a sample certificate for bailiffs about a salary card - A statement must be written to the bailiff who issued the decision as a result of which the card was seized, demanding that the seizure be lifted. A bank statement and a certificate from the employer are attached to the application. To speed up the process of lifting restrictions, make sure that the application is submitted to the bailiff in person during business hours. There are other ways to submit an application: by mail or through the office.

If you document that the seized account actually contains wages for the last reporting period, the bailiff will lift the seizure by issuing an appropriate resolution.

For speedy withdrawal, the bailiff can give you this decree with an order for transfer to the bank.

What to do if the wage garnishment is still not lifted

In the event that the removal of the seizure from your salary card account is delayed, you have the right to file a corresponding complaint in the order of subordination, to the prosecutor's office or to the court. The procedure for challenging is described in Article 128 of the Law “On Enforcement Proceedings”

Do not rush to send complaints about blocking all funds from your salary account to various authorities. In order to save time, the first thing you should do is contact the bailiff, since your complaint filed with the court or prosecutor's office will still be transferred to the bailiff in accordance with Chapter 18 of the Law on Individual Entrepreneurs.

Is it the bank's responsibility to notify the client about the seizure of his account?

Here you need to carefully read the terms of the agreement for the issue and servicing of a credit card. The document states that the holder, by signing it, automatically agrees that the Bank has the right to write off from other accounts that have residual funds overdue debt in the amount of the second mandatory payment without additional consent of the card holder, if such a condition is provided for in the terms of the agreement .

The holder authorizes the bank to convert the finances available in its accounts into foreign currency at the rate established by the bank on the date of the transaction in the event of failure by the client to fulfill financial obligations to it.

This means that the bank’s actions regarding write-offs are legal. To avoid being left without a livelihood, always carefully read each clause of the contract before signing it.

Video response from a lawyer about the seizure of a bank card

Legislation obliges all credit institutions operating in the Russian Federation to provide information regarding client funds upon request of bailiffs.

The rule applies to commercial structures on an equal basis with government ones.

Dear readers! The article talks about typical ways to resolve legal issues, but each case is individual. If you want to know how solve exactly your problem- contact a consultant:

APPLICATIONS AND CALLS ARE ACCEPTED 24/7 and 7 days a week.

It's fast and FOR FREE!

Financial organizations that do not work with the FSSP

As of 2019, over a hundred banking institutions have signed an official document regulating the nuances of providing information to the request of the bailiff service.

The fact that there is no contract does not exempt you from the obligation to provide customer data.. Refusal will result in a fine and other sanctions, including loss of license.

Debt collection

Finding organizations that do not cooperate with the FSSP is becoming increasingly difficult over time, since failure to provide information is actually a violation of the law with the ensuing consequences. There are no people willing to conflict with the state, to risk their own reputation and even existence.

The only option is cooperation with small financial institutions of non-state ownership, whose owners are not persons close to the authorities.

Some of them continue to rely on the principle of bank secrecy and try to maintain the confidentiality of information relating to the citizens they serve.Often, financial organizations do not directly avoid cooperation with bailiffs, but simply promptly warn clients about the impending arrest, giving them the opportunity to withdraw funds.

This is how one manages to maintain loyalty while formally complying with the law.

Full list

According to reviews, cooperation with bailiffs is minimized by these financial organizations:

- Home Credit;

- Promsvyazbank;

- Citibank;

- MTS-Bank;

- Vanguard.

How does the service obtain billing information?

The search for data on the funds available to debtors in banking institutions is carried out by sending search applications to various financial organizations.

Due to the huge number of companies operating on the market, it is difficult to control whether everyone received the request and responded to it honestly.

The application is guaranteed to reach the largest banking institutions, and in this case, with almost 100 percent probability, the funds will be automatically debited. They will not risk their authority and create problems with the law.

Procedure for collecting funds

The interaction of bailiffs with banks occurs according to the presented scheme:

- After the court decision comes into force, a request is submitted to the financial institution regarding the availability of funds from a particular citizen.

- The credit institution provides the necessary data.

- If there is money, the FSPP sends a collection order indicating the debtor's account.

- Finance is written off in the required amount.

What to do if an arrest is made?

It is necessary to start by finding out how legal the actions of those responsible are.

If there is an outstanding debt and there are no restrictions on writing off funds due to their special purpose, the only way to solve the problem is to pay off the debt.

In case of seizure of a special category account that does not allow collection, the debtor must:

- Collect documents confirming the fact.

- Submit an application to the FSSP, which will revoke the decision.

Controversial situations will have to be resolved through the courts.

Grounds for lifting sanctions

| Cause | Procedure |

| The debtor made a full refund to the creditor | It is required to collect all confirming payment orders and present them to the bailiffs by writing a statement. |

| The actions of authorized persons were recognized as unlawful | The money was not intended for the intended purpose, the debt was accrued by mistake, or the defendant was not notified in the prescribed manner about the process so that he had the opportunity to take action before the trial. |

| The parties reached a consensus | The writ of execution is taken from the FSSP. Subsequently, if the debtor ceases to comply with the agreement, the plaintiff has the right to re-file the document for collection; it is unlimited. |

| The defendant became bankrupt | All assets, including accounts, are transferred to the arbitration manager. |

Which accounts are they not allowed to touch?

It is mandatory to provide a documentation package including:

- papers confirming the intended nature of the money;

- statements demonstrating the actual transfer of finances;

- certificates from the bank indicating that savings have been blocked.

In the text of the appeal, it is advisable to focus on the illegal nature of the procedural measure that violates the interests of the applicant.

If the outcome is favorable, the illegality of actions regarding the citizen’s funds will be established, and he will be able to return them.

You will need to take a certified extract from the court decision and a writ of execution, which are presented to the service.