Delay on a loan when identified to the bank. Loan delay: what to do? Loan refinancing procedure

Today we propose to consider such an interesting topic as penalties for late payment of a loan. What threatens, from what day the delay on the loan is considered and what all this is fraught with - we will tell in the article.

Delay - what is it?

During the term of the loan agreement, you bring a certain amount to the bank every month. The creditor has appointed the day on which the automatic system "looks" into the account and debits this money. But then one day your salary was delayed, you left the city or simply forgot to put money on your credit account.

The bank, as usual, on the set day and time (usually 21.00) applies to your loan, but does not find an amount sufficient to write off. From this moment, the delay begins. Now the system will check the account every day, hoping to see the required amount on it.

How many days are loans delinquent?

The overdue debt counting starts from the first minute of its occurrence. The difference will be felt later, depending on the length of the delay. If the loan is overdue for 1 day, the consequences are almost invisible, but if the loan is overdue for 1 month, that will be ... But, first things first.

Delay is any deviation from the payment schedule, for which, according to Article 330 of the Civil Code, faces a penalty in the form of a forfeit. There are 2 types of forfeit:

- Penalty for late payment on a loan - a one-time sanction with a fixed amount determined by the loan agreement (on average - 800-1000 for the first delay, 1000-2000 for the second, and so on increasing);

- Penalty for late payment on a loan - calculated based on the actual number of days of delay, usually in the form of a fixed percentage.

According to the law, the amount of the penalty must be 1/360 (only 0.03%) or another percentage agreed by the parties. Of course, banks use the second option and write their numbers in the contract.

For example, Sberbank charges 20% per annum of the overdue amount for each day, up to its payment. Let's say you took out a mortgage with a monthly installment of 15 thousand. A 5-day delay on a loan will cost you 15,000 * 20% / 365 * 5 = 41 rubles. The amount may be small, but the consequences that affect the quality of the credit history are more dire.

Terms and penalties

1-10 days

The first 10 days are considered a technical delay, which could have arisen even through no fault of the client: for example, a payment through a terminal, another bank or the Russian post office may very likely freeze for up to 10 days. This fact will be reflected in the CI, but if it happened once, you will not experience great difficulties in obtaining a new loan.

10-30 days

After 10 days, the first fines begin to appear, the amount of which grows over time. At this time, the loan officer who made the application can call you and remind you of the need to pay.

30-60 days

The loan is overdue for almost 2 months. What can a bank do?

- Increase the amount of the fine

- Continue calculating the forfeit

- Connect your own collection service.

The main thing in such a situation is not to hide from the calls of the bank representatives, but to try to explain the reason for the situation that has arisen. By making contact with the bank, you can, firstly, count on, and secondly, avoid further consequences.

60-90 days

The loan delay has reached 3 months - what the bank can do:

- The accrual of fines and penalties continues

- Persistent security calls

- Full early repayment requirement

- Threat of the court

If within 3 months the bank and its employees failed to reason with the unscrupulous client with fines, penalties and warnings, and the account was never replenished, the bank puts forward a demand for full early repayment, threatening to take the case to court.

Advice from the site: so that the case does not go to court, ensure the minimum movement on the account: put at least 50 rubles on a loan: this will already be considered not complete, but partial non-fulfillment of the bank's requirements. Thus, you can postpone the trial for up to six months.

90-150 days

If the loan is overdue for 4 months and you have never replenished the account, the bank's request is sent to the court, a hearing date is set, which usually falls on the day when the loan delay reaches 5-6 months.

What the client should do: appear at the hearing (as a rule, 1% of borrowers go there) and talk about their poor financial situation, difficult life circumstances, etc., supporting the words with evidence (dismissal order, certificate of death of a close relative, medical report about a disease, an act on the fire of a residential property owned, etc.). Embellish the events a little, and the court can from you a good half of the accrued fines.

Speaking of fines: from this moment (when the case is submitted to the court), the bank ceases to charge penalties and penalties.

What's next?

In any case, the court will not write off the debt from you (the exception is a counterclaim on the bankruptcy of an individual). However, you will now be paying the debt in proportion to your income (for those employed, the amount of unemployment benefit is informally applied to the calculation).

In some cases, you may be lucky: if the loan is overdue for 3 years, and the bank has not yet filed a lawsuit, there is a question about the claim.

On the basis of a writ of execution, bailiffs begin to siege the client in order to recover the debt at the expense of personal property. Withdrawing everything that is permissible - the bailiffs are accountable, and the bank. From this moment on, a new "fairy tale" begins: threats, constant calls, "working out of relatives", unplanned personal meetings and other remnants of the methods of the 90s.

Assistance on a loan with a large delay

Not many cope with the pressure and give up in front of the persistence of the collectors, who, as a rule, operate outside the jurisdiction of the law. In this case, it is most correct to enlist the support of a good lawyer, or, as they are now called, an anti-collector.

A competent specialist can prove the fact of pressure and recover material damage from the offender, which is enough to cover the debt.

Must be performed properly and on time. Before concluding an agreement, the borrower carefully studies the conditions offered by the lender, assesses his current financial capabilities, and only then starts signing the agreement.

It makes no sense to point out the inadequacy of the conditions, change in the financial situation and other reasons for non-payment. If a citizen cannot declare himself bankrupt, then the obligations must be fulfilled. If they are not fulfilled, unfavorable circumstances may occur.

Consequences in case of violation of the terms of the loan agreement

A loan agreement is a type of civil law transaction, under the terms of which the parties have certain rights and obligations. The bank fulfilled its obligations - provided the borrower with the required amount, provided services and information support. For his part, the borrower must pay off the debt on time - the body of the loan with the interest accrued on it.

If payment is not received on time, the bank notifies the borrower of the delay. At the initial stage (Soft-collection), which can reach up to 60 days of delay, the borrower receives calls and notifications. At this stage, the credit institution's own (internal) department is engaged in the collection of overdue debts.

In the event of a delay of more than 60 days (Hard-collection), the bank can exercise its right to use the services of specialized debt / collection organizations. Working within the legal framework, these companies try to resolve the issue without the involvement of the judiciary. In some cases, their work brings results.

If contacting third parties does not lead to payment of the debt, the bank has the only option to return the entire amount - to go to court. Only through a court decision can sanctions be imposed on the borrower in the form of seizure of property, payment of the entire debt in full, and even criminal punishment.

Creditor's appeal to court

Excerpt from the three stages of debt collection is optional. The bank, in fact, can go to court after a few days of delay of the borrowers' obligations. But lenders do not do this for the following reasons:

- Any legal process takes time and involves costs - even obtaining a court order and transferring it to bailiffs can take more than a month.

- Going to court does not guarantee the receipt of all interest imputed to the borrower.

- Most problem loans are collected at the pre-trial stage.

The period after which the bank can go to court cannot be established. Each credit institution has its own rules on this matter. In most cases, it takes years for a bank to go to court. During all this time, the borrower's debt is growing.

Consequently, the main adverse effect for borrowers who do not pay for loans is the bank's appeal to the court. And if earlier the creditor used various psychological methods to repay the debt, now the collection will be carried out according to the law. It is from the bank's appeal to the court that all the other 5 most unfavorable consequences proceed.

1. Imposition of foreclosure on property

Such sanctions apply not only to secured loans or loans with collateral. The court can impose a foreclosure on the debtor's property for any credit obligations commensurate in size with the value of this property itself.

If the court takes the side of the bank, as is the case in most cases, then the debtor's liquid property can be recovered according to the writ of execution. The initiator of the collection is almost always the creditor (bank). The collection procedure is organized by the FSSP employees.

446 of the Civil Code of the Russian Federation gives a list of objects, items and other property benefits that cannot be foreclosed. In all other cases, the fined borrower must be prepared for the fact that his movable and immovable property can be recovered within the framework of the execution of the court decision.

2. Seizure of accounts and deposits of the borrower

By a court decision, all financial accounts of the borrower can be arrested or blocked by bailiffs. This is done in order to write off the amount of debt in favor of the creditor in the process of ensuring the execution of the court decision.

At the same time, not only deposit and settlement accounts of the borrower, but also card and salary accounts can be blocked. If the amount for writing off the debt is not enough on the specified accounts, then it will be written off in parts - as the accruals are received.

3. Payment of forfeit and reimbursement of legal costs of the claimant

In accordance with Art. 330 of the Civil Code of the Russian Federation, a borrower who has made a delay undertakes to return not only the entire amount with interest, but also a penalty. The amount of the forfeit is negotiated by the parties in an agreement or established by law.

As for the reimbursement of legal costs, the borrower (in this case, the defendant) may incur additional material costs in the form of reimbursing the bank for legal services and preparation for the proceedings. In this part, the court starts from the total amount of the claim (the total amount of the debt), the amount of the penalty, the financial situation of the defendant.

Reimbursement is made as a percentage - up to 100% of the costs incurred by the bank. Without an application from the plaintiff, the court will not calculate the amount of such compensation.

4. Criminal liability

Deprivation of liberty, with which creditors often intimidate their debtors, is indeed provided for in the framework of the legislation of the Russian Federation. In accordance with Art. 177 of the current Criminal Code of the Russian Federation, upon proof of malicious evasion of payment of debt, the borrower faces up to 2 years in prison. And here we are talking about very real terms.

Incorrect interpretation of the provisions of the article and legal illiteracy of the majority of borrowers become the reasons for speculation and substitution of terms. To talk about criminal prosecution, the following factors must be present:

- Malicious evasion - when the borrower has the ability to pay the obligation, but does not, even if there is a court order.

- The total amount of the debt is more than 2,250,000 rubles - if the amount of the debt is less, then there can be no question of any criminal prosecution.

Consequently, criminal liability for non-payment of a loan can theoretically occur, but only with the proven fact of malicious evasion of obligations. The lack of opportunities to pay the debt completely excludes criminal liability.

The number of convictions under the article in question in the Russian Federation is so scanty that it is extremely difficult to give even approximate statistics for the sake of an example. The point here is not only in the difficult proof of the borrower's guilt, but also in a large number of alternative sanctions, the use of which in relation to a citizen is more appropriate.

5. Negative impact on credit history

Any delay is always recorded in the credit history. Banks are required to transfer this information to at least one BCH. If there are long delays, even if they are closed at the time of applying for a new loan, the execution of an agreement will be associated with some difficulties.

If the credit history shows that the debt was collected from the borrower forcibly (through the courts), then it will be extremely difficult to correct this fact. With such an entry in the credit history, it will be problematic for the borrower to issue and, since he (the borrower) is deliberately considered unreliable.

: You should know that the limitation period for loan obligations is limited to 3 years. The report is kept not from the moment the borrower committed the last violation, but from the moment of the last demand from the bank. In fact, the collection procedure can last for years - until the borrower fulfills its obligations.

Anything can happen in life - a person took a loan, and suddenly lost the ability to pay it off. This leads to inevitable problems that can be solved in only one way - to pay off your debts. In any case, the collectors who call day and night say so. Is it true? Not really. Of course, you will still have to pay, but in some cases you can forget about the frantic interest accruing after delays.

It would seem like a stupid question. A person is unable to repay the loan because he has no money. But there may be a lot of reasons that need to be considered when looking for a way out of a difficult situation:

It often happens that a person does not lose his job and his income level does not fall, but a loan overdue is formed. Everything is simple here - when drawing up a loan agreement, such a friend does not calculate his strength, believing that he will repay his obligations without any problems. This is especially true when contacting microfinance organizations (MFOs). There, the debt is growing like a snowball, and the opportunity to pay it off painlessly and relatively profitably is melting before our eyes every day delays.

It's easier in the bank - the interest is not so crazy, the penalties and fines, if any, are symbolic. For example, a consumer loan at Sberbank for 25 thousand rubles with a monthly payment of 1800 rubles. with 6 months of delay gives no more than 1000 rubles. penalties and fines (not counting, of course, interest). The MFO, on the other hand, fights in full - after a month of delay with a debt of 10,000 rubles, the amount to be returned almost doubles. Due to such a rapid increase in debt, people do not have time to collect the required amount for payment, as a result of which the debt not only does not decrease, but continues to grow.

What will happen after the delay: possible consequences

A man sits at home, does not pay a loan for several months, and everyone thinks what will happen next? The possible consequences depend both on the amount of debt and on the time that such a problem borrower missed. Also note that the working methods of large banks and microloans are slightly different. So what's going on?

Three days delay

The bank will not even charge a penalty for these days, and so far there is no problem. In the worst case, an employee of a credit institution will call and politely remind you of the need to pay off the debt. MFIs behave worse. Already on the first day of delay, a call may come from a rude person who will inquire about the reasons for non-payment, and demand an early repayment "today". The sin of this approach is SMS Finance, which includes heavy artillery the next day after the payment has not been received. Ezaem goes even further - they call the day before the due date with a reminder.

By the way, this is illegal - neither the collector nor the creditor can bother a person if the fact of delay has not yet taken place.

Month of delay

This is a peculiar feature after which the debtor's position begins to deteriorate. By this time, banks and MFOs cease to independently contact the borrower, collection agencies are involved in the case. Credit organizations give them the right to interact under an agency agreement - the bank or microloan remains the lender, but other people will contact the borrower. There is nothing wrong with that, but unlike bank employees, such claimants are:

- are rude;

- threaten, including with reprisals;

- are constantly intimidated by lawsuits;

- promise to organize the departure of the mobile group.

You cannot believe them - 99% of the words of collectors who call on the issue of debt are a common lie, and these people, as a rule, do not differ in their balanced psyche and intellect.

If one agency is unable to receive money after a certain time, before the agency agreement is transferred to another company-collector. In the case of banks, such transfers from hand to hand continue for about six months, if we are talking about MFOs, then the calls can continue for years, sometimes even after the expiration of the statute of limitations on the loan, which is 3 years.

Overdue for more than a year

Some MFIs, of course, continue to call debtors both on their own and with the hands of collectors, but  most of the debts are written off by this time, and they cease to bother the borrowers. In the last couple of years, there has been a trend of selling debts to law firms that are filing a lawsuit. They buy such loan obligations in batches, not paying much attention to the circumstances of each particular case. These organizations write off very small debts, and go to court with the rest and win the case.

most of the debts are written off by this time, and they cease to bother the borrowers. In the last couple of years, there has been a trend of selling debts to law firms that are filing a lawsuit. They buy such loan obligations in batches, not paying much attention to the circumstances of each particular case. These organizations write off very small debts, and go to court with the rest and win the case.

By this time, banks either sue or write off the debt. "Forgiveness" occurs only if the amount of debt is not very large, up to 50 thousand rubles. It is easier for them to attribute such a loan to their own costs than to sue over it. But not all banks are so loyal. Sberbank, for example, can file a claim even because of a delay of 5 thousand rubles, but this happens a long time after the first non-payment on schedule.

Delay three years

You can safely forget about your duty, and continue to live as before. No court will accept a claim either from a creditor or from a collection agency, since the statute of limitations (SID) has expired. Some especially desperate MFIs still go for justice, but their claims are not even accepted - this is illegal. Sometimes the lender makes it to the last  and when there are a couple of months left before the expiration of the LED, he goes to court. The subtlety is that by this moment a lot of fines, penalties and interest have flowed in, the amount of debt becomes very large.

and when there are a couple of months left before the expiration of the LED, he goes to court. The subtlety is that by this moment a lot of fines, penalties and interest have flowed in, the amount of debt becomes very large.

According to the law, it is impossible to charge a forfeit and interest more than 4 times the body of the debt. For example, if a person took 10 thousand rubles from an MFO, then in total he cannot stay owed more than 40 thousand. If the creditor demands a large amount, then a counterclaim can be sent to the court - he will be satisfied 100%. It would not be out of place to complain about this to the supervising authorities:

- FSSP.

- Rospotrebnadzor.

However, lawsuits at the end of the TIE are very rare; this is more the exception than the rule. It is more profitable for the bank to send this debt at a loss and write it off, and the MFI will lose most of the money by writing off penalties, fines and illegal interest. In addition, the court will determine the optimal payment schedule for the debtor, and this may be 1000 rubles per month with a total debt of 200 thousand.

If the creditor sues at the end of the LID, you can send a counterclaim for the purpose of deliberately delaying the decision by the creditor in order to increase the amount owed.

Video: what is the limitation period for a loan

What not to do if there is a delay

Of course, debts must be repaid at a reasonable cost. One of the first thoughts that comes to mind for borrowers who are in a difficult situation is to take another loan and pay off their old debt. What you really shouldn't do is get involved in new commitments. The total amount of debt will only grow from this, since the body of the new loan is the full amount of the old debt together with all interest, and on this body the new creditor will "hang" his interest, and if there are delays, then penalties.

Borrow from relatives or friends? Yes, sometimes this is a way out, but if you can't pay off on time, and if there is  problems with a bank loan, then clearly not everything is good with the financial situation, then relations with loved ones will be ruined. This is much worse than having some trouble with a bank or MFI. It is better to refuse this venture too.

problems with a bank loan, then clearly not everything is good with the financial situation, then relations with loved ones will be ruined. This is much worse than having some trouble with a bank or MFI. It is better to refuse this venture too.

Of course, you need to turn off all phones, and not answer the calls of the collectors! Frankly, you won't make it any worse, but the solution is not the best either. The more the debtor hides from the creditor, the higher the risk of going to court. Of course, in some cases it is profitable, but sometimes it is easier to pay on your own, even if the payments are delayed by a couple of months. Moreover, if bank employees call, then you need to talk to them "normally":

- do not be rude;

- explain your difficulties, but without details;

- ask about options for solving the problem, for example, by providing an installment plan.

You need to talk politely but confidently. Do not give in to emotions. Keep the principle in your head: "the client is always right." Although not entirely reliable, you are still a client of a bank or an MFI. If the caller starts to be rude and threaten, record the conversation, and then send the complaint to both the credit institution and the supervisory authority.

Do not explain anything to the employees of collection agencies, and feel free to “send”, but again, without unnecessary rudeness. If you want to interact with the lender, then contact the bank or MFI directly.

Debt restructuring

If the problems are too serious, you cannot cope with the debts that have fallen on your head on your own, and the delay increases, contact the lender for a loan restructuring. Banks rarely offer it themselves, but there is such a possibility:

- You write a statement (either on the website or in writing through a registered letter, depending on the specific bank).

- Meet with an employee of the institution or talk by phone.

- Agree on a payment schedule.

Sometimes offers from credit institutions seep into the market to provide loans for restructuring current debts. This is intended for those people to whom the initial creditor did not approve the deferral, and there is no way to pay in the same rhythm. The new lender transfers the required amount to the old one, and draws up an individual payment schedule with the borrower. Yes, in the end you will get an overpayment, but it is not at all difficult to cope with such a loan, the main thing is that there is at least some official income.

MFIs themselves often propose arrears restructuring. This usually happens when a call center employee calls. The conditions are usually as follows:

- part of the debt is paid (usually about 10%);

- the remainder is divided into 3-7 equal payments;

- interest no longer drips.

In fact, this is a rather lucrative offer, and if the payment on the restructured debt is delayed, then additional sanctions in the form of fines and penalties are usually not provided.

Always read the supplement carefully. an agreement that the lender is obliged to draw up when granting the restructuring. Some MFOs sin by almost doubling the amount of debt, and the joyful debtor does not notice this.

Delay on a loan is not as bad as the collectors paint it. Nobody will put you in jail and your property will not take away, but they can file a lawsuit. This is also not scary - Themis takes the side of the debtors, and removes all illegal fines and penalties charged by a greedy credit institution. In addition, a convenient payment schedule for the borrower is established. The best option is to negotiate with the lender on loan restructuring. In this case, the amount of monthly payments can be changed, which will facilitate the payment of the debt. But there is no need to hide from creditors. This will not solve the problem, and the debt will grow like a snowball!

Video tips: what to do if the bank has filed a lawsuit for delay

Almost all Russians borrowed money from a bank at least once in their lives. With the funds borrowed, you can buy an apartment, a car, or spend this amount on consumer needs. Usually, the debt is not paid immediately in full. A certain part of the total amount is paid by the client every month according to a strict schedule. If he is late with the loan payments, the bank has the right to take appropriate measures:

- charge a fine;

- increase the size of the payment;

- involve the client in litigation.

Delay on a loan: what is it?

The phrase "loan delay" is understood as a violation of the terms of payments to the bank, provided for by the loan agreement. After the appearance of debt, the banking organization has the right to apply sanctions to the debtor (this includes penalties and fines, and the amount of the forfeit is indicated in the contract). The payments are not high, but they can significantly increase the amount of debt.

If the client is late with a one-time payment, the bank can accept it loyally. If he does this systematically, then the financial institution will add him to the list of hard-core debtors, which will negatively affect the person's credit history.

Concepts of penalties and penalties

Penalties imposed due to non-payment of loan payments on time represent a penalty that the financial institution will definitely require from the borrower. The legal basis for forfeits (penalties) and fines is given in Art. 330 p. 1 of the Civil Code of the Russian Federation, and the principle of their operation is described in Art. 395 of the same code.

The penalty is not imposed on the amount that has not been paid. The period of non-payment directly affects the amount of the penalty. Penalties are charged for delays on a daily basis and amount to approximately 0.05 - 2% of the amount owed. Sometimes a fine is imposed along with the penalty interest, due to which the amount of payments on the principal debt increases sharply.

The fine is a one-time penalty that is imposed in the event of any delay. It is divided into 4 types:

- interest on the amount owed, calculated daily in case of delay in payments;

- a fine of a fixed nature (for example, 300 rubles are charged for one delay);

- a fine with an increasing amount (for example, the client pays 200 rubles more for each delay in payment);

- fines accrued as interest on the amount of outstanding debt.

Sanctions imposed by various banks

Banks have a negative attitude towards overdue loan payments, so they try to make the amount of the penalty as high as possible, namely:

- assigns a daily penalty for non-payment of the debt, which is equal to 0.5% of its amount;

- The amount of the daily interest indicated is 0.06% of the outstanding debt;

- imposes daily interest on consumer loans in the amount of up to 2%, and loans secured by real estate - in the amount of 1%;

- Penalty interest charged by UniCreditBank is 0.5% of the total debt;

- VTB 24 promises to charge 0.6% daily for non-payment of the loan;

- In the bank "" a penalty is assigned after 10 days from the date of delay. Its daily size is 1%.

Legal regulatory system

The Civil Code of the Russian Federation (paragraph 1, chapter 4) fully regulates the procedure for collecting debts from clients. In case of delay, the bank may demand early repayment of the debt by charging additional interest (this is indicated in Article 811, clause 2 of the Civil Code of the Russian Federation). The document does not indicate what type of violation of payment terms this refers to - one-time or systematic.

In the presence of a large debt, banks prefer to involve collectors in the collection of funds, whose actions are not fully regulated by law. In their work, they rely on the following documents:

- Criminal and Administrative Codes of the Russian Federation;

- Laws 152-ФЗ "On personal data" and 149-ФЗ "On information, information technology and information protection" (entered into force on July 27, 2006);

- Law 218-FZ "On Credit Histories" (effective from December 12, 2004);

- Law 127-FZ "On Bankruptcy" (in force since October 26, 2002).

What measures to take in case of a loan delinquency?

If, for good reason (for example, in the event of a serious illness) you are not able to repay the loan on time, be sure to contact the bank first. Banking organizations are focused on debt repayment, and if the client presents solid grounds that impede the repayment of the loan, a compromise can be reached with them. The bank can do the following:

- change of payment dates;

- reduction in the amount of payment;

- exemption from payment of imposed fines.

These measures are also applicable to.

What to do if the loan is overdue from 3 to 5 days?

If you are late with the loan repayment, contact the bank employee and agree to postpone the payment. When payments are delayed by several days, it may not leave a negative imprint on your credit history. However, in case of systematic non-payment, the bank will impose a fixed interest or fine. He also introduces an unreliability note in the client's information, which can significantly damage a person's reputation in a financial institution.

Actions in case of a loan delay for 1 month

After one month or more from the moment of delay, banks begin to make active attempts to contact the defaulter and remind him of the debt. Do not avoid them, because this will only complicate your situation.

If you know exactly when you will be able to pay off the debt, then immediately notify the bank employees about it. Then you will most likely be able to avoid the imposition of interest and fines.

What to do if the loan is overdue for more than 3 months?

If the payment on the loan has not been paid for more than 3 months, the borrower's case falls to the employees of the security department, acting very tough. In this case, certain steps must be taken:

- Start communicating with the bank to soften the decisions they make.

- Collect papers that indicate the inability to pay off the debt.

- Send a statement to the credit department in which you ask for the cancellation of the fine, prolongation of the debt or, as well as the postponement of the date of debt repayment.

In this case, the bank can meet the needs of customers, especially those who had a good credit history before.

Advantages and disadvantages of loan refinancing

They call the issuance of cash loans on favorable terms in order to close the main debt, for which there was a long delay in credit payments. This procedure must be supported by good reasons.

Often the bank makes concessions, as it wants to repay the debt at least after a long time. The financial institution will not receive any benefit if the client goes bankrupt. The borrower can take advantage of this opportunity if he has not delayed payments on previously taken loans.

The advantages of this procedure are a technical decrease in interest, which entails a decrease in regular payments and the right to choose a bank with the most favorable conditions for refinancing. Among the disadvantages are the following:

- collection of a package of documents for a new one;

- providing the bank with an additional financial guarantee;

- the procedure is carried out with loans taken no later than 1 year ago.

Loan debt restructuring

This procedure is carried out only in the banking organization in which the loan was issued. If the borrower provides solid evidence, then the bank can help him to repay the loan with a long period of delay. There are several options for this help:

- prolongation of the contract, as a result of which there is a decrease in monthly payments;

- change in the currency through which the debt was paid;

- credit holidays (this includes breaks in the repayment schedule and exemption from interest);

- removal of penalties;

- decrease in interest rates.

What to do if the bank refuses to compromise?

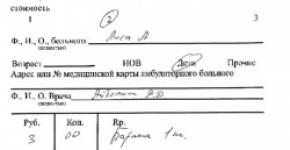

If your dialogues with the loan manager are unsuccessful and the banking organization requires an immediate full refund, try contacting the institution's managers. Supplement your application with written confirmation of problems that are preventing the payment of arrears (for example, a doctor's note).

Employees may reconsider the request to reschedule the due date. Otherwise, representatives of both parties will be brought to trial.

Debt collection through the court

If the loan is overdue for more than 3 months, the bank has the right to sue the borrower and demand from him early reimbursement of the entire amount. This procedure takes place when other means of negotiating, including the actions of the collectors, have proven ineffective.

If the loan agreement is filled out correctly, the court forces the borrower to pay the required amount. Bailiffs oversee the fulfillment of this duty. However, the court may require early termination of the contract if violations were found in it on the part of the financial institution.

Obtaining bankruptcy status

The Law 127-FZ "On Bankruptcy of Individuals", in effect from June 29, 2016, says about simplifying the procedure for declaring an individual bankrupt and about reducing the minimum amount of debts to 700,000 rubles. Banks will not benefit from this, but those who for a long time cannot pay off loans with them will benefit greatly.

The bankruptcy procedure takes about 6 months, sometimes it takes longer. All this time, the bank will in every possible way prevent the borrower from declaring bankrupt.

How to repay an overdue loan?

When a client is late on a loan, he should try to negotiate debt relief with the bank. If an agreement has not been reached, the bank will file an application with the court, which will oblige the borrower to close the debt ahead of schedule. If the borrower himself is able to repay the debt ahead of schedule, he is obliged to notify the bank with an appropriate application and put the amount necessary to close the loan to the bank account.

In case of a different outcome, a court is held, by decision of which the borrower will be forced to return the funds to the bank. The amount of the payment can be reduced by the court if the client confirms his insolvency. In case of non-repayment of the debt, the bailiffs begin to deal with the case, who take appropriate measures:

- send a decree to the debtor's place of work requiring that half of the salary be paid as debt;

- arrest all accounts of the borrower;

- seize the property belonging to him (in the case of a mortgage).

A loan delay does not bode well for the debtor. But in order to understand how serious the consequences will be, it is worth finding out the type of debt. Loan delays have their own types and characteristics. What are they and what to do if this or that debt has formed? Let's figure it out.

By delay on a loan, banks mean the wording specified in article 395 of the Civil Code of the Russian Federation. That is, it is money that was not returned to the creditor on time. Even if its term was only a couple of hours from the payment schedule. The only thing is that the "severity" of the delay and the term of its "shelf life" in the credit history will be different depending on how much the borrower is late in payment.

Delay penalties

Depending on the situation and the conditions prescribed in the loan agreement, the bank may impose various penalties for late payment. They put on material form. There are only two types of such punishments:

Fine... This is a one-time payment in a fixed amount for a credit violation. It is charged for each delay. For example, if the borrower paid four times not on time, he must additionally pay four penalties.

Penalty... This is a type of fine, but differs from it in two ways. The first is a daily charge. Second, the amount of the penalty is a certain percentage of the amount owed by the borrower. The amount of the penalty is usually stipulated in the contract. If not, then its size is regulated depending on the rate of the Central Bank of the Russian Federation at the time of accrual (in accordance with Article 395 of the Civil Code of the Russian Federation).

An important clarification - you cannot impose a fine or penalty on already existing fines or penalties.

Each bank is free to set its own amount of fines and penalties for delays. And this should be spelled out in the loan agreement.

In addition, some banks may further worsen the terms of the loan - for example, raise the rate for late payments. And in the future you will have to pay more, because the amount will be higher due to the increase in interest.

Technical delay

This type of delay is associated with the technical capabilities of the bank. In some cases, payment information is not received by the bank on time. This is due to technical failures. In such a situation, the money can either return to the payer's current account, or belatedly reach the bank.

This concept does not include delays, when a client, knowing in advance that money can go, for example, up to three days, sends a payment at the last moment. Since there is no fault of the bank in this - the debtor himself missed the deadlines, irresponsibly regarding the timing of the delivery of funds.

To avoid technical delays, it is important to consider all possible options. That is, send money in advance - at least two or three days before the deadline specified in the contract. At the same time, it is advisable to periodically glance at the current account, whether the money has returned.

How to dispute a technical delay

It is possible to challenge fines and penalties for technical reasons. If such a delay has already happened, a receipt of payment will help in convincing the bank - at least a banal check from an ATM or a screenshot of a confirmed operation if the payment was made through online banking. But you will have to separately ask for the cancellation of a new record of delinquency in your credit history. You will need to send a written request to the bank with this request, and he will already have to forward the official request to the Bureau of Credit Histories.

Minor delay

This type of delay occurs when the borrower seeks to do everything at the last moment, including paying off the loan. If you pay at the last moment, then the money may not reach the bank immediately. As a rule, the system processes such payments up to three business days.

In some cases, banks may forgive minor delays. It is worth checking this point with the operator or manager when concluding a contract.

The chance that the payment will be processed longer than expected arises in some situations:

- when paying through the cashier or ATM of another bank;

- when depositing money on weekends or holidays;

- when paying outside working hours (from 18:00 to 08:00).

Usually, minor delinquencies do not affect your credit history. But only if they don't happen all the time. If the borrower allows himself to constantly delay payments, then the bank will certainly enter information about him. Even if he is loyal to short-term delays.

Situational delay

This is a common delay of more than three days. It clearly does not happen constantly and, as a rule, arises due to unforeseen circumstances (delayed wages, sudden illness, and so on).

You can try to negotiate with the bank if you send him a written request explaining what exactly happened. It is important to support the explanation with appropriate documents - for example, a sick leave. In such a situation, some banks may agree to the client not to complain to the BCH, and also not to impose fines or penalties.

But it is worth remembering that in a situation where the client has managed to miss the payment deadline and fail to reimburse the debt within 14-30 days, he will no longer get rid of the fine and delays in the credit history.

Problematic delay

Next stage " evolution»Situational delay - problematic. This status is assigned to her when the client does not find money to pay off the debt in more than 30 days.

In such a situation, it is practically unrealistic to do anything other than pay off the accumulated penalties, fines and debts as soon as possible. You can try to negotiate with the bank on restructuring and provide all documents about the deteriorating financial situation, borrow money from friends and acquaintances, and so on. In some cases, banks can provide so-called credit holidays - to free the client from payments for a couple of months so that he can save up money.

If the bank owns any collateral, then it has the right to start selling it at this stage in order to recover the losses and return its money.

If a problematic delay has already happened, the main thing is to find money and return the debt as soon as possible and by any means (except for microloans - then you will not get off).

At the stage of troubled debts, if the client does not want to actively help the bank to pay off the debt or even hides from the creditor altogether, collectors come into play. The bank can sell them the debt for a fraction of its size, and then a third-party organization will deal with the return of the loan. In what ways - history is silent.

Long-term delay

Arises after 90 days from the date of delay. At this point, the bank already has the right (and, most likely, will use it) to go to court to recover money and fines. Provided that he did not sell the debt to collection agencies.

Long-term delinquency affects the credit history the most. Most banks will simply refuse to cooperate with a client who has defaulted on a loan for 90 days or more.

Long-term delays are of two types - dubious and hopeless. But in any case, such a situation is not good for the debtor.

Dubious

It is considered as such when there is something to take from the debtor - they will try to seize and sell the property on account of the debt for enforcement proceedings, and withhold part of the salary. In this case, the debtor, as a rule, keeps in touch with the bank or, at least, does not run away from the courts and bailiffs. Perhaps he has nothing at all. But in the near future it may appear.

In some situations, the delay may become hopeless even after the assignment of the questionable status. In any case, the best way out of the situation is to sell something unnecessary and finally pay off the debts. Otherwise, neither the bank, nor the bailiffs, nor the collectors will leave the debtor alone, unless he wins the court with the creditor (which is unlikely).

Hopeless

If the debt is recognized as uncollectible, the bank writes off the money spent on the borrower. A bad debt can be made if an individual is declared bankrupt if he has a loan of more than 500 thousand rubles. In this case, it must have property for a smaller amount than the size of the loan, or not have it at all. Moreover, in the event that the debtor has some property in private ownership, it is usually sold and the debt is partially repaid. In addition, if the bankrupt is working, then his superiors are notified of the employee's new status. And now it will be obliged to transfer wages to a separate account.

Bankruptcy has enough not very pleasant consequences - a ban on leaving, buying or selling property, the inability to use accounts and plastic cards, and so on. So it’s better not to lead to such a situation.

Consequences of delay

In addition to material punishment, a very delayed one will also follow - a spoiled credit history. All late payments are noted not only by the bank, but also in it. And in the future, due to the number and quality of such problems, any bank that looks at its credit history will decide whether to issue a loan to a client or not, and if it does, then at what percentage, is it not overstated?

Of course, this will not affect those who are not going to take out a loan in the future. But for those who often apply for a loan, this can seriously interfere with getting the desired money.

How long is the delay in credit history

The very fact of delay is always reflected in the credit history. But it is only meaningful to the lender for a while. It depends on the type of delay and its duration. There are two types of delays in credit history:

- The operating- when debts have not yet been paid off and not written off due to bankruptcy. They completely block access to any loans from banks.

- Closed- if the debt has been repaid, but the statute of limitations has not yet passed.

According to some reports, closed delinquencies have a certain expiration date. It varies depending on the length of the period when the person did not pay the debts. The exact data have not been disclosed, but you can navigate by the following indicators:

- 30 days or more- from six months to a year from the date of repayment;

- 60 days or more- from one and a half to two years;

- 90 days or more- from two to three years at best.

If the limitation period has passed, then the delay is no longer taken into account when analyzing the credit history. On average, the bank looks at indicators for the last two or three, sometimes four years. This is the most important term for the lender, since even very gross delays in the distant past do not say anything about the current client here and now. This is the philosophy.

What if you can't pay off the loan?

Sometimes it is simply impossible to repay the loan taken on time. And oncoming fines and penalties only exacerbate the situation. What to do in this case? There are several "legal" options:

- Execute loan restructuring. This will somewhat simplify the situation - for example, increase the term so that later you will pay a little less every month.

- Take out a new loan to refinance the old one- many banks offer this service under certain conditions.

- Re-borrow money from individuals- for example, from relatives. There are certainly no interest or penalties here, unless you write it down on the receipt.

In addition, you can simply refuse to pay off the loan and wait until the subpoena arrives. But in this case, you will have to lose much more - you will also have to pay legal costs. Not to mention the very fact of the trial and the possible consequences. In addition, the bank may not bother with the court, but transfer the loan to collectors. And already they will be engaged in "knocking out" the money from the debtor. By any legal (and not so much, if we are talking about a settlement with a high level of crime) ways. It's better not to live up to this.

It is important - you do not need to contact various organizations that promise to "release" from loans and clean up your credit history. This is simply not possible.

You will be charged a certain amount for your "work" and then nothing will be done. And you will be left without money and with debts. Then how could you run the spent amount to repay the loan.

In general, ideally, it is better to avoid delays. But if this has already happened, the consequences can be minimal. The main thing is to react in time and not run away from the lender. And in mild cases, you can even get off with one fine without damaging your credit history, or even come to terms with the bank amicably.