List of drugs that are subject to tax deduction. As amended by Prescription Drug Regions

There is information that the list of medicines for tax deduction in 2019 remained the same as in 2001, long gone, when the law on tax deduction only came into force.

This law was approved on June 26, 2007. The changes that were made by the governing bodies are dated by the same number.

Grounds for deduction

The grounds for have not changed from those that were previously relevant. For collection, such legally certified certificates as income declaration, receipts visualizing the amount of payment, and, finally, a special statement are required.

Starting from January 1, 2016, you can get a legal financial deduction directly from the budget of the organization, which is the current place of official employment.

Speaking about the question of whether a deduction for the purchase of rehabilitation or treatment means is possible, it is worth mentioning subparagraph 3 of paragraph 1 of article 219 of the Financial Code of the Russian Federation. In this case, the amount accepted for tax deduction can annually be no more than 120,000 rubles for 1 year.

By recounting for each month, you can understand that only 15 600 rubles per year are subject to legal return. In percentage terms, this figure is approximately 13% of all money spent.

It is known from the legislation of Russia that the taxpayer has no right to claim that the money that was paid during the calendar year for personal income tax was returned. Even if you contact the tax office at your place of residence, the application will be accepted and considered, but the amount can be returned no earlier than a year later.

The reason for this is that it is not allowed to file a financial declaration earlier than April of the year that follows the year of reporting.

However, according to the new introductions to the financial legislation of Russia, it is possible to reasonably demand the payment of a financial social deduction, without waiting for the completion of the period of 1 year.

It is of great importance that the medicines were purchased not at the expense of the employer, but paid directly by the employee himself. For clarity, it is necessary to save all receipts from pharmacies or scan them, converting them into electronic format.

It is important! In the event that the payment for expensive treatment of an employee was carried out from the budget of the organization, the amount spent cannot be affected by the deduction.

Drug names

All the names of drugs that are subject to the tax deduction are clearly spelled out in the list, which is approved by the law of the Russian Federation, adopted on March 19, 2001.

Taking into account the fact that each common drug has many copies with different names, each updated name must be registered in a special register separately.

The list of medicines for income tax refundshould be published in an updated form. They do this both on the Internet and in other media. Updating this list is also necessary because if any medicine was not found on the list, the right to recover is immediately invalidated.

Information and excerpts from the legislative act confirming this information are clearly indicated in a registered letter from the Federal Tax Service for Moscow dated June 1, 2010.

It is noteworthy that this list includes both those drugs that are prescribed under the supervision of a doctor, and those drugs that can be completely freely purchased at a pharmacy kiosk without showing a prescription.

List medicinal products subject to tax deduction,is wide enough, it includes such groups of medicines as:

- Antineoplastic, injected drip and jet.

- Strong pain relievers for anesthesia during operations.

- Narcotic formulations.

- Cytostatic drugs.

- Analgesics.

- Medicines that relieve allergy attacks, or antihistamines.

- Means for the therapeutic treatment of disorders of the musculoskeletal and central nervous systems.

- Preparations to prevent disorders of the functioning of the musculoskeletal system (anticonvulsants and others).

It is interesting! Also included in this list are those medicines that are prescribed for the treatment of people suffering from uncontrolled tremors of the arms and legs or Parkinson's disease.

In addition to everything, the same list includes drugs that have a sedative and sedative effect, used to eradicate the manifestations of mental disorders. This group also includes antidepressants of increased action, for example, Amitriptyline, Clomipramine and other similar samples.

This list also includes medicines designed to eliminate the manifestations of such diseases of the bone skeleton as osteoporosis, as well as rheumatoid arthritis and arthrosis.

It makes sense to count on a tax deduction for medicines also for those citizens who systematically take medicines that have a positive effect on the quality of blood clotting. This group also includes drugs that perform the function of plasma fluid.

It is interesting! This list also includes drugs that have a positive effect on the course of iron deficiency anemia and other types.

The heart is also entitled to a similar payment, since all specific drugs are in the same row as those listed above. Here you can also mention hypertensive patients, hypotensive patients and those who have suffered a heart attack or pre-infarction state. For clarity, it is worth giving a list of drugs, which includes:

- Enalapril;

- Anaprilin;

- Captopril;

- Valsartan;

- Digoxin;

- Quinapril.

This list can be continued for a very long time, since the article presents only drugs known to a wide range of consumers. In fact, the state takes good care of the strata of the population who are not able to provide themselves with the necessary medicines. The drug deduction is a perfect example of this.

Before buying any drug, if you want to make a personal income tax return with it, double-check whether it is on the official lists. Better yet, call the tax office and request a listing for your area. It is quite possible that due to its appearance on the market, it could have not yet been included in the list. And if it was not brought in, then it will be problematic to get a deduction for it. Be sure to reinsure yourself to avoid problems in the future.

Every citizen of the Russian Federation who pays income tax is granted the right to take advantage of the tax deduction for the cost of purchasing drugs on a prescription, which allows him to partially reimburse the costs.

Dear Readers! The article talks about typical ways of solving legal issues, but each case is individual. If you want to know how solve exactly your problem- contact a consultant:

APPLICATIONS AND CALLS ARE ACCEPTED 24/7 and WITHOUT DAYS.

It's fast and IS FREE!

If you decide to exercise this right, you need to know how and what is required to get the drug tax credit.

Who can apply?

What documents are needed?

To qualify, you need to collect certain. These include:

- 2-NDFL certificate;

- tax refund application;

- documentation that confirms payment for medicines and medical services;

- birth certificate or marriage certificate, if a refund is issued for a paid service for a child or husband / wife;

- a copy of your birth certificate, if you paid for the drugs that the doctor prescribed to your parent (if a woman has changed her last name in marriage, then her marriage certificate is required);

- copies of your ID and TIN.

When for medical care, you will need to add to the above papers:

- a service agreement between the patient and the medical institution;

- license for maintenance and provision of insurance services;

- statement of payment for medical services with codes.

When returning money for purchased medications, you will need:

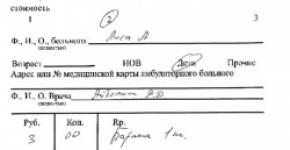

- a prescription that a doctor wrote out in a certain form specifically for the tax service;

- receipts and receipts for drug payments.

When making a deduction for paying a VHI policy, you will need:

- insurance company license;

- an agreement with an insurance company or a copy of the policy;

- payment receipts.

Drug Tax Credit: Drug List

The list, which is approved by a government decree, includes drugs that, when purchased on a prescription from a doctor, a taxpayer can claim a deduction. Moreover, each drug has a large number of analogues.

The medicines included in the list are included in the State Register, which the Ministry of Health must publish every year. If a doctor has prescribed a medicine that is not included in this list, then the citizen cannot claim a deduction.

This list includes:

- Drugs that are used for anesthesia, as well as that reduce the tone of skeletal muscles.

- Analgesics.

- Allergy medications.

- Medicines that affect the central nervous system.

- Anti-infective.

- Immunosuppressive and antineoplastic drugs.

- Anti-osteoporotic medications - stimulants.

- Drugs that affect the blood.

- Medicines that affect the cardiovascular system.

- Preparations required for diagnosis (contrast for X-ray).

- Antiseptics.

- Medicines used to treat gastrointestinal diseases.

- Hormonal drugs.

- Drugs for the treatment of kidney and urinary system diseases.

- Medicines used in ophthalmology.

- Uterine medicines.

- Drugs that are used to treat diseases of the respiratory organs.

- Electrolytes, nutrients.

- Vitamins.

Payment by relatives

According to the Tax Code of the Russian Federation, you can claim a tax deduction in the amount of the cost of drugs that the doctor has prescribed for you, your wife (husband), your children or ward under 18, your parents.

In the case of payment for the treatment of relatives, the contract and all receipts should be drawn up in the name of the citizen who will use the deduction. Also, when drawing up a deduction, in addition to copies, it is necessary to present the originals. This is necessary in order for the inspector to compare the originals and copies, putting the necessary stamp and date on the copies.

Since 2013, the right to issue a deduction from the money that was used to pay for the treatment of adopted or foster children under the age of 18 has appeared.

You cannot receive a deduction from the cost of medicines purchased for grandparents.

Expensive treatment

Expensive treatment is considered to be medical care from the list approved by a government decree, and the medical organization must be licensed to provide this type of service.

If the necessary medicines are not available in the medical organization, the patient can independently purchase them, and then issue a refund for them. Before you can receive a drug tax deduction, you need to confirm that the purchased drugs were used for this particular treatment.

There are no restrictions on the social deduction for expensive treatment. The amount that was spent on this medical care can be fully refunded.

A deduction for the cost of purchasing expensive drugs can be used if the following conditions are met:

- drugs that were purchased in the course of treatment are on the list of medical services, at the cost of which you can expect to receive a deduction;

- the medical organization does not have the necessary medicines, and their purchase under the contract is carried out at the expense of the patient (or the person who pays for his treatment);

- the medical institution issued a certificate to the patient stating that the drugs were required to carry out the treatment;

- a patient in a medical institution was issued a "Certificate of payment for medical services for submission to the tax authorities" with code 2.

The Federal Tax Service, in a letter dated 18.05.2011 No. AS-4-3 / 7958, indicated the circumstances under which, in the event that a citizen receives expensive treatment, the amount of payment is not limited.

To use the right to a tax deduction for purchased medicines, the patient must be submitted to the tax office:

- a certificate from the medical institution in which the treatment is carried out that the doctor has prescribed these drugs;

- papers that confirm the purchase of medicines;

- a certificate of payment for medical services (if the service was provided free of charge, then the amount should be 0 rubles).

The size

For treatment in 2020, it is carried out over the past year and has a number of restrictions. The payment should not exceed 13% of 120,000 (15,600) - the maximum amount established by the Government of the Russian Federation. This condition does not affect cases where treatment is considered costly - the refund of such costs is calculated in full.

, which is subject to return, should not be higher than the actual personal income tax received over the past year.

The list of drugs subject to tax deduction is quite extensive and includes drugs from various groups. It is approved by government regulations, is constantly changing, supplemented. It is used to calculate the size of social tax deductions.

Return conditions

Citizens who make tax payments to the state are provided with tax deductions in accordance with the clauses of the current Tax Code. The amount of social deductions each year is equal to the amount of money paid for drugs, and drugs must be included in the government list. The maximum amount cannot exceed 120 thousand rubles. in a year.

The payer of taxes has no right to expect a refund of a larger sum of the social deduction. It cannot exceed the amount of personal income tax paid to the budget during the year. The money spent on the purchase of medicines can be returned only next year, because the deadline for submitting a completed declaration lasts until the end of April of the next reporting year.

When expecting to receive deductions, patients should remember that the drugs for treatment must be prescribed by the treating doctor. Medicines are bought for funds that belong to the patient (taxpayer). When the cost of a drug is paid by the employer, there is no statutory deduction for that cost. In order to safely return your money and avoid various problems with the tax office, you need to make sure that there are no corrections in the recipe.

Back to the table of contents

What's on the list

The list of medicines for tax deduction is determined on the basis of a special decree of the Government of the Russian Federation. It presents various drug names that are not internationally classified as patented drugs.

The list of medicines for tax deduction is determined on the basis of a special decree of the Government of the Russian Federation. It presents various drug names that are not internationally classified as patented drugs.

Upon purchase, you can expect to receive a special deduction related to tax amounts. In this case, the drug must be purchased with a prescription from the attending physician.

In some cases, they pay for the purchase of medicines without a prescription, for this there are non-prescription departments.

There are many variations of the names of the tools from the list. To get the most accurate information, you need to focus on the State Register. If the patient has received a prescription for a drug that is not included in the developed list, then there is no question of social benefits.

The list of pharmaceuticals for tax deduction does not have information on the form of drug release.

If we consider the types of drugs, then we can distinguish several groups that are included in this list of drugs subject to tax deduction:

- Anesthesia drugs.

- Analgesics.

- Anti-allergic drugs.

- Medicines that affect the central nervous system.

- Preparations against infectious diseases.

- Immunosuppressive drugs.

- Medicines to fight various tumors.

- Anti-osteoporotic drugs.

- Aimed at normalizing the state of the blood.

- Means for stabilizing the activity of the cardiovascular system.

- Diagnostic drugs.

- Antiseptics.

- Means for the normalization of the gastrointestinal tract.

- Hormonal medications.

- Medicines for the treatment of the urinary system and kidneys.

- Ophthalmic drugs.

- Means for the treatment of the uterus.

- Medicines for the normalization of the respiratory system.

- A group of nutrients.

- Vitamins.

When considering means for anesthesia, we are talking about special preparations for anesthesia (various powders). In addition, this group contains drugs that achieve the effect of local anesthesia.

When considering means for anesthesia, we are talking about special preparations for anesthesia (various powders). In addition, this group contains drugs that achieve the effect of local anesthesia.

Various drugs are classified as analgesics, which are narcotic and non-narcotic in nature. This also includes the means by which gout is treated.

The effect on the central nervous system is exerted through drugs aimed at fighting seizures. This includes various antidepressants, anticholinesterase and other medications.

Back to the table of contents

Refund process

How do I get a drug tax deduction? It is necessary to contact the tax office at the place of residence, having with you:

- Certificate from the place of work (form 2-NDFL).

- Declaration (form 3-NDFL).

- A prescription that states that it has been issued for inspection.

- Documents that confirm the fact of payment for medicines (check, receipt).

The tax return is filed by individuals who pay tax on income from the beginning of the year to the end of April in the year following the reporting year. But if the subject submits a declaration solely to obtain a deduction, he may not be guided by the established deadlines. However, after deduction, it is allowed to apply for 3 years.

The tax deduction for the purchase of medicines is subject to return to the payer after a desk check of the information in the declaration and other submitted documents. The paid sums are subject to return after 30 days from the date of completion of verification activities. They last 90 days (counting down from the date of submission of the package of documents).

The tax deduction for the purchase of medicines is subject to return to the payer after a desk check of the information in the declaration and other submitted documents. The paid sums are subject to return after 30 days from the date of completion of verification activities. They last 90 days (counting down from the date of submission of the package of documents).

If a subject wishes to receive more detailed information about cameral inspections, he can go to the official website of the tax inspectorate or clarify the information he is interested in directly from a service employee.

Back to the table of contents

Deduction technology

When the purchase of medicines is necessary for the treatment of close relatives, for example, a wife or a child, the list of documents is supplemented with a copy of the marriage certificate, a photocopy of the child's birth certificate, if he is a minor. Subject to the purchase of the medicine for the parents, the person attaches his own birth certificate (copy).

These papers are independently certified. At the same time, the date is stamped and the signature is deciphered. When visiting the tax office, a person must show the originals to the employee so that he can verify the documents. After that, the tax office employee puts down the number and designation on the copies.

Citizens have the right to receive social deductions from the sums of money that were spent on the recovery or treatment of children in care (adopted) and not yet adults. In the form of a deduction, the amount spent cannot be returned if the child is already 18 years old.

Subjects cannot count on a deduction from the money that was paid for the purchase of drugs for therapy, not for the taxpayer himself, but for his grandparents.

At the same time, the Federal Tax Service allows one of the spouses to pay for drugs intended for the other, and then count on a tax deduction for the drugs.

When, for valid reasons, the patient is unable to buy a drug, acquaintances or friends, a common-law spouse or spouse come to his aid. To be able to exercise the right of deduction, you must use a power of attorney. In it, the patient notes his confidence in a particular person to purchase a medication for him at the pharmacy. Power of attorney is not required to be notarized.

The list of drugs subject to tax deduction has been published by the Government of the Russian Federation for over 10 years. In previous years, citizens most often applied for a refund when buying an apartment or studying. However, it should be remembered that a person who works officially for a year or more, for whom the employer transfers income tax to the budget, may receive a deduction and partially compensate for the costs of treatment.

Who is eligible to apply for a deduction, and how much refund can be expected

A person must be a citizen of Russia and a conscientious taxpayer. Naturally, he can return the money spent on his own treatment. Also, the state allows him to receive a tax deduction on medicines purchased for the following persons:

- his spouse or spouse, if their marriage is officially registered;

- his father or mother;

- own child or children who have not reached the age of majority, and, accordingly, are not yet working;

- minors adopted or children under his care.

The parents of those wishing to apply for a deduction are not required to be retired at that moment. After the age of 18, children are not legally required to receive a deduction for previously purchased drugs. Everything should be done on time.

People suffering from serious diseases of the chronic type, and those who are prescribed a rehabilitative course of treatment, allocate huge money from their budget to buy medicines and undergo procedures. It is not surprising that patients are interested in the maximum return on funds spent, however, some restrictions are prescribed in the Tax Code:

- Despite the expensive treatment, the amount to be returned is limited to 120 thousand rubles per calendar year. The rest is not taken into account when filing a declaration.

- The maximum amount of income tax that can be refunded per year is 15,600 rubles. The balance will be carried over to future years and paid out gradually.

- Not all purchased medicines prescribed by a doctor can be indicated in the application. Only those whose names are on the list of medicines published annually.

The more a person has a salary and, accordingly, the personal income tax withheld from it, the faster he will be able to return money for medicines. In our country, there is such a unique phenomenon as self-medication. It is impossible to receive a social deduction for medicines purchased at the personal discretion of a person. Moreover, most of the drugs on the list cannot be purchased in pharmacies without a prescription. Only medicines prescribed by a doctor and issued in the correct order on the appropriate form with all the necessary stamps and signatures are taken into account.

As a conscientious taxpayer, a person can make a refund of the funds spent on the purchase of drugs both for their own treatment and for their family members. The amount of the standard deduction is established by law, and it does not exceed 120 thousand rubles. The rate of return depends on the size of the official, so-called white, wages and the income tax withheld from them.

How to get a deduction

There have been no noticeable changes in the procedure for processing the deduction over the past few years. On the contrary, the rate of return of funds has increased due to the automation and creation of a single ledger. It is important to focus on the fact that the patient will receive monetary compensation only next year. What steps, how to get a deduction, you need to take:

- Fill in the correct declaration based on a certificate of income from the place of work.

- Write a statement using the template.

- Attach documents confirming that you were the buyer of the drugs.

- Take the above documents to the Federal Tax Service at the place of residence.

- Meet the deadlines - declarations are submitted by the end of April for the year following the reporting year.

It is generally accepted practice to apply for a social deduction to the tax office. Nevertheless, from January 1, 2016, another option became available - it became possible to get a deduction for medicines from your employer. The advantage of this option is that you will not have to wait until the end of the year, and the costs will be covered faster. In this case, you should pay attention to three things:

- A person can apply for the deduction only to himself.

- Medicines must be prescribed by the attending physician.

- The latter must be purchased with the personal funds of the taxpayer (and not the employer).

What does it mean to receive a deduction at the place of work of a taxpayer? This procedure is carried out in a simplified manner. The employer is provided with an application for a deduction, as well as a notice stating that the employee is eligible for a social deduction. It is issued by the tax office within a month after the application, drawn up in the form of an application with receipts and a prescription marked for the tax office.

The procedure for obtaining a tax deduction is well-established and consists of a number of fairly simple procedures. The main thing is to correctly draw up the documents and comply with the deadlines for their submission. To speed up the process and not wait for the end of the tax period, you can arrange it at the employee's place of work. In this case, the medications must be purchased by the person himself for their own treatment.

What is required for the drug tax deduction

The fundamental document is a doctor's prescription. Most often, doctors prescribe them without reminders, but there are drugs that can be bought at the pharmacy and over the counter. If the patient wants to include these items in the amount of his deduction, he should draw up documents for them. The doctor is obliged to write all prescriptions for prescribed drugs at the request of the patient within a three-year period (if this was not done during the course of treatment), based on the records in the medical record. Other documents:

- personal income tax declaration;

- certificate for the reporting period on income issued by the accounting department;

- cash receipts proving the costs of purchasing drugs;

- a copy of the first pages of the passport;

- copy of TIN;

- a prescription for medicines indicated in the list, in the amount of two forms. Their output - number and series - must match. It is drawn up in a certain form - No. 107-1 / y. The first copy must be presented at the pharmacy upon purchase, and the second at the Federal Tax Service Inspectorate. It must be stamped: "For the tax authorities of the Russian Federation, taxpayer's TIN".

Before leaving the doctor's office, it is also worth checking the presence of his personal seal, painting and hospital seal on the form. The list of documents can be increased at the expense of marriage or birth certificates (own or child), if a person submits for a deduction for medicines for relatives.

Prescriptions from a doctor attached to the set of documents must be up-to-date, that is, they must be written out no later than three months before submitting an application along with a tax return. Prescriptions for chronic patients are valid for one year. Each form has its own expiration date, which is indicated in the order of the Ministry of Health of 12/20/2012 No. 1175n. If you have any doubts in this matter, you can refer to this legislative act.

It is necessary to remember that the recipe is filled out correctly and that it contains all the necessary details. Important: a prescription for no more than two medicines can be written on one form. Changes to the recipe or crossing out words are not allowed. Better to ask for a new, neat copy. The package of documents for the IFTS must include all the necessary papers.

Non-standard situations and terms of receiving compensation

There is a group of taxpayers who are not required to submit a written report on their income to the authorities every year. They may not file a tax deduction return within the general deadlines. However, the time elapsed since the purchase of drugs should not exceed three years. The state grants the right to receive social benefits to non-close relatives of the patient in exceptional cases, which should be further explained and documented.

If a person is left completely alone, and his friends or acquaintances, using their own financial resources, buy medicines for him, they can also count on compensation. To do this, it is enough to issue a power of attorney for this person, where a patient in his right mind and strong memory prescribes that he has the right to buy the medicines he needs at the pharmacy. It is not necessary to involve a notary to certify the power of attorney. If it comes to a couple who lives together, but has not legalized their relationship, it is possible to get a tax deduction for the roommate for medicines, but they will face difficulties. Still, in such cases, it is customary to attach a marriage certificate.

It is worth mentioning such an obvious thing as the indication of false information in the documents provided for deduction to the tax office. Without exception, all information about the taxpayer is checked by employees in the database. They are given 90 days for this, which are counted from the moment the package of documents is accepted. Now it is convenient to monitor the status of your application online through your personal account on the website. Copies of the passport or certificates do not require certification from a notary. Nevertheless, the person applying for the social deduction must put his signature and date on them. You should take the originals with you to the tax office and demonstrate to the employee when registering the application for visual verification. The specialist also puts his own marks on the copies. After a desk audit, the taxpayer will be notified of the successful return of the amount spent on the purchase of drugs. The law specifies a period of 30 days, but in practice, due to the large number of applicants, you have to wait even longer.

Classification of drugs approved by the Government of Russia for 2017

The list of medicines for tax deduction is very extensive. It covers the common illnesses of the average citizen. Thanks to this, almost everyone can count on a social deduction when purchasing drugs. So, the list includes several sections.

| Number | Section title | Subgroups | Examples of |

|---|---|---|---|

| 1 | Anesthetic drugs | anesthetic agents, local anesthetics, muscle relaxants | lidocaine, ketamine, bupivacaine |

| 2 | Antirheumatic and anti-inflammatory medicines | narcotic, non-narcotic analgesics, non-steroidal anti-inflammatory drugs | diclofenac sodium, allopurinol, alendronic acid |

| 3 | Antiallergic | antihistamines | ketotifen |

| 4 | Effective on the central nervous system | anticonvulsants, sedatives | diazepam, amantadine, fluphenazine |

| 5 | Treatment of infectious diseases | antibacterial, anti-turberculosis drugs | indinavir, griseowulfin |

| 6 | Antineoplastic agents | hormones | tamoxifen |

| 7 | Osteoporosis drugs | osteogenesis stimulants | calcitonitis |

| 8 | Medicines to maintain normal blood counts | Antianemic drugs and plasma substitutes, blood clotting restoring agents | epoetin beta, ferrous sulfate |

| 9 | Means for stabilizing the activity of the cardiovascular system | antianginal, antiarrhythmic, vasopressor, hypotensive | methyldopa, ephedrine, isosorbitol of several types |

| 10 | Diagnostic tools | X-ray and fluorescent agents | galactose, pyrvotech, yogixol |

| 11 | Disinfection | antiseptics, antibacterial liquids | iodine, hydrogen peroxide |

| 12 | Stomach and Intestine Treatment | pancreatic enzymes, antispasmodic drugs | anthropin, lactulose, platifillin |

| 13 | Medicines to normalize the endocrine system | androgens, erogenous, insulin supplements, synthetic substances | menotropins, norethyrone, repaglinide |

| 14 | Preparations for the elimination of diseases in the kidneys | diuretics, medicines for prostate adenoma | palm creeping extract, spironolankton, alfuzosin |

| 15 | Ophthalmic drugs | meotic, regenerative, anti-glaucoma drugs | pyrenoxine, emoxipin |

| 16 | Drugs affecting the muscles of the uterus | hormonal drugs | dinoprost, ergometrine |

| 17 | Medicines for asthmatics | anti-asthma aerosols, other drugs that make breathing easier | aminophylline, acetylcysteine |

| 18 | Corrective solutions | electrolytes in liquid form, nutritional mixtures | sodium citrate, phenyl fries, magnesium asparaginate |

| 19 | Vitamin support for the body | vitamins and minerals | menadione, thiamine |

The list contains data for all sections. It presents various types of drugs: tablets, injections, powders, solutions, ointments, potions, gas in cylinders and others. Some medicines can be sold in pharmacies in both liquid and solid forms. However, there is no reference to this aspect in the Government's decree. Accordingly, no matter what condition the medication has, you can get a deduction for it if the other conditions are met. In order to navigate the complex names of drugs, several examples are given.

Tax deduction for purchasing medical supplies during expensive treatment

Sometimes a patient is admitted to the hospital for extremely costly treatment due to a serious illness that requires constant professional supervision. If it is included in a different list of medical services approved by the Government in 2001, a person who is interested in receiving compensation and has submitted documents to the tax office can count on a deduction according to the full amount of treatment. Without cutting the amount up to 120 thousand rubles.

Such cases are quite rare and are associated with an innovative type of treatment in our country. Then a medical institution licensed to provide this service cannot provide the patient with the necessary medicines and related materials. To undergo a full course of rehabilitation, a person buys them with his own money and gives them to the medical staff. After recovery, the taxpayer has the right to apply to the tax office at the place of residence, where he should act according to the usual scheme:

- fill out a declaration;

- to write an application;

- pre-issue at the hospital where the treatment was carried out, a certificate stating that his doctor prescribed the medications specified in the payment document, specifically for the provision of services from the approved list;

- keep receipts confirming that payment for medicines for a medical institution went from the applicant's personal wallet for tax deduction;

- take a certificate from the cash desk stating that a settlement has been made between him and the hospital in relation to these services;

- submit to the inspection a photocopy of the passport, originals of the issued prescriptions and other documents.

If the treatment was provided free of charge, a certificate will still be required. In the column, the amount to be paid will be 0 rubles, but this will be considered proof of the need to purchase expensive medicines. As a result, we got two more documents that need to be attached to the list discussed above.

The waiting times for consideration of the application and receipt of compensation from the state in both cases are the same: verification of the submitted documentation will take three months, and the applicant must transfer financial compensation within one month. The tax deduction for the purchase of expensive medical supplies is also distinguished by the fact that compensation can only be received by the person who underwent treatment and incurred the cost of the medicine. If the spouse paid them for it or, conversely, the funds were purchased for the parents, such a deduction will be refused. Only compensation is possible with a reduction in the amount to the above amount.

In conclusion, we will repeat the main aspects raised in the topic of filing a declaration for drugs from the list, subject to tax deduction. Of paramount importance is the correctness of the prescription issued by the doctor, then the preservation of cash receipts for confirmation, the entry of the patient's medication into the lists of drugs subject to tax deduction. Observe the stipulated terms and amount of the refund of the funds spent, the scheme of actions, the list of required documents and the procedure for their submission. Do not forget about an alternative and faster option for a tax deduction for treatment - through your employer.

Additionally, keep in mind the information on exemptions that some taxpayers may expect you to need. Receiving a tax deduction for medical treatment is the same standard procedure as receiving a social deduction for studying or purchasing a home. Having figured out the intricacies of this process, it will not be difficult to get back some of the cash.

LIST OF MEDICINAL PRODUCTS PRESCRIBED BY THE YOUR DOCTOR TO THE TAXPAYER AND PURCHASED BY THEM AT THE EXPENSE OF OWN FUNDS, THE AMOUNT OF THE COST OF WHICH TAKEN INTO ACCOUNT WHEN DETERMINING THE AMOUNT OF SOCIAL TAX DEDUCTION (as amended by Resolutions of the Government of the Russian Federation of 26.06.2007 N 411) Section 1. Anesthetics and muscle relaxants

Anesthesia products

Halothane (solution for inhalation anesthesia in vials)

Hexobarbital (powder for injection)

Dinitrogen oxide (bottled gas)

Ketamine (injection)

Sodium oxybate (solution for injection)

Thiopental sodium (lyophilized powder for injection)

Diethyl ether (liquid in vials)

Local anesthetics

Bupivacaine (injection)

Lidocaine (aerosol, solution for injection, gel, solution in carpules, eye drops)

Muscle relaxants

Atracuria besilate (solution for injection)

Botulinum Toxin, Albumin (Lyophilized Powder for Injection)

Vecuronium bromide (powder for injection)

Pipecuronium bromide (powder for injection)

Suxamethonium bromide (powder)

Section 2. Analgesics, non-steroidal anti-inflammatory drugs, drugs for the treatment of rheumatic diseases and gout Narcotic analgesics

Morphine (solution for injection, tablets)

Morphine + Narcotine + Papaverine + Codeine + Thebaine (injection)

Pentazocine (injection, tablets)

Pyritramide (solution for injection)

Trimeperidine hydrochloride (solution for injection, tablets)

Fentanyl (injection)

Non-narcotic analgesics and non-steroidal anti-inflammatory drugs

Acetylsalicylic acid (tablets)

Diclofenac sodium (tablets, pills, injection solution, suppositories, gel, eye drops)

Ibuprofen (capsules, tablets, syrup, cream)

Ketoprofen (tablets, capsules, suppositories, gel, powder for solution)

Lornoxicam (tablets, lyophilized powder for preparation of injection solution)

Meloxicam (tablets, suppositories)

Nalbuphine (solution for injection)

Tramadol (injection, capsules, tablets, oral drops, suppositories)

Remedies for the treatment of gout

Allopurinol (tablets)

Other funds

Colchicine (tablets, pills)

Penicillamine (tablets, capsules, pills)

Section 3. MEANS USED FOR TREATMENT OF ALLERGIC REACTIONS

Antihistamines

Quifenadine (tablets)

Ketotifen (tablets, capsules, syrup)

Chloropyramine (tablets, injection)

Section 4. DRUGS AFFECTING THE CENTRAL NERVOUS SYSTEM

Anticonvulsants

Valproic acid (tablets, capsules, syrup, pills, suspension, drops)

Carbamazepine (tablets)

Clonazepam (tablets, drops, injection)

Lamotrigine (tablets)

Phenytoin (tablets)

Phenobarbital (tablets, oral solution)

Ethosuximide (capsules)

Remedies for the treatment of parkinsonism

Amantadine (tablets, solution for injection)

Biperiden (tablets, injection)

Levodopa + benserazide (capsules)

Levodopa + carbidopa (tablets)

Trihexyphenidil (tablets)

Sedatives and anxiolytics, drugs for the treatment of psychotic disorders

Haloperidol (tablets, injection)

Diazepam (tablets, injection, suppositories)

Zuclopentixol (tablets, solution for injection)

Clozapine (tablets, injection)

Levomepromazine (tablets, solution for injection)

Lorazepam (tablets)

Medazepam (tablets, granules, capsules)

Nitrazepam (tablets)

Peritsiazine (drops, capsules)

Perphenazine (tablets)

Pipothiazine (solution for injection, drops)

Sulpiride (tablets, injection, capsules, oral solution)

Thioproperazine (tablets, injection)

Thioridazine (tablets, dragees)

Trifluoperazine (tablets, solution for injection)

Phenazepam (tablets, solution for injection)

Fluspirilene (injection)

Fluphenazine (injection)

Chlorpromazine (tablets, injection, pills)

Chlorprothixene (tablets)

Antidepressants and normotimal agents

Amitriptyline (tablets, injection, pills)

Imipramine (tablets, dragees, injection)

Clomipramine (tablets, dragees, injection)

Lithium carbonate (tablets, capsules)

Maprotiline (tablets, dragees, injection)

Mianserin (tablets)

Moclobemide (tablets)

Sertraline (tablets)

Tianeptine (tablets)

Fluoxetine (tablets, capsules)

Citalopram (tablets)

Sleep disorders

Zolpidem (tablets)

Drugs for the treatment of multiple sclerosis

Glatiramer acetate (lyophilized powder for injection)

Interferon beta (lyophilized powder for injection)

Means for the treatment of alcoholism and drug addiction

Naloxone (solution for injection)

Naltrexone (tablets, capsules)

Anticholinesterase drugs

Distigmine bromide (tablets, injection)

Neostigmine methyl sulfate (tablets, injection)

Pyridostigmine bromide (tablets, dragees, injection)

Other drugs affecting the central nervous system

Vinpocetine (tablets, solution for injection)

Hexobendine + Etamivan + Etophyllin (tablets, solution for injection)

Nimodipine (tablets, solution for infusion)

Section 5. MEANS FOR PREVENTION AND TREATMENT OF INFECTIONS

Antibacterial

Azithromycin (tablets, powder, syrup)

Amikacin (powder for injection, solution for injection)

Amoxicillin + clavulanic acid (solution for injection)

Ampicillin (tablets, capsules, powder for injection)

Benzathine benzylpenicillin (powder for injection)

Benzylpenicillin (powder for injection)

Vancomycin (powder for injection)

Gentamicin (ointment, cream, injection, eye drops)

Josamycin (tablets, suspension)

Doxycycline (tablets, capsules, powder for injection)

Imipenem (powder for injection)

Carbenicillin (powder for injection)

Clarithromycin (tablets)

Co - trimoxazole (tablets, suspension, injection)

Lincomycin (capsules, ointment, injection)

Meropenem (powder for injection)

Mesalazine (suspension)

Mupirocide (ointment)

Norfloxacin (tablets, eye drops)

Pefloxacin (tablets, solution for injection)

Spiramycin (tablets, granules for suspension)

Sulfacetamide (eye drops)

Chloramphenicol (tablets, capsules, powder for injection, eye drops)

Cefaclor (capsules, granules, syrup, suspension)

Cefaperazone (powder for injection)

Cefipim (powder for injection)

Cefotaxime (powder for injection)

Ceftazidime (powder for injection)

Ceftriaxone (powder for injection)

Cefuroxime (powder for injection)

Ciprofloxacin (tablets, injection, eye drops)

Erythromycin (tablets, ointment, syrup, ampoules)

Anti-tuberculosis drugs

Isoniazid (tablets, injection)

Lomefloxacin (tablets)

Pyrazinamide (tablets)

Prothionamide (tablets)

Rifabutin (capsules)

Rifampicin (capsules, powder for injection)

Streptomycin (powder for injection)

Ethambutol (tablets, dragees)

Ethionamide (dragee)

Antiviral agents

Acyclovir (tablets, ointment, cream, powder for injection)

Ganciclovir (capsules, powder for injection)

Didanosine (tablets, powder for oral solution)

Zidovudine (capsules, syrup, injection)

Indinavir (capsules)

Efavirenz (capsules)

Lamivudine (tablets, oral solution)

Nevirapine (tablets, suspension)

Stavudine (capsules, powder for oral solution)

Antifungal agents

Amphotericin B (ointment, powder for injection)

Amphotericin B + Methylglucamine (Tablets)

Griseofulvin (tablets, liniment, suspension)

Itraconazole (capsules)

Clotrimazole (vaginal tablets, cream, aerosol, solution)

Terbinafine (tablets, cream)

Fluconazole (capsules, injection)

Antiprotozoal and antimalarial drugs

Hydroxychloroquine (tablets)

Metronidazole (tablets, injection, suppositories)

Chloroquine (tablets, injection)

Other funds

Bifidumbacterin (tablets, powder for suspension preparation)

Vaccines and serums

Immunobiological preparations (for the diagnosis and prevention of infectious diseases in accordance with the epidemiological situation in the constituent entities of the Russian Federation)

System test for AIDS diagnosis

Section 6. ANTITUMOR, IMMUNODEPRESSIVE AND ACCOMPANYING DRUGS

Cytostatic agents

Azathioprine (tablets)

Aranose (powder for injection)

Asparaginase (powder for injection)

Bleomycin (powder for injection)

Busulfan (tablets)

Vinblastine (Lyophilized Powder for Injection)

Vincristine (lyophilized powder for injection, solution for injection)

Vinorelbine (solution for injection)

Gemcitabine (Lyophilized Powder for Injection)

Hydroxycarbamide (capsules)

Dacarbazine (powder for injection)

Dactinomycin (powder for injection, solution for injection)

Daunorubicin (powder for injection)

Doxorubicin (powder for injection)

Docetaxel (concentrate for solution for injection)

Idarubicin (capsules, lyophilized powder for injection)

Irinotecan (solution for infusion)

Ifosfamide (powder for injection)

Calcium folinate (solution for injection)

Carboplatin (powder for injection, solution for injection)

Carmustine (freeze-dried powder)

Clodronic acid (capsules, concentrate for preparation of infusion solution)

Melphalan (tablets, powder for injection)

Mercaptopurine (tablets)

Methotrexate (tablets, powder for injection, solution for injection)

Mitoxantrone (solution for injection, concentrate for infusion)

Mitomycin (powder for injection)

Oxaliplatin (powder for preparation of infusion solution)

Paclitaxel (solution for injection, concentrate for infusion)

Procarbazine (capsules)

Prospidium chloride (lyophilized powder, ointment)

Thioguanine (tablets)

Tiotepa (Lyophilized Powder for Injection)

Tretinoin (capsules)

Fludarabine (powder for injection)

Fluorouracil (solution for injection, concentrate for infusion)

Chlorambucil (tablets)

Cyclophosphamide (tablets, dragees, injection)

Cisplatin (lyophilized powder for injection, solution for injection)

Cytarabine (powder for injection, solution for injection)

Epirubicin (Lyophilized Powder for Injection)

Etoposide (solution for injection)

Hormones and antihormones(as amended by Resolutions of the Government of the Russian Federation of 26.06.2007 N 411)

Aminoglutethimide (tablets)

Anastrozole (tablets)

Ganirelix (solution for injection)

Goserelin (depot capsules)

Medroxyprogesterone (tablets, granules, injection suspensions)

Tamoxifen (tablets)

Triptorelin (solution for injection, lyophilized powder for preparation of injection solution)

Flutamide (tablets)

Cetrorelix (lyophilized powder for preparation of injection solution)

Related products

Interferon alpha (powder for injection, solution for injection, suppositories)

Lenograstim (lyophilized powder for injection)

Molgramostim (lyophilized powder for injection)

Ondansetrione (tablets, solution for injection)

Filgrastim (solution for injection)

Section 7. DRUGS FOR TREATMENT OF OSTEOPOROSIS

Osteogenesis stimulants

Alendronic acid (tablets)

Alfacalcidol (capsules)

Calcitonin (powder for injection)

Calcium carbonate + ergocalciferol (tablets)

Section 8. DRUGS AFFECTING BLOOD

Antianemic agents

Iron hydroxide sucrose complex (injection)

Iron sulfate (tablets, pills)

Iron sulfate + ascorbic acid (tablets)

Folic acid (tablets)

Cyanocobalamin (injection)

Epoetin beta (injection)

Drugs affecting the blood coagulation system

Alpostadil (powder for solution for injection)

Alteplase (lyophilized powder for injection)

Heparin sodium (solution for injection)

Nadroparin Calcium (Syringes with Injection Solution)

Pentoxifylline (tablets, injection)

Protamine sulfate (solution for injection)

Streptokinase (powder for injection)

Ticlopidine (tablets)

Fenindion (tablets)

Enoxaparin sodium (syringes with solution for injection)

Solutions and plasma substitutes

Amino acids for parenteral nutrition (solution for parenteral nutrition)

Gemin (concentrate for preparation of infusion solution)

Dextrose (solution for injection, solution for infusion)

Pentastarch (solution for infusion)

Plasma preparations

Albumin (solution for infusion)

Clotting factor VIII (powder for injection)

Clotting factor IX (powder for injection)

Lipid-lowering drugs

Simvastatin (tablets)

Phospholipids + Pyridoxine + Nicotinic Acid + Adenosine Monophosphate (Injection)

Section 9. DRUGS AFFECTING THE CARDIOVASCULAR SYSTEM

Antianginal drugs

Isosorbide dinitrate (tablets, capsules, injection, aerosol)

Isosorbide mononitrate (tablets, capsules)

Nitroglycerin (tablets, capsules, plaster, injection solution)

Antiarrhythmic drugs

Allapinin (tablets, solution for injection)

Amiodarone (tablets, injection)

Atenolol (tablets)

Metoprolol (tablets)

Procainamide (tablets, injection)

Propafenone (tablets)

Quinidine (tablets)

Etacizin (tablets)

Antihypertensive drugs

Azamethonium bromide (solution for injection)

Amlodipine (tablets)

Betaxolol (tablets, eye drops)

Verapamil (tablets, capsules, pills, injection solution)

Doxazosin (tablets)

Methyldopa (tablets)

Nifedipine (tablets, capsules)

Propranolol (tablets, injection)

Fozinopril (tablets)

Medicines for the treatment of heart failure

Valsartan (tablets)

Digoxin (tablets, drops, solution for injection)

Irbesartan (tablets)

Captopril (tablets)

Quinapril (tablets)

Perindopril (tablets)

Enalapril (tablets, solution for injection)

Vasopressor funds

Dobutamine (lyophilized powder for injection, concentrate for infusion)

Dopamine (solution for injection, concentrate for infusion)

Phenylephrine (injection, eye drops)

Ephedrine (solution for injection)

Section 10. DIAGNOSTIC EQUIPMENT

X-ray contrast agents

Sodium amidotrizoate (solution for injection)

Barium sulfate + sodium citrate + sorbitol + antifomsilan + nipagin (powder)

Gadodiamide (solution for injection)

Gadopentetic acid (solution for injection)

Galactose (granules for injection solution)

Yogeksol (solution for injection)

Iopromide (solution for injection)

Fluorescent agents

Fluorescein sodium (solution for injection)

Radioisotope facilities

Albumin microspheres, 99mTs (preparation reagent, lyophilized powder for solution preparation)

Bromezide, 99Tc (reagent for preparation, lyophilized powder for solution preparation)

Pentatech, 99mTs (preparation reagent, lyophilized powder for solution preparation)

Pirfotech, 99mTs (reagent for preparation, lyophilized powder for solution preparation)

Strontium 89 chloride isotonic solution (solution for injection)

Tekhnefit, 99Ts (reagent for preparation, lyophilized powder for solution preparation)

Tekhnefor, 99mTs (reagent for preparation, lyophilized powder for solution preparation)

Section 11. ANTISEPTICS AND DISINFECTORS

Antiseptics

Iodine (alcohol solution)

Disinfectants

Hydrogen peroxide (solution)

Chlorhexidine (solution)

Ethanol (solution)

Section 12. Means for the treatment of diseases of the gastrointestinal tract

Antacids and other antiulcer drugs

Omeprazole (capsules)

Pirenzepine (tablets, injection)

Famotidine (tablets, solution for injection)

Antispasmodics

Atropine (eye drops, solution for injection)

Drotaverinum (tablets, solution for injection)

Platyphyllin (solution for injection)

Pancreatic enzymes

Pancreatin (tablets, capsules, pills)

Drugs for the treatment of liver failure

Artichoke leaf extract (tablets, syrup, injection)

Lactulose (syrup)

Antienzymes

Aprotinin (lyophilized powder, injection)

Section 13. HORMONES AND DRUGS AFFECTING THE ENDOCRINE SYSTEM

Non-sex hormones, synthetic substances and antihormones

Betamethasone (tablets, ointment, cream, drops, injection)

Bromocriptine (tablets, capsules)

Hydrocortisone (lyophilized powder for injection, solution for intravenous injection, ointment, lotion)

Chorionic gonadotropin (powder for injection)

Deoxycortone (tablets)

Dexamethasone (tablets, eye drops, injection)

Desmopressin (solution for injection, drops)

Dihydrotachysterol (capsules, powder for injection, drops)

Clomiphene (tablets)

Levothyroxine sodium (tablets)

Levothyroxine + potassium iodide (tablets)

Liothyronine + levothyroxine + potassium iodide + sodium propyloxybenzoate (tablets)

Lutropin alfa (lyophilized powder for preparation of injection solution)

Menotropins (powder for solution preparation)

Methylprednisolone (tablets, powder, ointment, suspension for injection, solution for injection)

Nandrolone (oil solution for injection)

Octreotide (solution for injection)

Prednisolone (tablets, powder for injection, ointment, eye drops, solution for injection)

Somatropin (powder for injection)

Tetracosactide (suspension for injection)

Tiamazole (tablets)

Triamcinolone (ointment, tablets, suspension for injection)

Fludrocortisone (tablets, eye ointment)

Follitropin alfa (lyophilized powder for preparation of injection solution)

(the position was introduced by the Decree of the Government of the Russian Federation of June 26, 2007 N 411)

Follitropin beta (solution for injection, lyophilized powder for preparation of injection solution)

(the position was introduced by the Decree of the Government of the Russian Federation of June 26, 2007 N 411)

Choriogonadotropin alfa (lyophilized powder for preparation of injection solution)

(the position was introduced by the Decree of the Government of the Russian Federation of June 26, 2007 N 411)

Cyproterone (tablets, oily solution for injection)

Androgens

Methyltestosterone (tablets)

Estrogens

Hydroxyprogesterone (solution for injection, solution in oil)

Dydrogesterone (tablets)

Norethisterone (dragee)

Progesterone (oil injection)

Ethinylestradiol (tablets)

Insulin and drugs used in diabetes mellitus

Acarbose (tablets)

Glibenclamide (tablets)

Glickvidone (tablets)

Gliclazide (tablets)

Glimepiride (tablets)

Glipizide (tablets)

Glucagon (powder for injection)

Insulin DLD (solution for injection)

Insulin KD (solution for injection, suspension for injection)

Insulin - Comb (suspension for injection)

Insulin SD (suspension for injection)

Metformin (tablets)

Pioglitazone hydrochloride (tablets)

Repaglinide (tablets)

Section 14. Means for the treatment of kidney and urinary tract diseases

Means for the treatment of prostate adenoma

Alfuzosin (tablets)

Palm creeping extract (capsules)

Tamsulosin (capsules)

Finasteride (tablets)

Therapies for renal failure and organ transplants

Immunoglobulin antithymocyte (solution for infusion)

Keto analogs of amino acids (tablets)

Peritoneal dialysis solution (solution)

Cyclosporine (capsules, solution, concentrate for infusion)

Diuretics

Hydrochlorothiazide (tablets)

Indapamide (pills, tablets)

Mannitol (injection)

Spironolactone (tablets)

Furosemide (tablets, solution for injection)

Section 15. MEDICINES USED FOR OPHTHALMIC DISEASES, NOT OTHERWISE DESIGNED Anti-inflammatory drugs

Azapentacene (solution)

Lodoxamide (eye drops)

Pirenoxine (tablets)

Cytochrome + sodium succinate + adenosine + nicotinamide + benzalkonium chloride (eye drops)

Miotics and Glaucoma Treatments

Dorzolamide (eye drops)

Pilocarpine (eye drops)

Timolol (eye drops)

Regeneration stimulants and retinoprotectors

Emoxipin (solution for injection)

Section 16. DRUGS AFFECTING THE UTERUS

Hormonal agents affecting the muscles of the uterus

Methylergometrine (tablets, injection, drops)

Oxytocin (solution for injection)

Pituitrin (solution for injection)

Ergometrine (tablets)

Other drugs affecting the muscles of the uterus

Hexoprenaline (tablets, solution for injection, concentrate for infusion)

Dinoprost (solution for injection)

Dinoprostone (solution for injection, gel)

Section 17. DRUGS AFFECTING THE RESPIRATORY ORGANS

Anti-asthma drugs

Ambroxol (solution for inhalation and oral administration)

Aminophylline (tablets, solution for injection)

Beclomethasone (capsules, aerosol, spray)

Budesonide (powder for inhalation)

Ipratropium bromide (solution for inhalation)

Ipratropium bromide + fenoterol hydrobromide (solution for inhalation, aerosol)

Cromoglycate disodium (capsules for inhalation, powder, eye drops)

Nedocromil (aerosol, eye drops, spray)

Salbutamol (aerosol, tablets, injection)

Theophylline (tablets, capsules)

Terbutaline (aerosol, tablets, powder for inhalation, solution for injection)

Fenoterol (aerosol, solution for inhalation)

Epinephrine (injection)

Other drugs for the treatment of respiratory diseases, not elsewhere specified

Acetylcysteine (tablets, granules, injection, aerosol)

Section 18. SOLUTIONS, ELECTROLYTES, ACID BALANCE CORRECTION MEANS, FOOD MEANS

Nutrient mixtures

Lofenalac (formula powder)

Phenyl - fries (powder for preparation of the nutritional formula)

Electrolytes, means of correcting acid balance

Potassium asparaginate (tablets, injection)

Potassium iodide (tablets, mixture, solution)

Potassium chloride (solution for injection)

Calcium chloride (tablets, solution for injection)

Magnesium asparaginate (tablets, injection)

Sodium bicarbonate (solution for injection)

Sodium citrate (powder, solution)

Electrolyte solutions (solutions for infusion)

Section 19. VITAMINS AND MINERALS

Vitamins

Menadion (solution for injection)

Thiamin (tablets, injection)