Accounting form OS 6. Inventory card for accounting of fixed assets

IN " Accounting application » No. 25 for 2007 we talked about how to fill out an act of acceptance and transfer of fixed assets according to form No. OS-1. This time we will talk about the inventory card for recording a fixed asset item (form OS-6).

The main document regulating the procedure for processing operations related to the acceptance of fixed assets for accounting is Resolution of the State Statistics Committee of Russia dated January 21, 2003 No. 7 “On approval of unified forms of primary accounting documentation for accounting of fixed assets.”

It is this document that provides for the unified form No. OS-6 “Inventory card for recording a fixed asset object.”

The card is used to record the availability of fixed assets. It reflects information about the acceptance of a fixed asset item for accounting, its movement within the organization, reconstruction, modernization, overhaul, as well as disposal or write-off.

The card is filled out in one copy. Entries in it are made on the basis of the act of acceptance and transfer of fixed assets and other documents (for example, technical passport, etc.). If a group of fixed assets is accepted for accounting, one inventory card is issued for them in form No. OS-6a “Inventory card for group accounting of fixed assets”.

An organization that has a small number of fixed assets can carry out object-by-object accounting in the inventory book (form No. OS-6b) indicating the necessary information about fixed assets by their types and locations (clause 12 of the Guidelines for accounting of fixed assets, approved Order of the Ministry of Finance of Russia dated October 13, 2003 No. 91n).

Let's look at how to fill out form No. OS-6 using a specific example.

EXAMPLE

In June 2007, a medical organization, OJSC Petra, purchased a table for x-ray equipment (model MBP-18/002) through a retail chain for the cost of 63,720 rubles, including VAT - 9,720 rubles. The table was manufactured by Furniture Plant No. 18 LLC.

Table release date - 01/07/2007.

The organization established its useful life for accounting and tax accounting purposes on the basis of the Classification of fixed assets included in depreciation groups, approved by Decree of the Government of the Russian Federation of January 1, 2002 No. 1, 7 years (fourth depreciation group).

Serial number - 1278, inventory - 20.

The table was put into operation on 06/05/2007. At the same time, the organization’s accountant drew up an act of acceptance and transfer of fixed assets (form No. OS-1), on the basis of which it is now necessary to draw up an inventory card for accounting for the fixed asset item.

A month later (07/05/2007) the table was equipped with additional protective shields for a total amount of 14,300 rubles. The additional equipment was formalized by an act in form No. OS-3 (act number - 12).

The accounting policies of organizations provide for sequential numbering of inventory cards from the beginning of the year. The table is the 79th fixed asset item purchased by the organization this year.

Let's start filling out the inventory card with the so-called head of the document: this is, first of all, the number and date of the card. Based on the conditions of the accounting policy, the inventory card number is 79. The date of the card must correspond to the moment the fixed asset item was accepted for accounting (reflected in the debit of account 01 “Fixed Assets”), as well as the date of the act of form No. OS-1.

Next, the accountant fills in the details of the organization (namely, the name, OKPO and OKOF codes of the organization), and also indicates the name of the structural unit in which the fixed asset item accepted for accounting is located.

Then the name of the fixed asset object accepted for accounting is indicated.

Please note that in this line it is necessary to indicate the full name indicating the brand and model, just as in the act of form No. OS-1. In our case, “Table for medical equipment model MBP-18/002.”

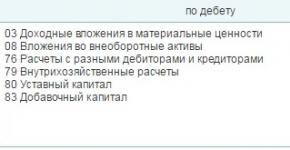

Then you need to enter the depreciation group number (IV), registration passport number (in our case, absent), factory (1278) and inventory (20) numbers, and also indicate the date the fixed asset was accepted for accounting (06/05/2007) and the subaccount for which it is reflected (01-1).

Now let's move on to filling it out first section form “Information about the fixed asset as of the date of transfer.”

Section 1 is filled out on the basis of the data reflected in section 1 of the act of form No. OS-1 and having an informational nature for objects of fixed assets that were in operation. In cases of purchasing objects through a distribution network or manufacturing for one’s own needs, Section 1 is not completed.

In our example, the organization purchases a new desk, so it may not fill out the specified section. Meanwhile, it would not be a mistake to indicate the date of issue reflected in the act and indicate the details of the act itself. The remaining lines need to be filled with dashes.

Let's move on to second section“Information about the object of fixed assets as of the date of acceptance for accounting.” Here, first of all, the initial cost of the fixed asset is entered. In our example, this is the cost of purchasing the table, excluding VAT (RUB 54,000). VAT is not taken into account in the cost of the object, since our organization is a payer of this tax and does not carry out activities exempt from VAT, and accordingly has the right to deduct the full amount of VAT presented by the supplier.

The next detail is the useful life. According to the Classification of fixed assets included in depreciation groups, approved by Decree of the Government of the Russian Federation dated January 1, 2002 No. 1, medical furniture belongs to the fourth depreciation group with a useful life of over 5 years to 7 years inclusive. In our situation, by order of the manager, the useful life is set at 7 years.

Third sectionThe cards will be filled out by the organization in the event of a revaluation of the fixed asset. Here you will need to indicate the date of the revaluation and its coefficient. In column 3 - reflect the replacement cost based on the results of the revaluation.

Let's move on to fourth section form, which is called “Information on acceptance, internal movements, disposal (write-off) of fixed assets.”

In our example, the accountant fills out this part of the form on acceptance of fixed assets on the basis of an act in form No. OS-1.

In the future, additional information related to the internal movement of the object may be entered into this section - on the basis of an invoice in form No. OS-2, or its disposal (write-off) - on the basis of an act in form No. OS-4.

Now let's move on to filling out the second page of the inventory card.

Let's start with fifth section“Changes in the initial cost of an item of fixed assets,” which reflects information on the costs of modernization, additional equipment, completion and reconstruction, as well as the decrease in value during partial liquidation.

In our example, the organization retrofitted the table, which was reflected in the specified section of the card. The cost of additional equipment was 14,300 rubles.

Next sixth section The inventory card is intended to reflect the costs of repairs, which are entered into the card on the basis of form No. OS-3.

The very last one left seventh section“Brief individual characteristics of an object of fixed assets.” It is necessary, first of all, to register the devices and accessories that are part of the fixed asset.

In our case, this is the table itself, a built-in cabinet and a built-in stand for X-ray equipment.

Such information can be useful when replacing parts and accessories of a fixed asset, as well as when rearranging components from one object to another, which often occurs in practice and entails the problem of accounting for such rearrangements.

Also, when accepting fixed assets for accounting, the inventory card must include data on the presence of precious metals and precious stones in the composition of this fixed asset, as well as their mass (in grams, kilograms). After all, at the time of disposal of fixed assets, elements of retired equipment containing precious materials must be capitalized.

In our case, there are no precious and semi-precious materials in the acquired fixed assets.

Once completed, the inventory card is signed by the person responsible for maintaining it.

Accountants often believe that maintaining an inventory card only in electronic form is sufficient. Indeed, if necessary (during an audit or tax audit), it can always be printed and signed.

But in this case, the organization violates paragraph 4 of Art. 9 Federal Law of November 21, 1996 No. 129-FZ “On Accounting”, according to which the primary accounting document must be drawn up at the time of the transaction, and if this is not possible, immediately after its completion.

In addition, there is a possibility that the employee responsible for maintaining cards is no longer working in the organization at the time of the inspection.

In conclusion, please note that, if necessary, the inventory card can be supplemented with new details (reflecting this accordingly in the accounting policies of the organization). But under no circumstances should you delete existing details.

Unified form OS-6 - inventory card for accounting of fixed assets. In the article we will talk about the purpose and filling out the unified form OS-6.

Form of the unified form OS-6

If document flow in an organization is carried out using unified accounting forms, then analytical accounting of fixed assets (FPE) is carried out using inventory cards according to the unified OS-6 form. Inventory card OS-6 for accounting of fixed assets (the form of which you can download on our website) and instructions for filling it out were approved by Decree of the State Statistics Committee of the Russian Federation dated January 21, 2003 No. 7.

For group accounting of fixed assets, use the unified form OS-6a “Inventory card for group accounting of fixed assets”.

Form OS-6 of the inventory card for recording fixed assets may not be filled out by organizations whose number of fixed assets is small. Such organizations, instead of inventory cards, can keep an inventory book in the OS-6b form (clause 12 of the Guidelines for the accounting of fixed assets, approved by order of the Ministry of Finance of the Russian Federation dated October 13, 2003 No. 91n (hereinafter referred to as the Guidelines for the accounting of fixed assets)).

Since 2013, the use of unified forms approved by the State Statistics Committee has become optional, so it is possible to use independently developed documents of similar content.

For information about what information should be present in a self-developed document form, read the article “Primary document: requirements for the form and the consequences of its violation” .

Inventory card OS-6: procedure for maintaining and filling out

Inventory cards are designed to record fixed assets, as well as their movement within the organization. An inventory card in the OS-6 form is opened for each fixed asset, and it is recommended to draw up such a document also for leased objects (clause 14 of the Guidelines for accounting for fixed assets).

An inventory card of fixed assets is opened on the basis of the act of acceptance and transfer of fixed assets (forms OS-1, OS-1a, OS-1b). From it, part of the information about the acquired object is transferred to the inventory card for recording fixed assets (sections 1 and 2 are filled out). Also, when filling out the card, information from accompanying documents, for example technical data sheets of manufacturers, is used.

For more details on the types of OS-1 form, see the following materials:

- “Unified form No. OS-1 - act of acceptance and transfer of fixed assets” ;

- “Unified form No. OS-1a - form and sample” ;

- “Unified form No. OS-1b - form and sample” .

At the time the OS is accepted for accounting, the card reflects the following information:

- in section 1 - information about the asset as of the date of transfer: date of issue, data on the commissioning document, service life, accrued depreciation, residual value (the section is filled out for objects that were already in operation by the previous owner);

- in section 2 - the initial cost and useful life (they will be needed to calculate depreciation);

- in section 4 - information about the acceptance of the object (details of the acceptance document, department, cost of the fixed assets and the financially responsible person are indicated);

- Section 7 contains a brief individual description of the object.

The remaining sections are filled in as the OS operates. In particular, the following information is entered into the card:

- on the revaluation of fixed assets (section 3);

- movement of the object and its write-off (section 4);

- costs of reconstruction, modernization and repair (sections 5 and 6).

The card is signed by an authorized employee (usually an accountant).

A sample of filling out an inventory card for fixed assets can be found on our website.

NOTE! In the example of filling out an inventory card for accounting for fixed assets, sections relating to changes in the value of a fixed asset, its repair, individual characteristics, and the accountant’s signature are given on the 2nd page.

Results

An inventory card according to the unified OS-6 form is used to record and move fixed assets within the company. But the use of unified forms is not mandatory since 2013, therefore the organization has the right to develop a card form independently, adhering to the requirements for the preparation of primary documents specified in Art. 9 of the Law “On Accounting” dated December 6, 2011 No. 402-FZ.

The creation and registration of inventory cards for accounting for fixed assets in the OS-6 form is usually carried out at those enterprises and organizations that own a significant amount of property and which need to control its content, storage and movement. Each individual fixed asset has its own card, and cards can be issued for both company property and leased property.

FILES

Before opening the card

Before creating this accounting document, it is necessary to draw up an act of acceptance and transfer of fixed assets - it is from this that information about the object comes into the card. In addition, to fill it out, data is taken from other accompanying papers, such as, for example, technical passports of products, equipment and machinery.

The inventory card refers to the internal accounting documentation of the enterprise and information is entered into it for any actions with the property registered in it (purchase, transfer from one department to another, repair, reconstruction, modernization, write-off, etc.).

Rules for document execution

The inventory card of the object has a unified form with code OS-6, approved by Resolution of the State Statistics Committee of Russia dated January 21, 2003 N 7.

The document is drawn up for each object separately and in a single copy, and if the cards are kept in electronic form, then there must be a copy of it on paper (it is the paper versions that contain the “live” signature of the financially responsible person). It is not necessary to certify the document with the company seal, because it refers to its internal documentation.

Example of registration of an inventory card according to the OS-6 form

Filling out the document header

At the beginning of the document write:

- name of the company that owns the fixed asset,

- the structural unit to which the property is assigned,

- inventory card number,

- date of its preparation,

- name of the registered object.

Here, in the column on the right, the enterprise code according to OKPO (All-Russian Classifier of Enterprises and Organizations) is indicated - it is contained in the constituent papers and the code of the fixed asset object according to OKOF (All-Russian Classifier of Fixed Assets). Continuing to fill out the right column, we enter detailed information about the object:

- number of the depreciation group to which it belongs according to the accounting of the enterprise,

- passport registration number,

- serial and inventory numbers,

- date of registration of the fixed asset for accounting,

- number of the account (sub-account) through which it passes.

Below, the location of the fixed asset object is entered in the corresponding lines (indicating the department code, if such coding is used at the enterprise) and information about the manufacturer (this data can be found in the technical passport).

Filling out detail tables

The second part of the document opens sections dedicated to the registered object.

Note: information is entered into the first section only if the property was already in use at the time of entry into the card. If it is new, you do not need to fill out this section.

To the second section The cost of the object at the time of acceptance for accounting and its useful life are included.

Third section is issued when revaluing a fixed asset - and the price can vary both upward and downward. The difference between the original cost and after revaluation is determined as the replacement price.

To the fourth section cards, information about all movements of registered property is entered. The data is entered here strictly on the basis of accompanying papers indicating the type of operation, the structural unit to which the asset belongs, the residual value and information about the responsible person.

If the fixed asset is owned by several persons, then they must be indicated under the fourth table with the percentage distribution of shares.

Filling out sections of the reverse side of the OS-6 form

In the fifth section indicates all changes in the original value of the object, regardless of the actions performed with it. The type of operation, data from the supporting document, as well as the amount of expenses incurred by the organization in the process of carrying out the necessary procedures are written here.

Sixth section includes information about repair costs, with a full breakdown of each operation performed (type of repair, accompanying documentation, amount of expenses).

Seventh section contains special data about the object of fixed assets, including data on the content of precious and semi-precious metals, stones and materials in its composition.

In the last table of cards Structural units, elements and other features that are a distinctive feature of the property, as well as its qualitative and quantitative indicators, are registered. If there are any comments, they are entered in the last column of the table.

Finally, the document is certified by the employee responsible for maintaining inventory cards at the enterprise (his position must be indicated here and a signature must be affixed with a transcript).

To record information about fixed assets objects accepted for accounting and reflect information about their movement and movement, the standard form OS-6 is used - an inventory card, which is created individually for each object.

The accountant is responsible for preparing the inventory card; the OS-6 form is submitted to the facility upon receipt. The accountant fills out the OS-6 inventory card. Further, during the operation of the object, data on changes, movements, and changes in value occurring with the object are reflected.

The last entry in the inventory card is made when an object is disposed of or written off.

The disposal of an object is carried out on the basis of a transfer and acceptance certificate, write-off is documented in a write-off act:

- OS-4a for transport - ;

- OS-4 for other objects - .

In the article we suggest downloading a form for an inventory card of fixed assets and a sample of filling out the OS-6 form.

Small businesses typically use fixed asset accounting.

Sample of filling out the inventory card OS-6

The card has several subsections, some of which the accountant fills out when accepting the fixed asset for accounting on the basis of the transfer and acceptance certificate. Other sections are filled in during the process of using the object for its intended purpose.

The following data is filled in at the top of the OS-6 card:

- name of the organization and division;

- information about the fixed asset item, its depreciation group, the date of acceptance for accounting;

- location of the fixed asset;

- object manufacturer.

The inventory card receives a personal number.

The first section shows data on the fixed asset on the date of transfer - transferred from the transfer act accompanying the receipt of the object. The second section also shows data based on the transfer and acceptance act - from the second section of the act, information is transferred to the date of acceptance for accounting.

The third section of the OS-6 inventory card is filled out during the operation of the facility - the results of the revaluations are indicated - surplus and shortage.

The fourth section provides data on internal movements (entries are made on the basis), as well as on departure from the organization on the basis of an acceptance certificate or write-off on the basis of a write-off act.

The fifth section shows the results of the modernization, reconstruction, and completion. The costs of these procedures increase the initial cost of the object.

Repair costs that do not increase the cost of the fixed asset, but are written off as expenses of the organization, are shown in the sixth section of the OS-6 inventory card.

The seventh section of the OS-6 form shows the personal characteristics of the fixed asset; this information can be gleaned from the transfer and acceptance certificate, on the basis of which the object is capitalized as a fixed asset.

The responsible employee who draws up the OS-6 inventory card puts his signature on the last sheet of the form.

Sample for free download

Inventory card of fixed assets form OS-6 form - .

Inventory card for recording an asset, form OS-6, sample filling - .

The basis of every production organization is a stock of property objects. They are taken into account according to the norms and principles that are regulated by Resolution of the State Statistics Committee of the Russian Federation dated January 21, 2003 No. 7. Property is accounted for as an inventory item with a unique number, the compilation of which is established by the accounting policy of the enterprise. An inventory card is generated for objects in the form - OS-6, and for group accounting - OS-6a.

An organization does not have to keep records using the OS-6 form; it has the right to create a document independently, using the unified form as a sample.

The essence of the inventory card

An inventory card is an accounting register that exists to keep records of a specific object. It reflects information about the parameters of the property, its movement between the internal departments of the organization, the repairs carried out, as well as the write-off of the object.

Features of opening an inventory card

The creation of the register begins at the moment of acceptance of the fixed asset. It is filled out objectively based on initial information from documents, such as a delivery note and a commissioning certificate.

If homogeneous objects of equal value are received, then it will be more convenient to open a group accounting card. It is created in one copy.

The accounting register contains essential information about the accounting property:

- Name, short and full;

- Unique inventory number;

- Useful life;

- Cost at the time of commissioning;

- Date of acceptance for registration and commissioning;

- Data on the renovation of the facility, additional equipment, reconstruction, relocation and deregistration.

In many enterprises, accounting is kept automatically; therefore, cards can be stored on a computer disk, and if necessary, they can be printed or viewed on a monitor screen.

The procedure for filling out the inventory card

Registration of the card begins with entering the name of the organization and the object itself, as well as the department to which the property is received. On the left, in the tabular part you need to indicate:

- OKUD form code;

- OKPO code;

- Code OKOF;

- Depreciation write-off group;

- Factory number and number assigned by the organization;

- The date of acceptance of the fixed asset for accounting.

The main part of the OS-6 or OS-6a form, in the case of recording several objects in one card, consists of seven sections in the form of a table:

- The first section is required to be completed if the production of the object was intended for the needs of the organization or it was acquired through retail trade;

- The second section reflects information about the assigned group for writing off depreciation and, in accordance with it, the useful life (SPI);

- The third section is filled out in the event of a property revaluation event. Then the date of its holding, the coefficient and the resulting recovery value are indicated;

- The fourth section collects information from the act of acceptance or transfer, as well as internal movement, disposal or write-off;

- The fifth section shows the amount of expenses for updating, changing and completing the accounting object;

- The sixth section reflects the repair work performed and the amount of expenses for its implementation;

- The seventh section characterizes the main tool, revealing the features of the assembly and the presence of component parts.

The completed register is submitted for approval and signing by the person accepting the object for maintenance and storage. During the use of the property, the card will promptly reflect its condition.

The storage period for this document is set by the enterprise independently, with the condition that it will not be less than five years.