Risks in real estate management. Open Library - an open library of educational information a) risk distribution between participants

Real estate financing risks

The risk reflects the possibility of deviation of the actual output data from the expected planned results. Risks depend on the specifics of the investment project, profitability, stability in the given market.

Consider the main risks associated with real estate financing:

- credit risk - losses if the borrower does not make payments;

– interest rate risk – the probability that the rate on a loan is adjusted less frequently than on borrowed funds in the face of rising interest rates;

– risk of early repayment – losses in case of early repayment of a loan with a fixed interest rate;

– pre-commitment risk – the risk of financing loans for which a fixed interest rate is determined before the start of financing;

- liquidity risk - the probability that the creditor will not have enough funds to pay for his obligations, received as repayment of debt on loans issued;

– the risk of changes in the conditions for mobilizing funds – losses in the event of a decrease in the value of funds (base rate) when lending with a fixed premium (relative to the base rate).

Credit risk is associated with losses in cases where the borrower is unable to make payments on the loan or if the value of the pledged property is insufficient to repay the borrower's obligations to the lender. The borrower's solvency is determined by the ratio of the borrower's income and the interest rate on the loan. In the event of non-payment, there are several types of losses for the creditor. The lender incurs losses if the amount received from the sale of the real estate transferred to him in possession is less than the repaid part of the loan. Along with the costs of operating, repairing and selling property, there are also administrative costs for managing outstanding loans and seized property.

Credit risk management is carried out through a thorough analysis of the collateral object, the solvency of the borrower and the development of recommendations on the acceptable loan amount. When determining the probability of repayment of a loan, the main attention is paid to determining the amount of the borrower's income and assessing the value of the property transferred as collateral. When lending to real estate development (construction, reconstruction, modernization), credit risk is significantly reduced if it is known that the borrower has previously completed several projects similar to the one for which the loan is requested.

Interest rate risk is a decrease in the profit of a credit institution due to a negative unforeseen change in the level of interest rates. That is, these are potential losses caused by financing with an imbalance in the periodic revision of interest rates on loans and borrowed funds.

Ways to manage this risk: financing with the help of securities with the same maturity and the use by creditors when calculating loan payments of various methods of their indexation, taking into account inflation and the borrower's income.

Prepayment risk is the potential loss on reinvestment that is caused by early repayment of a mortgage loan with a fixed interest rate. The risk also arises in connection with losses in the financing of loans, the interest rates for which are determined before the start of financing. This risk is called pre-commitment risk.

When lending, alternative conditions are provided for the lender and the borrower. The borrower receives the right to repay the loan before the end of the loan agreement, and the lender, in turn, has the opportunity to periodically change the interest rate on the loan with a changing interest rate. Lenders also provide borrowers with the ability to determine the rate of interest on a loan before the loan financing process begins.

Liquidity risk is associated with the insufficiency of receipt of payments on loans to fulfill the current obligations of the creditor, arises in connection with the difficulties in raising cash by selling assets at market prices or close to them. Liquidity risk management requires a number of financial transactions. In particular, the cash flow is calculated to determine the bank's cash needs and a cash mobilization strategy is developed with the identification of sources and costs. Reducing liquidity risk is directly related to the development of the secondary market for mortgage loans, creating conditions for attracting long-term resources in this area, ensuring refinancing of issued mortgage loans,

The risk of changing the terms of fund raising arises from long-term lending at a variable interest rate. In this case, the interest rate on the loan is fixed, and the interest rate on borrowed funds is variable.

The risk of changes in the terms of fund raising can be managed by financing loans with long-term floating rate debt.

Along with the above, there are specific risks that arise when lending to housing construction. For example, there is a risk that finished apartments may be sold more slowly than planned. Ways to mitigate this risk include requiring a certain number of units to be pre-sold and splitting the lending process into several independent steps when dealing with large projects.

There is also a risk of fire or theft of installed or stored materials or other property damage. Reducing this risk is achieved by insurance, security and other ways of ensuring security that do not contradict the law.

There is a risk of granting a loan due to the falsification of documents provided by the borrower and the diversion of loan funds for the intended purposes. It can be reduced, firstly, by investing funds received from the borrower and, secondly, by making an additional investment of the borrower's own funds if it is determined that the amounts remaining from the loan provided are not enough to complete the construction.

When financing investments, one should take into account the risks inherent in investments in real estate, which require a significant amount of capital investment, while they are long-term and subject to a greater influence of risk factors than investments in other areas of the economy.

The profitability of an investment project should be analyzed on the basis of estimates of the current risk-free rate, general market risk and risk due to the characteristics of real estate as an investment asset.

Risk free investment investments for which there is absolute certainty about their return. There are no absolutely risk-free investments, but those with the maximum degree of return reliability include investments, the return of which is guaranteed by the state.

Accordingly, the current rate on long-term government obligations (for example, bonds) or similar securities is taken as the risk-free rate when analyzing investments in real estate.

Market risk - annual variability IRR due to changes in regular income and the cost of capital. In the real estate market, unlike the securities market, profitability is determined not on the basis of simple statistical processing of sales prices and rental values, but on the basis of estimates performed by professional appraisers. Such estimates depend on the qualifications and experience of the appraiser and may be erroneous.

The risk associated with investing in real estate is specific risk due to the unique features of real estate: low liquidity, high costs of money and time for transactions, the need for quality management. When investing in real estate, it is necessary to take into account the possible decrease in the profitability of the investment project relative to the projected one, the excess of actual costs over previously expected ones, the impossibility of completing the investment project due to an unforeseen excessive increase in prices for materials, the inability to sell the constructed object at the previously planned higher price, the exposure of real estate elements to risk destruction.

The following sources of risk of investment in real estate are distinguished:

Property type;

- supply and demand in the market;

- location;

- compliance with the terms of the lease;

- depreciation of objects;

- legislative regulation and changes in taxation;

- inflation;

- reinvestment.

The risk of real estate type depends on supply and demand.

Location risk is broader as it also includes property type risk.

Lease risk is associated with the fact that the tenant cannot pay the full amount of the rent stipulated by the contract. This risk is more significant for real estate with a single tenant.

The risk of property depreciation lies in the fact that the profitability of real estate may decrease due to physical wear and tear and aging. In order to increase the profitability of a building, owners usually choose to incur significant material costs.

The risk of legislative regulation and changes in taxation is associated with the fact that significant costs will be required when increasing tax rates.

Inflation and reinvestment risks have less of an impact on real estate investment than the others listed above.

When investing equity, there is no way to diversify the risk through changes in the capital structure, diversification is achieved through different types of real estate and different regions.

Using debt to finance real estate investments means using mortgage debt.

Essence and classification of risks

Management of risks

Formation of anti-risk policy

Self Tests

Glossary

Learning objectives of the module

1. Get an idea of the essence of the modern concept of risk management and their classification.

2. Learn methods for preventing and reducing risks.

3. Master the issues of formation of anti-risk policy.

4. Gain insight into risk prevention schemes throughout the life cycle of various properties.

Essence and classification of risks

The problem of risks is essential for the analysis of the effectiveness of investment, construction and real estate companies in the real estate market. It should be borne in mind that any

a real estate transaction is a transaction that carries elements of risk. At the same time, real estate transactions are among the most risky business sectors. There are quite a few reasons for this, but such features of the real estate market as locality, high dependence on the state of the regional economy, the long-term nature of investments, and low liquidity of goods on the market are of paramount importance. Superimposed on the high capital intensity of real estate and a significant level of costs of real estate transactions, these circumstances put the problem of risk management in one of the first places in business in the real estate market. We can say that risk management is the quintessence of all management issues for real estate entrepreneurship. In order to manage risks, first of all, it is necessary to know the content (nature) of risks. Risk is possibledeviations of the actual results of a particular operation or project innegative side compared to those originally planned.

The American Institute of Project Management (PM1), which develops and publishes standards in the field of project management, has significantly revised the sections governing risk management procedures. The new version of the PMBOK (adopted in 2000) describes six risk management procedures related to any business area, including real estate. In real estate transactions, the risk may manifest itself in a lower than previously planned price when selling real estate; in higher than expected level of operating expenses in real estate management; in a decrease in the actual profitability of an investment project compared to the project one, and even in the loss of property rights. The scale of such risks can be very different: from the loss of income or part of it to the complete loss of invested funds or property.

Risks are caused by the uncertainties that exist in each project. Under uncertainty refers to the incompleteness or inaccuracy of information about the conditions for the implementation of the project, including the costs and results associated with them. Uncertainty associated with the possibility of adverse situations and consequences during the implementation of the project is characterized by the concept risk. Risks can be "known" - those that are identified, assessed, for which planning is possible. Risks "unknown" are those that are not identified and cannot be predicted.

The following types of uncertainties and investment risks seem to be the most significant:

The risk associated with the instability of economic legislation

the current economic situation, investment conditions and

use of profits;

External economic risk (the possibility of introducing restrictions on trade and supplies, closing borders, etc.);

The uncertainty of the political situation, the risk of adverse

socio-political changes in the country or region;

Incompleteness or inaccuracy of information about the dynamics of technical

economic indicators, parameters of new equipment and technology;

Fluctuations in market conditions, prices, exchange rates, etc.;

Uncertainty of natural and climatic conditions, the possibility

natural Disasters;

Production and technological risk (accidents and failures

equipment, manufacturing defects, etc.);

Uncertainty of the goals, interests and behavior of participants;

incompleteness or inaccuracy of information about the financial position and business reputation of participating enterprises (possibility of non-payments, bankruptcies, breaches of contractual obligations).

Externally unpredictable risks

1. Unexpected government regulatory measures in the areas of:

Logistics;

Design standards;

Production standards;

Taxation.

2. Natural disasters:

floods;

Earthquakes;

climate change, etc.

3. Crimes:

Vandalism;

Sabotage;

Terrorism.

environmental;

Social.

5. Breakdowns:

In creating the necessary infrastructure;

Due to the bankruptcy of engineering, supply, construction, etc. contractors;

in financing;

Due to errors in defining project objectives;

Due to unexpected political changes.

Externally predictable risks

1.Market risk due to:

Deterioration of the possibility of obtaining raw materials;

Raising the cost of raw materials;

Changing consumer requirements;

economic changes;

Increasing competition;

Loss of positions in the market;

The unwillingness of buyers to comply with trade rules.

2. Operating:

Inability to maintain the working state of project elements;

Security breach;

Departure from the goals of the project.

3. Unacceptable environmental impacts.

4. negative social consequences.

5. Change in exchange rates.

6. Unexpected inflation.

7. Taxation.

Internal non-technical risks

1. Disruptions to work plans due to:

Lack of labor force;

Lack of materials;

Late delivery of materials;

Poor conditions at construction sites;

Changes in the capabilities of the project customer, contractors;

Design errors;

planning errors;

Lack of coordination of work;

leadership changes;

incidents and sabotage;

Difficulties of the initial period;

unrealistic planning;

Weak management.

2. Cost overrun due to:

disruption of work plans;

Wrong supply strategy;

Unqualified personnel;

Overpayments for materials, services, etc.;

Parallelism in the work and inconsistencies in the parts of the project;

contractor protests;

Wrong estimates;

Unaccounted for external factors.

Technical risks:

1. Technology change.

2. Deterioration in the quality and productivity of production by linking the project.

3. Specific risks of the technology laid down to the project.

Legal risks

1. Licenses.

2. Patent law.

3. Failure to fulfill contracts.

4. Litigation with external partners.

5. Internal litigation.

6. Force majeure (extraordinary circumstances).

Insured risks

1. Direct damage to property:

Transport incidents;

Equipment;

materials;

Contractor property.

2. Indirect losses:

Dismantling and relocation of damaged property;

Rearrangement of equipment;

Loss of rental income;

Violation of the planned rhythm of activity;

Increase in the required funding.

Risks insured in accordance with regulatory documents to unauthorized persons:

Infliction of bodily harm;

Property damage;

Damage to the project due to design and implementation errors.

But in practice, managers working with real estate distinguish their classification:

I. Market risks(business risks, commercial risks) associated with the specifics of the business area and the impact on non-macroeconomic and regional factors.

As you know, any real estate object has legal physical and economic certainty. At the same time, any real estate transaction takes place within certain territorial entities with their inherent administrative rules and procedures. Accordingly, the following sources can be distinguished market risks:

one). Legal(the possibility of loss of ownership, the formation of losses due to errors in the conclusion of agreements and contracts, the appearance of claims of third parties, the presence of unidentified encumbrances of the object, etc.);

The specifics of the economic and legal turnover of real estate, the multi-stage real estate transactions require special attention to the legal side of transactions. This is especially important, since the formation of the legal framework for real estate transactions has not yet been completed, a number of regulatory documents contradict each other, the composition of transferred rights to real estate is not always accurately determined during transactions, and the system for registering rights to real estate and transferring these rights is not developed. As the experience of the development of the real estate market shows, the reason for the emergence of subsequent claims on transactions, lawsuits is often the low level of legal analysis during transactions, the impossibility of obtaining complete information.

Careful legal research, cooperation with insurance companies will reduce the likelihood of these risks and prevent a significant part of them.

Legal risks can be roughly divided into two groups:

a) the first includes the risks associated with contestability third parties of ownership of the object that is the subject of the transaction. For example, if the purchased apartment has repeatedly participated in transactions after privatization, and the court, for one reason or another (and there may be a great many such reasons), has declared any of the transactions invalid, then the last transaction can automatically be declared invalid.

Knowing the background of the purchased apartment is a necessary condition in order to make a decision on its acquisition. At the same time, it should be borne in mind that civil law establishes a 10-year limitation period for concluded transactions.

b) the second group includes risks associated with legal literacy representatives of the firm (managers and agents) who help you organize the transaction, and the legal correctness of drawing up countless documents that you will be asked to sign.

This type of risk is determined by the technology of a particular real estate transaction. Here it is necessary to be guided by the fact that there are no universal agreements. Each transaction is unique, and its uniqueness must be reflected in all contracts concluded both at a real estate agency and at a notary. Everything agreed upon by the parties to the transaction, including even the smallest details, should be reflected in the contractual documentation.

2). economic risks, arising from real estate transactions are associated with changes in the market situation.

This change can be manifested in a number of factors - in a change in demand influenced by a decrease in business activity or incomes of the population, an increase in prices for materials and equipment, in the appearance of alternative offers on the market (for example, an increase in the supply of rental premises to an alternative to acquiring ownership), in an increase in supply by competing firms, etc. The possibility of preventing and reducing the degree of probability of losses of a company (firm) due to the existence of economic risks largely depends on the depth of study of economic decisions made, constant study of the market situation, the availability of a system of alternative supplies, etc.

Risks may arise for the following reasons:

Insufficiently representative analysis of the market situation for similar transactions and projects;

Misinterpretation of available data;

Biased attitude to data.

2. Risks due to one or another option chosen by the company (firm) to finance its activities, the degree of elaboration of its financial decisions. For example, choosing a project loan is a riskier option than issuing ordinary shares, as it involves paying principal and interest on a fixed schedule, which is not the case with issuing shares. At the same time, the issuance of shares without confidence and the possibility of their placement may turn out to be a more expensive financing tool than credit resources.

3. Risks arising from errors in financial calculations.

For example, errors in the preparation of the income and expenditure plan

financial resources can lead to the insolvency of the company

(firms) at some stage of the project or transaction, which would require the involvement of more expensive resources, if at all possible. Being present in almost all real estate transactions, these risks at the same time play a different role depending on the market networks or the field of activity.

Sh. Production (economic) risks related to the level of the firm and determined by the quality of its activities.

Almost all the risks that any investor investing in real estate may face are qualified above.

Management of risks

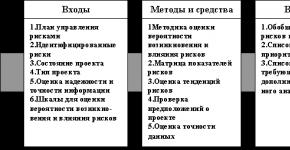

Management of risks - these are processes associated with the identification, analysis of risks and decision-making, which include maximizing the positive and minimizing the negative consequences of the occurrence of risk events. The risk management process usually includes the following procedures:

Risk management planning - selection of approaches and planning of risk management activities:

Qualitative risk assessment - a qualitative analysis of risks and conditions of their occurrence in order to determine their impact on the success of the project:

Quantification - a quantitative analysis of the likelihood of occurrence and the impact of the consequences of risks on the project:

|

Risk response planning - determination of procedures and methods to mitigate the negative consequences of risk events and use possible benefits;

Risk monitoring and control - monitoring risks, identifying remaining risks, implementing the risk management plan and evaluating the effectiveness of risk mitigation actions.

All these procedures interact with each other, as well as with other procedures. Each procedure is performed at least once in every project. Although the procedures presented here are considered to be discrete elements with well-defined characteristics, in practice they may overlap and interact.

Risks depend on the specifics of the investment project, profitability, stability in this market.

Consider the main risks associated with real estate financing:

1. Credit risk– losses if the borrower does not make payments.

Credit risk is associated with losses in cases where the borrower is not in

able to make payments on the loan or if the value of the pledged property is insufficient to repay the borrower's obligations to the creditor. The borrower's solvency is determined by the ratio of the borrower's income and the interest rate on the loan.

Ways to manage this risk: financing with the help of securities with the same maturity and the use by creditors when calculating loan payments of various methods of their indexation, taking into account inflation and the borrower's income.

3. Prepayment risk– losses in case of early repayment of a loan with a fixed interest rate.

Prepayment risk – it is the potential loss on reinvestment that is caused by the early repayment of a fixed-rate mortgage. The risk also arises in connection with losses in the financing of loans, the interest rates for which are determined before the start of financing. This risk is called pre-commitment risk.

The borrower receives the right to repay the loan before the end of the loan agreement, and the lender, in turn, has the opportunity to periodically change the interest rate on a loan with a changing interest rate.

4. Liquidity risk- the probability that the creditor will not have enough funds received as repayment of debt on loans issued to pay for his obligations.

Liquidity risk is associated with the insufficiency of receipt of payments on loans to fulfill the current obligations of the creditor, arises in connection with the difficulties in raising cash by selling assets at market prices or close to them. Liquidity risk management requires a number of financial transactions. The cash flow is calculated to determine the bank's cash needs and a cash mobilization strategy is developed with the identification of sources and costs. The reduction of liquidity risk is directly related to the development of the secondary market for mortgage loans, the creation of conditions for attracting long-term resources in this area, and the provision of refinancing of issued mortgage loans.

5. Risk of changes in the terms of fund raising– losses in the event of a decrease in the value of funds (base rate) when lending with a fixed premium (relative to the base rate).

The risk of changing the terms of fund raising arises from long-term lending at a variable interest rate. In this case, the interest rate on the loan is fixed, and the interest rate on borrowed funds is variable.

The risk of changes in the terms of fund raising can be managed by financing loans with long-term floating rate debt.

In addition to the above, there are specific risks.

When financing investments, one should take into account the risks inherent in investments in real estate, which require a significant amount of capital investment, while they are long-term and subject to a greater influence of risk factors than investments in other areas of the economy.

The risk associated with investing in real estate is a specific risk due to the unique features of real estate: low liquidity, high costs of money and time for transactions, the need for quality management. When investing in real estate, it is necessary to take into account the possible decrease in the profitability of the investment project relative to the projected one, the excess of actual costs over previously expected ones, the impossibility of completing the investment project due to an unforeseen excessive increase in prices for materials, the inability to sell the constructed object at the previously planned higher price, the exposure of real estate elements to risk destruction.

Sources of real estate investment risk: type of real estate, supply and demand in the market, location, compliance with lease conditions, depreciation of objects, legislative regulation and changes in taxation, inflation, reinvestment.

The risk of real estate type depends on supply and demand.

Location risk is broader as it also includes property type risk.

Rental risk is related to the fact that the tenant cannot pay the entire amount of the rent provided for in the contract. This risk is more significant for properties with a single tenant.

The risk of property depreciation lies in the fact that the profitability of real estate may decrease due to physical wear and tear and aging.

The risk of legislative regulation and changes in taxation is associated with the fact that significant costs will be required when increasing tax rates.

Inflation and reinvestment risks have less of an impact on real estate investment than the others listed above.

Risk Prevention and Mitigation Methods

Main risk management methods applied to

real estate:

1. Organization charts:

1.1. Distribution of risk between participants.

The initiative desire of the owner to share the risk in some way between partners - different groups of participants in business interaction.

Schemes, separation algorithms can be different:

From the simplest (parity division);

To a more complex one: to make responsible for the risk or to assign a greater share of responsibility to those participants in business interaction (business project) who are better than others in assessing and controlling risks. Moreover, this will be connected with the requirements to provide participants with reliable information about the professional level of persons in risk management.

The distribution of risk is implemented when developing a financial plan for a business project and contract documents on the interactions of participants. The distribution can be made at a qualitative level, as well as accompanied by quantitative assessments.

Qualitative risk distribution is implemented in a joint decision of the business project participants. At the center of the solution is the nature of the internal and external interactions of the participants.

For quantitative assessments of risk distribution schemes, it is necessary to involve calculation tools: the financial model of the project, network diagrams, decision tree. Moreover, it is necessary to remember about the contradictions of interests of the seller and the buyer, the owner and the tenant, the customer and the contractor.

1.2. Risk transfer is carried out in full to another project participant, including a partner. This is possible in situations where the person initiating the transfer of risk is unable, due to financial circumstances, to bear responsibility for the risk.

Risk avoidance is a reflection of management style.

Each scheme is implemented through an appropriate system of contracts, where it reflects all the named organizational conditions for management and targeted division of responsibility for possible emerging risks.

2. Organizational and financial schemes:

2.1. Risk diversification.

For real estate management, the challenge is to find ways to reduce the overall risk at a satisfactory level of income. Characteristically, the risks of investments can be associated with the risk of the entire portfolio as a whole. Since in practice the projects included in the portfolio are somewhat different, and their risks are not additive, the correlation coefficient of individual projects and the portfolio as a whole is always less than one. Thus, the integral risk of the portfolio can be reduced, including in comparison with the most risky project.

2.2. Risk insurance.

Risk insurance is the transfer of risk to a third party in exchange for a fixed fee. Such transfer of risk is addressed to a special licensed insurance company and is a paid operation (insurance premiums, premiums are paid). In this case, the insurer assumes all the risks of the insured agreed upon by the insurance contract.

For the risks associated with real estate management, the leading place belongs to the articles and provisions related to property insurance, as well as insurance of contractual liability and business risk.

The insurer has the right to independently determine the amount of the insurance premium and schedules for payment of insurance premiums. The sum insured when insuring property or business risk, in general, should not exceed their actual value.

a) Bank guarantees.

2.5. Regular review of the terms of the concluded contract is carried out and carried out taking into account the levels of rental rates, the terms and volumes of loans to be repaid in stages, deferrals of tax benefits granted, assessment of the property, made for the purpose of its taxation or insurance. The reasons are fluctuations in market prices, supply and demand conjunctures, significant changes in the economic and socio-political situation, increased inflation rates, unforeseen evolutions of reforms, adjustments in laws and regulations.

To prevent risk situations, it is advisable to provide in advance in the text of the contract the possibility or even the obligation of regular recalculations of the most important indicators of financial interaction.

2.6. .

One of the most risky elements in commercial real estate development projects is the problem of the future effective implementation of the finished object.

An active preliminary search for clients, tenants, buyers and making deals with them before the completion of the construction of the facility is a powerful stabilizing, anti-risk tool. In addition, prepayment significantly strengthens the financial scheme of the project for the developer.

3. Private risks.

Among private risks, it is advisable to include, first of all, the risks of the non-viability of the project, financial risks in accordance with the components of the project business plan being developed (tax and credit risks, risks of implementing the project results, including the risk of construction in progress, etc.)

Among other possible methods and measures to solve the problem of preventing and reducing risks, one should name:

Improve management in general, learn to manage "good";

Application of modern business administration techniques and active public relations related to social conflicts and environmental risks;

Improving the professional qualifications of managers and executive personnel;

Development and competent use of the legal environment, economic management mechanisms, as well as modern information technologies and multimedia tools, etc.

Risks that can be minimized in the process of real estate management:

· liquidity risk– the risk that, upon completion of construction, there will be problems with the sale of the property due to the fact that the consumer qualities of the building proposed for sale will not meet the requirements for similar objects on the market;

· downside risk- arises if the owner cannot provide the planned level of rental rates for the leased areas, since the management of the property is inefficient;

· risk of property damage is the risk of loss of property due to improper operation, non-compliance with safety standards, etc. e. The simplest example is a malfunction in the technical and technological systems of a building, or an insufficient number and qualification of maintenance personnel providing a comprehensive service for maintaining an object;

1. At the stage of formation:

a) distribution of risk between participants

risk transfer

risk insurance

guarantee schemes for the use of obligations

c) estimated margin

preliminary search for clients and prepayment

2. At the stage of use:

a) risk avoidance

diversification

b) distribution of risk between participants

risk transfer

risk insurance

c) estimated margin

regular recalculation of the terms of interaction

preliminary search for clients and prepayment

3. At the stage of development:

a) risk transfer

risk diversification

performance guarantee schemes

b) risk insurance

estimated margin

regular recalculation of the terms of interaction

c) distribution of risk between participants

risk avoidance

preliminary search for clients and prepayment

4. At the stage of termination of activities:

a) risk avoidance

guarantee schemes for the fulfillment of obligations of actions for

analogies

b) distribution of risk between participants

risk diversification

risk insurance

c) estimated margin

regular recalculation of the terms of interaction

risk transfer.

Glossary

Country risk– the risk of investing money in securities of joint-stock companies.

Risk of legislative changes arises in connection with the re-registration of a joint-stock company, obtaining a license for the right to carry out transactions with securities.

Currency risk associated with investments in foreign exchange securities and is due to changes in the exchange rate of the national currency.

inflation risk arises from the fact that at high rates of inflation, the income received by investors from securities depreciate faster than they will increase in the near future.

Industry risk. This risk manifests itself in a change in the investment qualities and market value of securities and in the losses of investors based on the industry belonging to a certain type.

Unsystematic risk considered diversifiable.

Credit (business) risk observed in a situation where the issuer issuing debt securities will be unable to pay interest on them or the principal amount of the debt.

Liquidity risk associated with the possibility of losses in the sale of securities due to changes in their quality.

Interest risk- the probability of losses that investors will incur with a change in interest rates in the credit market.

Capital risk- the total risk for all investments in securities.

selective risk– the risk of wrong choice of securities for investment in comparison with their other types when forming a portfolio.

Revocation risk– possible losses for the investor if the issuer withdraws his bonds from the stock market due to the excess of the fixed income level on them over the current market interest.

Securities delivery risk in futures contracts, it is associated with a possible failure to fulfill obligations for the timely delivery of securities held by the seller.

Operational risk caused by malfunctions in the operation of computer networks for processing information related to securities, a low level of qualification of technical personnel, violation of technologies, etc.

Keywords

Risk events

Quantitative risk analysis

Qualitative Risk Analysis

Risk identification

Risk management

fyfrjUcmuquafrfazfr activity

UDC 330.322.2

RISK ASSESSMENT IN REAL ESTATE INVESTMENT FINANCING

E. YU. KALASHNIKOVA,

Candidate of Economic Sciences, Senior Lecturer, Department of Finance and Credit E-mail: [email protected] yandex.ru Stavropol State University

The relevance of such problems as assessing the risk of investing in real estate in the formation of an investment portfolio, and managing financing are due to the recovery of the real estate market in the post-crisis period and the need to search for new assets for investment in the financial market. Prices in this market are relatively stable, yet investing in real estate, like investing in securities, is subject to risks.

Key words: risk, investments, real estate, evaluation.

The variety of characteristics of real estate and the peculiarities of their location, combined with the lack of a substitute for similar real estate on the local market, makes it possible for individual sellers to take a monopoly position in the market.

Institutional investors (commercial banks, insurance companies), considering real estate as an asset that occupies a certain place in the investment portfolio, include real estate in aggregated portfolios, since the return on this asset is in antiphase with respect to the return on traditional financial assets (stocks and bonds).

Unlike financial investments, real estate has a clearly expressed material form, the highest level of protection against inflation, the possibility of multi-purpose use

objects. The disadvantages include low liquidity, high costs for the creation and maintenance of facilities.

Under these conditions, the assessment of the effectiveness of investments in real estate acquires an important role. It can serve many purposes: defining investment policy, monitoring performance, choosing a property location, developing relationships with new investors, and so on. The assessment should be based on an analysis of the income it brings. Investment income in this case includes two components: current income (cash flow from real estate transactions) and change in the value of assets (as a result of revaluation of property).

A characteristic feature of evaluating the effectiveness of investments in real estate is a relatively higher level of risk - this is the risk of unforeseen losses, losses, shortfalls in income, profits compared to the planned option. Investment risk, in turn, is the likelihood of unforeseen financial losses (decrease in profits, income, and even loss of the investor's capital) due to adverse circumstances.

As follows from the common practice of studying the problem, the issue of risk management in the field of investment is especially acute.

in real estate today stands when applied to high-cost investment projects, starting from the stage of their development. Moreover, this is equally important and methodologically adequate both for long-term investment projects and for medium and short-term projects. In all these cases, the issue is related to information uncertainty, probable disruptions and critical deviations in the execution of the project and possible damages, and the differences are manifested mainly quantitatively - in the scale and timing of these undesirable events and their consequences.

At the same time, first of all, we will consider the risks in the context of evaluating the effectiveness of an investment project, replenishing and multiplying financial and other resource costs. Namely, the risks associated with events that affect project performance indicators: net present value, internal rate of return, break-even point, etc.

Therefore, when working with investment projects, risk is understood as the possibility of getting deviations in the results of project execution in a negative direction compared to some initial estimate. Such deviations may arise due to the deviation of the initial conditions or other parameters from the normative ones, originally planned or obtained from statistical calculations.

There are various approaches to risk classification when investing in real estate. There are risks associated with changes in prices, interest rates and the purchasing power of the population. Allocate price, interest and inflation risks.

Non-systemic risks are those risks that may affect only individual securities or small aggregates of them. These risks are also called individual securities risk or unique risk, since such risks are usually inherent in the securities of a specific company or, moreover, only in specific financial instruments. Usually, the non-systemic category includes liquidity risk, business risk, financial risk, and default risk.

To minimize non-systemic risks, a method such as diversification is used, for the application of which it is necessary to compile an investment portfolio. By creating this portfolio, the investor makes up a set of several financial instruments issued by different issuers, which means they are subject to different non-systemic risks. Thus, the investor seeks to diversify investment risks, i.e., avoid simultaneous changes in the profitability of each instrument in the same direction. At the same time, the fewer securities in the investment portfolio, the higher the level of risk. The method of diversification in relation to minimizing non-systemic risks proved to be very effective, provided that a sufficiently large investment portfolio is compiled.

The limit for diversification is the level of risks inherent in the given financial market as a whole, i.e. risks, which in theory are called systemic.

Systemic risks are understood as risks that are inherent in working not with individual securities, but with certain combinations of securities. Systemic risks are also called investment portfolio risk or market risk. The latter name is systemic risks because they affect the entire market or a significant part of it. Accordingly, the greatest attention to systemic risks should be paid to those investors who prefer the formation of an investment portfolio to capital investments in individual instruments.

Systemic risks are caused by possible uncertainties in the economic situation on the market, general trends characteristic of the market as a whole, and therefore affect the securities of almost all issuers operating in this market. In the case of systemic risks, the diversification method does not work, and it is extremely difficult to avoid the risk of incurring losses in the course of investment. Among these risks are interest rate risk, currency risk, exchange rate risk, inflation risk, political risk, etc.

This risk becomes especially relevant when working with financial instruments of developing countries, but it is also present when working on established markets.

In addition to these risks, there are other factors that, to a greater or lesser extent,

degrees can affect the success of real estate investments.

On the one hand, the risks associated with the real estate sector are subject to the general laws of the risk doctrine, on the other hand, they have their own specifics that distinguish them from the risks associated with investments in financial markets. There are several classifications of types of risks associated with investments in real estate.

The most common of these is the division of risks into business risks and financial risks. The nature of business risks is associated with the loss by the investor of part of the income from assets due to a change in the market situation, which is influenced by factors such as a decline in production and unemployment, natural disasters, changes in income levels, changes in the preferences and tastes of the population, etc.

Financial risk, or the risk of bankruptcy, is formed due to the underestimation of operating expenses, which may lead to a lack of net operating income to pay off a secured loan. Financial risks are related to the liquidity or solvency of the investor. They complement business risks and increase each time debt service or non-operating costs increase.

In order to prevent or at least minimize negative consequences, it is necessary to conduct a risk analysis - a procedure for identifying risk factors and assessing their significance, in fact, an analysis of the likelihood that certain undesirable events will occur and adversely affect the achievement of project goals. Risk analysis includes risk assessment and methods to reduce risks or reduce their adverse effects.

At the first stage, the relevant factors are identified and their significance is assessed. The purpose of risk analysis is to provide potential partners with the necessary data to make decisions about the advisability of participating in the project and develop measures to protect against possible financial losses.

Risk analysis can be divided into two types: qualitative and quantitative. Qualitative analysis aims to identify (identify) factors, areas and types of risks. Quantitative risk analysis should make it possible to numerically determine the size of individual risks and the risk of the project as a whole.

A qualitative analysis of investment risks implies a quantitative result,

i.e., the process of conducting a qualitative analysis of project risks should include not only a description of specific types of risks of a given project, identification of possible causes of their occurrence, analysis of the expected consequences of their implementation and proposals for minimization, but also a cost estimate of all these risk-minimizing measures for a particular project.

This analysis is carried out at the stage of developing a business plan, and the mandatory comprehensive examination of an investment project allows you to prepare extensive information for analyzing its risks.

The first step in risk identification is to specify the risk classification in relation to the project being developed. The point is that in order to analyze, assess and manage risks, it is initially necessary to identify possible risks in relation to a particular project. Whereas such important work as the search for the causes of their occurrence or a description of the possible consequences of their implementation, the development of compensatory or risk-minimizing measures and obtaining a full cost estimate of all indicators can be carried out at subsequent stages.

In the theory of risks, the concepts of a factor (cause), type of risk and type of loss (damage) from the occurrence of risk events are distinguished.

Risk factors (causes) are understood as such unplanned events that can potentially come true and have a deviating effect on the intended course of the project, or some conditions that cause uncertainty in the outcome of the situation. At the same time, some of these events could have been foreseen, while others could not have been predicted.

Such factors may be directly the economic activity of the entrepreneur himself, the lack of information about the state of the external environment that affects the result of the project activity.

The main risk factors for investment projects include:

Errors in the design and estimate documentation;

Insufficient qualification of specialists;

Force majeure circumstances (natural, economic, political);

Violation of terms of deliveries;

Low quality of raw materials, equipment, technological processes, products, etc.;

Violation of the terms of contracts, termination of the contract.

The main results of a qualitative risk analysis are:

Identification of specific project risks and their causes;

Analysis and cost equivalent of the hypothetical consequences of the possible implementation of the noted risks;

Proposal of measures to minimize damage and their cost estimate.

In addition, at this stage, the boundary values (minimum and maximum) of a possible change in all project factors that are checked for risks are determined.

The mathematical apparatus of risk analysis is based on the methods of probability theory, which is due to the probabilistic nature of uncertainty and risks. Risk analysis tasks are divided into three types:

Direct lines, in which the risk level is assessed on the basis of a priori known probabilistic information;

Inverse, when an acceptable risk level is set and the values (range of values) of the initial parameters are determined, taking into account the established restrictions on one or more variable initial parameters;

The tasks of studying the sensitivity, stability of effective, criterion indicators in relation to the variation of the initial parameters (probability distribution, areas of change of certain values, etc.). This is necessary due to the inevitable inaccuracy of the initial information and reflects the degree of reliability of the results obtained in the analysis of project risks. The analysis of project risks is carried out on

based on mathematical models of decision-making and project behavior, the main of which are:

Stochastic (probabilistic) models;

Linguistic (descriptive) models;

Non-stochastic (game, behavioral) models.

The characteristics of the most used risk analysis methods are presented in Table. one.

Table 1

Risk Analysis Methods

Method Characteristic

Probabilistic analysis It is assumed that the construction and calculations of the model are carried out in accordance with the principles of probability theory, while in the case of sampling methods, this is all done by calculations on samples. The probability of losses is determined on the basis of statistical data of the previous period with the establishment of the area (zone) of risks, the adequacy of investments, the risk ratio (the ratio of expected profit to the volume of all investments in the project)

Expert risk analysis The method is applied in case of absence or insufficient amount of initial information and consists in involvement of experts for risk assessment. A selected group of experts evaluates the project and its individual processes according to the degree of risk

Method of analogues Use of a database of implemented similar projects to transfer their effectiveness to the project under development. This method is used if the internal and external environment of the project and its analogues has sufficient similarity in terms of the main parameters

Analysis of indicators of the limiting level Determining the degree of sustainability of the project in relation to possible changes in the conditions for its implementation

Project sensitivity analysis The method allows you to evaluate how the resulting project implementation indicators change with different values of the specified variables required for the calculation

Analysis of project development scenarios The method involves the development of several options (scenarios) of project development and their comparative evaluation. The pessimistic variant (scenario) of a possible change in variables, the optimistic and the most probable variant are calculated

The method of constructing project decision trees Assumes a step-by-step branching of the project implementation process with an assessment of risks, costs, damages and benefits

Simulation methods Based on the step-by-step finding of the value of the resulting indicator by conducting multiple experiments with the model. The main advantages are the transparency of all calculations, ease of perception and evaluation of the results of the project analysis by all participants in the planning process. One of the serious disadvantages of this method is the significant cost of calculations associated with a large amount of output information.

carry out the calculation of the standard deviation, dispersion and coefficient of variation. The indicator of the root mean square (standard) deviation 5 for a real project is calculated by the formula:

where ¿ is the number of periods (months, years); n is the number of observations;

Estimated income from an investment project of the /-th type with different values of the situation on the investment goods market;

О - average expected income (net cash flow, IRU) for the project; R. - the value of the probability, which corresponds to the estimated income (total value of P = 1), a fraction of a unit.

Probability is determined by experts.

Variation expresses changes in the quantitative assessment of a trait in the transition from one case (variant) to another. For example, changes in the return on assets (equity, investments, etc.) can be determined by summing up the product of the actual values of the economic return on assets and the corresponding probabilities P:

er = u er. R.

The standard deviation is defined as the square root of the weighted average variance y[d. The higher the result, the more risky is the project under consideration.

The coefficient of variation K^ allows you to assess the level of risk if the indicators of the average expected income for the project differ from each other:

where 5 is the mean square (standard) deviation;

O - average expected income (net cash receipts, MRU) for the project. When comparing projects by risk level, preference is given to the one for which the value of Kv is the smallest, which indicates the most favorable ratio of risk and income.

An example is a project risk assessment simulation model. Based on an expert assessment for each of them, three

possible scenarios: pessimistic, most probable and optimistic.

For each variant, the parameter IRU, characteristic only for it, is determined, i.e., its three values are obtained: URUX (for the pessimistic variant); MRU2 (for the most probable); IRU3 (for the optimistic option).

For each variant, the range Pv of the variation is determined according to the LRG criterion using the formula:

pv \u003d SHU - SHUH.

Consider two alternative investment projects with a three-year implementation period. Both projects are characterized by the same size of investments and the price (cost) of capital equal to 10%.

As follows from the analysis of the data in Table. 2, project II has higher IRU values. However, it is more risky than project I because it has a higher range of variation.

We justify this conclusion by calculating the standard deviation for two projects. The sequence of actions is as follows.

By expert way, we will establish the probability of IRA values for each project (Table 3).

Let's calculate the average value of IRU for each project:

table 2

Calculation of the range of variation for two alternative

projects, million rubles

Indicator Project I Project II

Investment volume 30 30

Expected average annual

cash inflow

Pessimistic 11 10.5

Most probable 12.5 15.7

Optimistic 14.2 17.4

IRC forecast for scenarios:

Pessimistic -1.4 -2

Most probable 2.1 10.2

Optimistic 6.7 13.4

Range of variation 8.1 15.4

Table 3

MRU values

Expert assessment of probability

NRU1 = - 1.4 0.2 + 2.1 0.5 + + 6.7 0.3 = 2.78 million rubles;

IRUi = -2 - 0.1 + 10.2 0.6 + + 13.4 0.3 = 9.94 million rubles Calculate the standard deviation 5 for each project:

51=7~(-1,4 - 2,78)2 0,2 + (2,1 - 2,78)2 0,5 + + (6,7 - 2,78)2 0,3 =-7624 = 2,5;

5P = Y~(-2 - 9.94)2 0.1 + (10.2 - 9.94)2 0.06 + + (13.4 - 9.94)2 0.3 = ^118.26 = 4.27. The calculation of standard deviations shows that project II is more risky than project I.

The statistical method of calculating the level of risk requires a large amount of information, which is not always available to the investor (project initiator).

Cost-benefit analysis focuses on identifying potential risk areas. The overspending of investment costs compared to the project parameters can be caused by the following reasons:

Changing the design boundaries;

The occurrence of additional costs for the contractor during the construction of the facility;

Differences in project efficiency (profitability, payback, safety);

Initial underestimation of the project cost, etc.

These key factors can be disaggregated to determine the level of risk of the investment being made.

The method of expert assessments is based on a survey of expert experts.

The obtained statistical results are processed in accordance with the analytical task. To obtain more representative information, specialists with a high professional level and extensive practical experience in the field of real investment are involved in the examination.

The method of using analogs is to search for and use the similarity, similarity of phenomena (projects) and their comparison with other similar objects. For this method, as well as for the method of expert assessments, a certain subjectivity is characteristic, since intuition, experience and knowledge of an expert and an analyst are of decisive importance in evaluating projects.

In the process of assessing possible losses from investment activities, absolute and relative indicators are used. Absolute

the volume of financial losses associated with real investment is the amount of loss (damage) caused to the investor in connection with the occurrence of adverse events. The relative amount of financial losses (losses) associated with investment risk is expressed as the ratio of the amount of possible loss to the chosen base indicator (to the expected income from investments or to the amount of capital invested in this project).

Kir of loss / And 100,

where Khir is the investment risk coefficient^;

And - the volume of investments (capital investments) directed to a specific project. Such financial losses can be considered low if their amount to the amount of investment in the project does not exceed 5%; average, if this indicator fluctuates between more than 5 and up to 10%; high - over Yuido 20%; very high if their level exceeds 20%.

The expected level of risk is taken into account in the rate of return on invested capital: the higher the level of expected risk, the higher should be the required rate of return on invested capital. In general, the rate of return on invested capital can be calculated using the formula: ^ = Risk payment. This approach to determining the required rate of return is common to both investments in real estate and investments in traditional financial assets. The basis for calculating the risk fee is the determination of systematic risk, reflecting unmanaged macro-level risks or industry risks.

When investing in real estate, sources of unmanageable risks are:

Low liquidity of real estate;

Uncertainty of legislative regulation of real estate transactions;

Uncertainty in taxation;

Competition in the capital market and real estate market;

business cycle duration;

demographic trends;

Employment trends and changes in the population's solvency.

Managed risks include micro-risks:

Terms of the lease;

Level of operational and financial leverage;

The structure of invested capital and its value;

Market share of a certain type of real estate;

The location of the property;

tenant structure.

Decisions to invest in illiquid assets should be based on an analysis of the perceived level of risk. At this point, a quantitative analysis of the level of risk is carried out. This happens in three stages:

Determining the frequency of distribution of rates of return: modes, medians or average rates of return;

Definition of standard deviation as a measure of unmanaged risk;

Definition of covariance as a relative measure of risk per unit of income.

The frequency of distribution of investment rates of return for the retrospective period is determined as follows. If the return on the asset was: 10% - 6 times, 9.5% - 10 times, 8.2% - 12 times, 6% - 2 times, 12% - 4 times, then in this case it is possible to determine the arithmetic mean: (10 + 9.5 + 8.2 + 6 +12) / 5 = 9.14.

A more accurate result is obtained by using a weighted average:

[(10 6) + (9.5 10) + (8.2 12) + (6"4) +

+ (12 4)] /36 = 9.038. The median is located in the middle of the numbers, arranged in ascending order. For example, 6,6,6, 6; 8.2, 8.2, 8.2, 8.2, 8.2, 8.2, 8.2, 8.2, 8.2, 8.2, 8.2, 8.2; 9.5, 9.5, 9.5, 9.5, 9.5, 9.5, 9.5, 9.5, 9.5, 9.5; 10,10,10, 10, 10, 10; 12, 12, 12, 12.

In this case, the median is 9.5%. In a series of numbers 2, 3, 4, 5, 5, 8, the median will be (4 + 5) / 2 = 4.5.

Mode is the value that occurs most frequently in the analyzed series of numbers. In our example, the mode is 8.2.

The use of mean, median, or mode in risk assessment is situation-specific.

When analyzing the level of risk of investment in real estate, it is advisable to use a weighted average that reflects the rate of return that an investor can receive in the long run. The expected return is based on a well-defined income distribution:

E (I) = £ I,P(I,) = I, P(I,) +

R2 P(n) +... + RnP(Rn),

where P(R1) is the probability of income occurrence Rt The level of risk of an individual asset is measured by the change in asset income, expressed as

standard deviation, which is quite difficult for all types of real estate due to their low liquidity and the difficulty of obtaining timely and reliable information about the state of the real estate market.

Since income-generating real estate is characterized by a stable uniform income stream, the variation a2 in a series of income received is determined by the formula:

o2 \u003d £ (I - I) 2 / n -1 \u003d (I - I) 2 +

+ (I - I) 2 + .... + (Yap - I) / n -1.

Normal Deviation - Square Root

from the variation: a \u003d l / o2 ".

Variation of expected returns:

a2 = ¿[I, - E(I)]2P(Rg)n -1 = [I - E(I)]2P(I,) +

[R2 - E(R)]2P(Rg) +... = [Rp - E(R)]2 P(Rp) n -1. The typical deviation for expected returns is again the square root of the variation.

Covariance RDA is a relative measure of risk, defined as risk per unit of income. For income received can be defined as SDA - =,

and for expected returns as: SDA - --.

So, to determine the variation, standard deviation and covariance for the following series: 10%, 6%, -4%, 8%, 12%, it is necessary to determine the arithmetic average rate of return, which is 6.4%. Variation:

a2 \u003d [(10 - 6.4) 2 + (6- 6.4) 2 + (-4- 6.4) 2 + + (8-6.4) 2 + (12-6.4) 2] /(5 - 1) = 155.2/4= 38.8. Standard deviation:

a = l/a2 = HSM = 6.229%.

Covariance: SDA^-^=6229/6.4=0.973, E(I)

which determines the level of systematic risk.

After assessing by qualitative and quantitative methods, it is necessary to compare the level of risk of investments in commercial real estate and other financial assets. This is determined by the features of profitable real estate:

Significant capital investment;

Rigid interconnection of the flow of income from real estate, depending on the situation in the region and the prospects for its development;

Low liquidity coupled with high maintenance costs.

The level of risk associated with investing in profitable real estate is largely determined by investment instruments (Fig. 1).

The need to maintain a high level of return on investment in real estate requires the choice of the most optimal investment instruments, since each of them has its own rate of return, risk level, liquidity, level of control and evaluation methods.

Profitable real estate has a number of significant advantages over traditional financial assets:

First, unlike corporate stocks, on which dividends are paid annually, the ownership of profitable real estate provides the investor (owner) with a monthly income stream, which is based on monthly rent payments. The cash flow from corporate shares depends on the volume of product sales, the development strategy of the enterprise and its financial stability. Real estate income streams are more stable because they are based on leases, which are often long-term.

Second, the area of use of cash flows from corporate securities may change over time, as the corporation may sell and buy areas of business, expand or contract. The use of real estate cash flows is more stable as real estate is a fixed asset.

Thirdly, the cash flow of income from real estate ownership is less dynamic than from corporate stocks, being strongly negatively correlated to the flow of income from investments in stocks and bonds.

The real situation with typical fluctuations in the rate of return on investments in corporate securities and real estate is shown in Fig. 2. Real estate provides a more sustainable income stream and, most importantly, real estate returns have a clear upward trend during a downturn in returns on financial assets. In addition, when investing in profitable real estate, it must be taken into account that market prices for real estate increase as inflation rises and fall sharply during periods of declining inflation.

Investments in real estate provide a higher return, and therefore a high level of risk.

Rice. 1. Level of risk of investment in real estate compared to corporate securities

Investment in real estate -Investment in financial assets

Rice. 2. Flows of income from investments in real estate and in typical financial assets: I - the rate of return on investments in assets; ? - holding period

The presence or absence of risk associated with the implementation of a particular scenario is determined by each project participant in terms of the magnitude and sign of the corresponding deviations from the design parameters. The risk associated with the occurrence of certain conditions for the implementation of the project depends on the point of view of whose interests it is evaluated (the risk of the participation of a project, a shareholder, a creditor, etc.). Separate uncertainty factors are taken into account in efficiency calculations if, with unequal values of these factors, the costs and results of the project differ significantly. In practice, the project is considered sustainable if, under all scenarios, it turns out to be effective and financially feasible, and possible negative consequences are eliminated by the methods provided for by the feasibility studies of the project. If such measures do not improve the financial stability of the project, then it is rejected by the investor.

Based on the consideration of methods of analysis and risk assessment, a number of conclusions can be drawn.

First, in the event of adverse circumstances, measures should be taken to reduce project risks by creating reserves of monetary and material resources, production capacities and a possible reorientation of the enterprise's activities.

Secondly, it is possible to significantly reduce investment risks through sound forecasting, self-insurance, investment insurance, transfer of part of project risks to third-party legal entities and individuals (development of project financing, issuance of consortium loans to borrowers by the community of large banks, etc.).

Thirdly, self-insurance is associated with the formation of reserve funds from net profit and

cover them for possible losses. Self-insurance makes sense when the probability of loss is low or when the company has a large number of the same type of equipment and vehicles.

Fourthly, limiting the concentration of project risks is used for those types that go beyond the permissible level (for capital investments made under conditions of critical and catastrophic risks).

Fifth, in the implementation of expensive science-intensive projects, the transfer of part of the risk to venture companies. The latter, in case of failure of the entire project, will take on part of the possible losses of the project initiator.

And, sixth, the surest way to reduce project risks is a reasonable choice of investment decisions, which is reflected in the feasibility study and business plan of the investment project.

The risk associated with investing in real estate is a specific risk due to the unique features of the property. These are low liquidity, large expenses of money and time for transactions, the need for high-quality management.

When investing in real estate, it is necessary to take into account the possible decrease in the profitability of the investment project relative to the projected one, the excess of actual costs over previously expected ones, the impossibility of completing the investment project due to an unforeseen excessive increase in prices for materials, the inability to sell the constructed object at the previously planned higher price, the exposure of real estate elements to risk destruction and more.

Bibliography

1. Abramov S. I. Investing: textbook. allowance. Moscow: Center for Economics and Marketing, 2007.

2. Anshin V. M. Investment analysis: textbook. allowance. M: Delo, 2008.

3. Bard V. S. Investment problems of the Russian economy: textbook. allowance. M.: Exam, 2008.

4. BelykhL. P. Formation of a real estate portfolio. M.: Finance and statistics, 2005. 264 p.

5. Blank I. A. Fundamentals of investment management. Kyiv: Elga-N: Nika-Center, 2008.

6. Vakhrin P. I. Investments: textbook. Moscow: Dashkov i K, 2007.

7. Zimina. I. Investments: questions and answers: textbook. M: Jurisprudence, 2006.

8. Semirenko E. Organization and financing of investments: textbook. M.: Finance and statistics, 2007.

9. Sergeev I. V., Veretennikova I. I. Organization and financing of investments: textbook. allowance. M.: Finance and statistics, 2009.

10. Tarasevich E. I. Financing investments in real estate. Moscow: Dashkov i K, 2006.

11. Shevchuk D.A. Organization and financing of investments: M.: Phoenix, 2006.

12. Russian real estate market - http://www.realtymarket.ru.

4. Management of the process of investment and financing of real estate

4.3. Real estate financing risks

Risk reflects the possibility that actual outputs may deviate from expected planned results. Risks depend on the specifics of the investment project, profitability, stability in this market.

Consider the main risks associated with real estate financing:

- credit risk - losses if the borrower does not make payments;

– interest rate risk – the probability that the rate on a loan is adjusted less frequently than on borrowed funds in the face of rising interest rates;

– risk of early repayment – losses in case of early repayment of a loan with a fixed interest rate;

– pre-commitment risk – the risk of financing loans for which a fixed interest rate is determined before the start of financing;

- liquidity risk - the probability that the creditor will not have enough funds received as repayment of debt on loans issued to pay for his obligations;

– the risk of changes in the conditions for mobilizing funds – losses in the event of a decrease in the value of funds (base rate) when lending with a fixed premium (relative to the base rate).

Credit risk is associated with losses in cases where the borrower is unable to make payments on the loan or if the value of the pledged property is insufficient to repay the borrower's obligations to the lender. The borrower's solvency is determined by the ratio of the borrower's income and the interest rate on the loan. In the event of non-payment, there are several types of losses for the creditor. The lender incurs losses if the amount received from the sale of the real estate transferred to him in possession is less than the repaid part of the loan. Along with the costs of operating, repairing and selling property, there are also administrative costs for managing outstanding loans and seized property.

Credit risk management is carried out through a thorough analysis of the collateral object, the solvency of the borrower and the development of recommendations on the acceptable loan amount. When determining the probability of repayment of a loan, the main attention is paid to determining the amount of the borrower's income and assessing the value of the property transferred as collateral. When lending to real estate development (construction, reconstruction, modernization), credit risk is significantly reduced if it is known that the borrower has previously completed several projects similar to the one for which the loan is requested.

Interest rate risk is a decrease in the profit of a credit institution due to a negative unforeseen change in the level of interest rates. That is, these are potential losses caused by financing with an imbalance in the periodic revision of interest rates on loans and borrowed funds.

Ways to manage this risk: financing with the help of securities with the same maturity and the use by creditors when calculating loan payments of various methods of their indexation, taking into account inflation and the borrower's income.

Prepayment risk is the potential loss on reinvestment that is caused by early repayment of a mortgage loan with a fixed interest rate. The risk also arises in connection with losses in the financing of loans, the interest rates for which are determined before the start of financing. This risk is called pre-commitment risk.

When lending, alternative conditions are provided for the lender and the borrower. The borrower receives the right to repay the loan before the end of the loan agreement, and the lender, in turn, has the opportunity to periodically change the interest rate on a loan with a changing interest rate. Lenders also provide borrowers with the ability to determine the rate of interest on a loan before the loan financing process begins.

Liquidity risk is associated with the insufficiency of receipt of payments on loans to fulfill the current obligations of the creditor, arises in connection with the difficulties in raising cash by selling assets at market prices or close to them. Liquidity risk management requires a number of financial transactions. In particular, the cash flow is calculated to determine the bank's cash needs and a cash mobilization strategy is developed with the identification of sources and costs. Reducing liquidity risk is directly related to the development of the secondary market for mortgage loans, creating conditions for attracting long-term resources in this area, ensuring refinancing of issued mortgage loans,

The risk of changing the terms of fund raising arises from long-term lending at a variable interest rate. In this case, the interest rate on the loan is fixed, and the interest rate on borrowed funds is variable.

The risk of changes in the terms of fund raising can be managed by financing loans with long-term floating rate debt.

Along with the above, there are specific risks that arise when lending to housing construction. For example, there is a risk that finished apartments may be sold more slowly than planned. Ways to mitigate this risk include requiring a certain number of units to be pre-sold and splitting the lending process into several independent steps when dealing with large projects.

There is also a risk of fire or theft of installed or stored materials or other property damage. Reducing this risk is achieved by insurance, security and other ways of ensuring security that do not contradict the law.

There is a risk of granting a loan due to the falsification of documents provided by the borrower and the diversion of loan funds for the intended purposes. It can be reduced, firstly, by investing funds received from the borrower and, secondly, by making an additional investment of the borrower's own funds if it is determined that the amounts remaining from the loan provided are not enough to complete the construction.