Example of filling out the OS form 6. Characteristics of the fixed assets accounting card

The basis of every production organization is a stock of property objects. They are taken into account according to the norms and principles that are regulated by Resolution of the State Statistics Committee of the Russian Federation dated January 21, 2003 No. 7. Property is accounted for as an inventory item with a unique number, the compilation of which is established by the accounting policy of the enterprise. An inventory card is generated for objects in the form - OS-6, and for group accounting - OS-6a.

An organization does not have to keep records using the OS-6 form; it has the right to create a document independently, using the unified form as a sample.

The essence of the inventory card

An inventory card is an accounting register that exists to keep records of a specific object. It reflects information about the parameters of the property, its movement between the internal departments of the organization, the repairs carried out, as well as the write-off of the object.

Features of opening an inventory card

The creation of the register begins at the moment of acceptance of the fixed asset. It is filled out objectively based on initial information from documents, such as a delivery note and a commissioning certificate.

If homogeneous objects of equal value are received, then it will be more convenient to open a group accounting card. It is created in one copy.

The accounting register contains essential information about the accounting property:

- Name, short and full;

- Unique inventory number;

- Useful life;

- Cost at the time of commissioning;

- Date of acceptance for registration and commissioning;

- Data on the renovation of the facility, additional equipment, reconstruction, relocation and deregistration.

In many enterprises, accounting is kept automatically; therefore, cards can be stored on a computer disk, and if necessary, they can be printed or viewed on a monitor screen.

The procedure for filling out the inventory card

Registration of the card begins with entering the name of the organization and the object itself, as well as the department to which the property is received. On the left, in the tabular part you need to indicate:

- OKUD form code;

- OKPO code;

- Code OKOF;

- Depreciation write-off group;

- Factory number and number assigned by the organization;

- The date of acceptance of the fixed asset for accounting.

The main part of the OS-6 or OS-6a form, in the case of recording several objects in one card, consists of seven sections in the form of a table:

- The first section is required to be completed if the production of the object was intended for the needs of the organization or it was acquired through retail trade;

- The second section reflects information about the assigned group for writing off depreciation and, in accordance with it, the useful life (SPI);

- The third section is filled out in the event of a property revaluation event. Then the date of its holding, the coefficient and the resulting recovery value are indicated;

- The fourth section collects information from the act of acceptance or transfer, as well as internal movement, disposal or write-off;

- The fifth section shows the amount of expenses for updating, changing and completing the accounting object;

- The sixth section reflects the repair work performed and the amount of expenses for its implementation;

- The seventh section characterizes the main tool, revealing the features of the assembly and the presence of component parts.

The completed register is submitted for approval and signing by the person accepting the object for maintenance and storage. During the use of the property, the card will promptly reflect its condition.

The storage period for this document is set by the enterprise independently, with the condition that it will not be less than five years.

When a company keeps records of fixed assets (fixed assets) analytically, the main document is the inventory accounting card - form OS-6. It is established by organizations operating on the territory of Russia, separately for each OS object, reflecting the transactions that are carried out with the property.

What is an OS-6 card for accounting for fixed assets?

The inventory card form was introduced by the Decree of the Federal State Statistics Service back in 2003, and since 2013 this template has been used as a sample; enterprises can independently change it, supplement it with columns and lines, it is only prohibited to remove sections from it.

The filling rules are regulated by the guidelines introduced by Order of the Ministry of Finance No. 91n. Together with the OS-6 card, in the accounting department of an enterprise, if there are several homogeneous objects, the OS-6a forms are used - to keep records of a group of such units of property. Companies belonging to small businesses can use an inventory book (OS-6b). Only a small number of operating systems, which generally belong to the enterprise, are registered in this way. This form contains the view, location of objects and other information.

For each unit of fixed assets, one copy of OS-6 is created, which is stored in the accounting department; it is also advisable to draw it up for leased property, which is accounted for in off-balance sheet accounts.

All entries in OS-6 are made on the basis of primary documents, such as acts, invoices, and accompanying documents from suppliers. In the case of execution of acts for construction, relocation, write-off of fixed assets, their data is also entered into OS-6.

A few rules for maintaining OS-6:

- if the property is accepted for accounting in the current month, then the completed form for them can be stored separately, but starting from the next month, they must be moved to the rest;

- monthly, the accountant must check the total amount of inventory cards with the fixed assets accounting data;

the amount of the specified depreciation is accrued from the beginning of operation; - all information reflected in the card must be reliable, since violations and errors entail penalties from government inspection bodies;

- Each OS-6 is assigned its own unique number.

When is OS-6 filled out?

When performing almost any business transaction with property, changes are entered into OS-6. It opens when an asset is accepted for accounting on the basis of the transfer and acceptance certificate OS-1 (OS-1a - for buildings and structures, OS-1b - for groups of objects). All information to be filled out is taken from these forms.

During operation, manipulations are performed with the assets, on the basis of which primary documents are drawn up. They subsequently serve as the reason for filling out and making changes to OS-6.

These could be the following operations.

OS revaluation

It is carried out to recalculate the initial cost depending on the current market situation. At the same time, one of the principles of accounting is fulfilled - its reliability and completeness. Conducting a revaluation is not the obligation of the organization, but its right, but if the price was clarified once, then for similar types of fixed assets it should be formalized continuously once a year. The result of this operation - markdown or revaluation - is entered into OS-6.

Internal movement of property

An invoice OS-2 is drawn up for this operation and is used when moving assets within an organization or changing the responsible person at the storage location.

Write-off of objects from accounting

Produced when:

- property falls into disrepair - is formalized by acts OS-4 (OS-4a - for cars, OS-4b - for groups of OS);

- the asset is sold, transferred without payment, exchanged - transfer and acceptance certificates OS-1 are drawn up;

- The operating system is rented or leased.

Reconstruction of objects

It is carried out to reconstruct and improve the operating system when it is necessary to increase the power of equipment, product quality, or expand the list of operations performed. It is drawn up by act OS-3, the data of which is transferred to the inventory card.

Technical re-equipment

Involves improvement of technical and economic indicators through the use of new technologies, increased automation, and replacement of obsolete or worn parts. The primary document evidencing the implementation of the operation is also the OS-3 act.

Modernization

As in the two previous cases, it is confirmed by OS-3, the operation is carried out to increase productivity, change the technical purpose of the OS, and acquire new useful qualities.

All these procedures change the initial cost of the property, which must be reflected in OS-6.

How to fill out OS-6 correctly?

Both the accountant personally and the organization as a whole are responsible for the accuracy and completeness of the information specified in OS-6, so filling it out should be taken seriously and thoughtfully.

First you need to decide what an OS is. This category includes property purchased or received free of charge for use in an activity, and not for subsequent sale. It should not be confused with finished goods, goods for resale, recorded on separate accounts. To reflect the data of primary documents on transactions with fixed assets in inventory cards, they must be correctly drawn up with all the details filled in: number, date, name of the organization, content of the business transaction, its meters, signatures of the compilers and responsible employees.

When accepted for accounting, each asset is assigned its own inventory number, which is no longer repeated in the organization.

Step by step filling:

Document header – all data must be filled out correctly:

- the name of the organization and its division is correctly indicated;

- the number and date of the document was present;

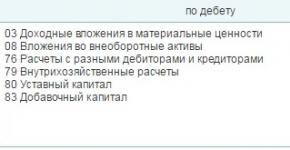

- the full name of the OS, factory (if any) and inventory number are indicated; the account on

- which takes into account property, depreciation group.

Section 1 - contains fields for mandatory completion based on OS-1 acts at the time of transfer of the object, indicating the details of these documents. If the OS was previously operated by another organization, then in this block you need to note the amount of accrued depreciation and the residual value of the property;

Section 2 – should include the values of the initial cost of the fixed assets and useful life relevant at the time of acceptance for accounting;

Section 3 - is filled in when revaluing fixed assets; the date of the transaction, coefficient, and value obtained after taking into account the revaluation are entered into the inventory card. Since the revaluation is carried out regularly, the number of completed lines should be equal to the number of times it was carried out;

Section 4 – reflects data on acceptance, movement between internal divisions, disposal of fixed assets. The details of the primary documents must be indicated, where the object is being moved and at what cost, as well as the financially responsible person for its storage;

Section 5 - includes information on changes in the initial cost of the asset as a result of reconstruction, modernization, completion of individual components and, in general, the facility, its additional equipment. Partial liquidation disclosures are also required. The fields with the type, date of the document, and the amount of costs incurred are filled in;

Section 6 – separates out the OS repair operation; the same information as in the previous paragraph should be entered in this block;

Section 7 – contains brief characteristics of the OS:

- full technical name, number of components;

- the fact of containing precious metals or stones. If available, it is necessary to disclose the type, units of measurement, quantity;

- completeness, additional elements, components - the presence and features of fixtures and extensions;

- dimensions, weight;

- other notes.

At the end of the document, the responsible employee of the accounting service who compiled it in paper or electronic form puts his signature.

So, OS-6 is a document for analytical accounting of fixed assets at an enterprise, containing all the data on its internal movements, improvements and repairs. It is necessary to fill out an inventory card from the beginning of the operation of the asset until its disposal; this must be done consistently and continuously when performing transactions with property that entail a change in its value.

In contact with

The creation and registration of inventory cards for accounting for fixed assets in the OS-6 form is usually carried out at those enterprises and organizations that own a significant amount of property and which need to control its content, storage and movement. Each individual fixed asset has its own card, and cards can be issued for both company property and leased property.

FILES

Before opening the card

Before creating this accounting document, it is necessary to draw up an act of acceptance and transfer of fixed assets - it is from this that information about the object comes into the card. In addition, to fill it out, data is taken from other accompanying papers, such as, for example, technical passports of products, equipment and machinery.

The inventory card refers to the internal accounting documentation of the enterprise and information is entered into it for any actions with the property registered in it (purchase, transfer from one department to another, repair, reconstruction, modernization, write-off, etc.).

Rules for document execution

The inventory card of the object has a unified form with code OS-6, approved by Resolution of the State Statistics Committee of Russia dated January 21, 2003 N 7.

The document is drawn up for each object separately and in a single copy, and if the cards are kept in electronic form, then there must be a copy of it on paper (it is the paper versions that contain the “live” signature of the financially responsible person). It is not necessary to certify the document with the company seal, because it refers to its internal documentation.

Example of registration of an inventory card according to the OS-6 form

Filling out the document header

At the beginning of the document write:

- name of the company that owns the fixed asset,

- the structural unit to which the property is assigned,

- inventory card number,

- date of its preparation,

- name of the registered object.

Here, in the column on the right, the enterprise code according to OKPO (All-Russian Classifier of Enterprises and Organizations) is indicated - it is contained in the constituent papers and the code of the fixed asset object according to OKOF (All-Russian Classifier of Fixed Assets). Continuing to fill out the right column, we enter detailed information about the object:

- number of the depreciation group to which it belongs according to the accounting of the enterprise,

- passport registration number,

- serial and inventory numbers,

- date of registration of the fixed asset for accounting,

- number of the account (sub-account) through which it passes.

Below, the location of the fixed asset object is entered in the corresponding lines (indicating the department code, if such coding is used at the enterprise) and information about the manufacturer (this data can be found in the technical passport).

Filling out detail tables

The second part of the document opens sections dedicated to the registered object.

Note: information is entered into the first section only if the property was already in use at the time of entry into the card. If it is new, you do not need to fill out this section.

To the second section The cost of the object at the time of acceptance for accounting and its useful life are included.

Third section is issued when revaluing a fixed asset - and the price can vary both upward and downward. The difference between the original cost and after revaluation is determined as the replacement price.

To the fourth section cards, information about all movements of registered property is entered. The data is entered here strictly on the basis of accompanying papers indicating the type of operation, the structural unit to which the asset belongs, the residual value and information about the responsible person.

If the fixed asset is owned by several persons, then they must be indicated under the fourth table with the percentage distribution of shares.

Filling out sections of the reverse side of the OS-6 form

In the fifth section indicates all changes in the original value of the object, regardless of the actions performed with it. The type of operation, data from the supporting document, as well as the amount of expenses incurred by the organization in the process of carrying out the necessary procedures are written here.

Sixth section includes information about repair costs, with a full breakdown of each operation performed (type of repair, accompanying documentation, amount of expenses).

Seventh section contains special data about the object of fixed assets, including data on the content of precious and semi-precious metals, stones and materials in its composition.

In the last table of cards Structural units, elements and other features that are a distinctive feature of the property, as well as its qualitative and quantitative indicators, are registered. If there are any comments, they are entered in the last column of the table.

Finally, the document is certified by the employee responsible for maintaining inventory cards at the enterprise (his position must be indicated here and a signature must be affixed with a transcript).

Each inventory item has its own inventory number, as well as an inventory card - a “passport” of the fixed asset. The inventory card contains all the information about the object: characteristics, information about internal movements of the object, repairs and repair costs, etc. Form OS-6 is a unified form of inventory card for recording fixed assets. The unified form of the OS-6 form was approved by Decree of the State Statistics Committee of January 21, 2003 No. 7. You are not required to use an official form - you can draw up the document yourself, and use the unified OS-6 card as a sample for filling out. Please note that the developed form must contain all required details.

Inventory card for accounting of fixed assets

If your organization has a small number of fixed assets, you have the right not to fill out the OS-6 inventory card separately for each object, but to take them all into account in the inventory book, indicating all the necessary information there (form OS-6b).

It is necessary to fill out the OS-6 inventory card or book on the basis of an act or invoice on the acceptance and transfer of fixed assets, technical passports of the object and other documents for the acquisition. Please note that if you lease an asset, it is also recommended to create an inventory card for the asset.

Sample filling OS-6

In the header of the inventory card for accounting for fixed assets, fill in the name of the company, the asset, the location of the object, the form code according to OKUD - 0306005 (do not confuse it with the inventory card for accounting for non-financial assets - 0504031), code according to OKPO, OKOF, numbers (factory, inventory, etc. .), date of acceptance and write-off from accounting.

The main part of the inventory card of the OS-6 form consists of 7 sections - tables. At the time the object is accepted for registration, the following sections must be completed in the OS-6 form:

- Section 1, which contains information about the object as of the date of transfer;

- Section 2, which contains information about the object as of the date of its acceptance for accounting;

- Section 4, which contains information about the acceptance of the object;

- Section 7, which contains the characteristics of the object.

The remaining sections of the OS-6 form should be completed during the operation of the facility:

- in section 3, information about the revaluation of an asset is filled in;

- Section 4 contains information about internal movements of an object between divisions of the enterprise and its write-off;

- Section 5 contains information about changes in the original cost. Filling out this section of the OS-6 form, for example, is necessary when upgrading a facility, reconstructing or completing construction;

- Section 6 displays the costs of repairing the facility.

The completed form of the fixed assets inventory card is signed by the responsible person. If the enterprise makes a decision to dispose of a fixed asset for any reason (operating conditions were violated, an accident or emergency occurred, or for another reason), based on the write-off act, a corresponding mark is made in the inventory card in the OS-6 form. Inventory cards for objects that have been retired must be stored for a period established by the head of the company, but not less than five years.

If you are filling out the OS-6 inventory card for the first time, familiarize yourself with the filling out sample and pay attention to the procedure for filling out the OS-6 form. A sample of filling out OS-6 is given below.

To account for fixed assets, inventory cards are filled out, which reflect all movements and movements of the object, as well as other actions related to the fixed asset (revaluation, repair, modernization, reconstruction).

To account for one fixed asset item, an inventory card in form OS-6 is filled out; for a group of similar objects, a card in form OS-6a can be created. For small enterprises, it is allowed to reflect information about all OS objects in one inventory book OS-6b -.

In this article we will look at the design features of the inventory card form OS-6.

All inventory cards of an enterprise can be systematized in a file cabinet, taking into account the classification of fixed assets. Fixed assets, in this situation, are accepted into depreciation groups and distributed according to the place of use (within sections and classes). In addition to information about the object and its location, the inventory card contains the following information:

- the service life of a fixed asset item, during which it performs its assigned tasks in the organization;

- method of calculating depreciation;

- information about non-accrual of depreciation (if necessary);

- information about the unique qualities of the object.

It is recommended to make inventory cards for rented funds as well. Then the inventory number assigned by the lessor can be taken into account by the lessee. In a situation where there are quite a large number of fixed assets in the organization’s branches, accounting is carried out in a special inventory list. It indicates the basic information from the inventory cards (date and number), as well as the corresponding object number, its original cost and information about the internal movement or disposal of the object (internal movement is accompanied by the execution of an OS-2 invoice, a form and sample of which can be downloaded from).

Inventory cards that were added to objects with funds taken into account and retired during the reporting period can be kept separately from cards for other fixed assets until the end of the month. Every month, the information contained in the inventory cards is summarized and compared with synthetic accounting indicators. Taking into account the cost of the described objects, the units of measurement for the amounts in the cards are rubles or thousands of rubles.

For intangible objects, fill in

Sample of filling out an inventory card for recording fixed assets, form OS-6

Data in the inventory card about the object is entered on the basis of the data in the transfer and acceptance certificate (or OS-1b).

Data in the inventory card about the object is entered on the basis of the data in the transfer and acceptance certificate (or OS-1b).

For objects that were previously in operation, you should fill out the first section and transfer the data from a similar section of the acceptance certificate. For new objects this section is not completed.

In the second section, information about the fixed asset is filled out on the date of acceptance for accounting - the initial cost and useful life.

The third section is completed if a revaluation of its value is carried out in relation to an object, indicating the resulting replacement cost.

All movements of fixed assets are reflected in the fourth section. Acceptance data is entered on the basis of the acceptance and transfer act, data on disposal as a result of donation or sale - also on the basis of the transfer and acceptance act, write-off data - on the basis of the OS-4 write-off act (you can download the form and sample), OS-4a for vehicles (you can download the form and sample OS-4a from).

The fifth section reflects information about ongoing modernization and reconstruction, which results in a change in the initial value of the object. In the sixth section, information about the costs of current repairs is filled in, as a result of which the initial cost of the operating system does not change.

The fifth section reflects information about ongoing modernization and reconstruction, which results in a change in the initial value of the object. In the sixth section, information about the costs of current repairs is filled in, as a result of which the initial cost of the operating system does not change.

The seventh section may reflect the individual characteristics of the object (by analogy with the same section of the transfer and acceptance certificate).

Download sample document

Inventory card of fixed assets OS-4 form - .

Inventory card sample of filling out form OS-4 - .