The wage fund ph represents. The concept of the wage fund - composition, structure, formation and analysis

Calculation of payroll (payroll fund) is a practical way of planning personnel costs. Key definitions, ready-made formulas for calculating the annual and monthly payroll, a sample of the staffing table and other useful documents are in the article.

From the article you will learn:

Payroll is a wage fund: what is included in the concept of payroll, how to calculate and plan it, every personnel officer and accountant should know. It is often necessary to operate with this concept, since we are talking about an amount that makes up a significant share of the cost of manufactured products and plays an important role in annual budgeting. The employer pays taxes from the payroll, analyzes it in order to forecast personnel costs, and takes it into account when compiling. An expert will tell you more about the procedure for preparing mandatory statistical reports in Form No. P-4 with information about salaries:

Question from practice

How to fill out and submit a statistical report on Form No. P-4 “Information on the number and wages of employees”?

Nina Kovyazina answers,Deputy Director of the Department of Medical Education and Personnel Policy in Healthcare of the Russian Ministry of Health.

Form No. P-4 must be filled out and submitted at certain intervals by all organizations, regardless of their areas of activity. An exception is provided only for small businesses. If the organization has separate divisions, the form is filled out separately for each division and for the organization as a whole. At the same time, internal...

Payroll is a broad concept that includes, in addition to remuneration for work, also social benefits, compensation, and gifts. See the structure and individual elements of the remuneration system, which clarifies the difference between different types of additional payments and allowances.

There is no single legally approved list of types of payments that make up the payroll: what the wage fund includes, the employer decides independently, based on established practice and the goals pursued. As a rule, the payroll includes wages, vacation pay, insurance contributions, and social benefits to employees.

What is included in the payroll: structural features

Typically, payroll consists of payments to staff in cash, but if you pay part of your earnings in cash, do not forget to include it in the calculations. The wage fund consists of:

- wages and allowances;

- ;

- bonuses and commissions;

- compensation for special labor conditions;

- ;

- vacation pay for basic and additional paid vacations;

- severance pay;

- payment for medical services;

- payment for periods of forced downtime.

The list can be varied by adding gifts, financial assistance to employees, payment for gym memberships, etc. to the number of payments taken into account. In order not to miss anything, analyze the current items of the employer's expenses - from annual bonuses to staff to payments under civil contracts that do not belong to the structure of the wages, but are taken into account when calculating the payroll.

Advice from the editor. When calculating the payroll, do not forget to include payments under contract agreements in the calculation. Despite the fact that performers are not considered employees of the company and are not included in the staffing table, remuneration for services rendered or work performed is reflected in the SZV-M reports and included in the payroll structure. Even if there were no payments under the agreements in the reporting period, the executor. How to correctly formalize civil legal relations with contractors, read the article “”.

Payroll calculation for month and year

Typically, when accounting, auditing and forecasting costs, a monthly or annual payroll is used: detailed instructions will tell you how to calculate this indicator. When calculating the annual payroll, data for the past calendar year is taken into account. To determine the annual payroll, you will need three documents:

- salary slips for the past year;

- time sheets for all 12 months;

- organizations.

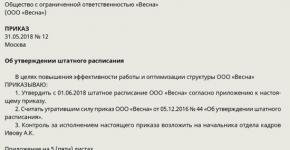

The last document is especially important, since it is the tariff rates of all employees of the organization by position and department. Every employer is required to draw up a staffing table.

There are two simple ways to find out the size of the payroll: the balance sheet calculation formula is used in accounting, while the other, universal, is used when budgeting expenses and analyzing the financial and economic activities of the company. To calculate the payroll on the balance sheet, you should add up the credits of account 70 (“Settlements with personnel for wages”), 73 (“Settlements with personnel for other operations”) and 69 (“Settlements for social insurance and security”) in correspondence with the accounts :

- 08 “Investments in non-current assets”;

- 20 “Main production”;

- 25 “General production expenses”

- 26 “General business expenses”;

- 91 “Other income and expenses”, etc.

The result obtained reflects data for the past year. Dividing it by 12, we get the average monthly payroll. If you need to determine the indicator for a specific month, you will have to separately analyze the monthly balance data.

The general formula for calculating payroll is presented in two versions. The first option is the most optimal, which does not require additional calculations, looks like:

FOTg = ZPg + Dg + Ng

where FOTg is the annual wage fund, ZPg is the salary accrued for the year, Dg is all additional payments for the year, Ng is all allowances for the year. If the organization’s personnel receive, take them into account in the calculations. The second option is more complex:

FOTg = ZPSm * Chsm * 12

where FOTg is the annual wage fund, ZPSm is the average monthly salary, Chsm is the average monthly number of personnel, 12 is the number of months in the year.

Certificate of monthly payroll

Tax authorities who carry out control measures and check how deductions from the payroll are paid and accounted for can request a certificate of the monthly wage fund. A similar document is requested by insurance funds, banks when applying for a loan, etc.

compile it without fail.

- A unified form has not been developed for such cases. When submitting a certificate, please indicate:

name and details of the enterprise; How it will help:

name and details of the enterprise; establish the most profitable remuneration system for the company and register it in personnel documents.

correctly reflect in the documents salaries and tariff rates, regional coefficients, incentive payments.

Payroll is a very important indicator used in statistical reporting and allows one to draw conclusions about the effectiveness of company management. Analyzing labor costs is useful in planning personnel decisions. To calculate the payroll, use simple formulas and documents that each enterprise maintains: staffing schedule, payslips,

Every business owner has to form one if he has people working under him. At the same time, the fund must be provided in full and without excess, since every deviation to a lesser or greater extent is fraught with consequences.

It is very important to contribute to this fund all expenses associated with paying taxes for employees, contributions to the Pension Fund and other mandatory payments.

The wage fund is an intra-organizational fund that includes all payments, in total, related to wages, as well as current social benefits.

The compilation is carried out for a certain period, taking into account the market situation, inflation, and the cost of this type of labor.

Thanks to this fund, the main part of the production cost is formed.

The fund includes:

- Wage;

- All types intended for promotion;

- Cash costs for providing the employee with lunch, accommodation and other necessary conditions;

- Costs associated with the purchase of uniforms;

- Vacation pay, including or forced by students;

- Incentive payments, for example, for the work of teenagers;

- Expenses for medical examination of personnel;

- Compensation for any changes in the company’s activities;

- Additional payments for various achievements;

- Payment for shift service;

- Compensation for long-term inability to work;

- Payments to external employees;

- Encouraging students to practice.

The following cannot be taken into account:

- Target payments and bonuses from special funds;

- Bonuses for the year;

- Material support of any kind;

- A certain type of supplement to pension payments;

- Some type of compensation;

- Free loans, payment for vouchers and travel;

What does the employee wage fund consist of? The answer is in this video:

Payroll tax

This tax is deducted from any salary in the amount of 13%.

The peculiarity of the tax is that it is calculated once a month, while the law provides for the payment of wages at least twice a month.

Examples of calculations

The payroll for 2017 is 215,000 rubles, which means that the costs associated with wages will be:

- In the Pension Fund of the Russian Federation – 47,300 rubles;

- In the Social Insurance Fund - 6,235 rubles plus 1,290 for injuries;

- In the Federal Compulsory Medical Insurance Fund - 10,965 rubles.

All data is calculated by economists and included in the financial plan of the enterprise.

Enterprise fund planning

In order for an organization to develop progressively, proper planning of work is necessary, which is why payroll is needed.

There are characteristic features of its use at the enterprise:

- The percentage ratio for the level standard and total production volumes is displayed;

- Incremental method - with an increase in productivity, the salary level also increases by 1%;

- Residual methods in which the fund acts as a major part of the profits, which increases the company's profits.

Such resources are formed as a residual amount of profit, but before this, funds are formed in the social, scientific, technical and production sectors.

This indicator is displayed with a reserve, taking into account the pace of work, execution of orders and contracts.

Important: a salary fund can be created by those companies that are completely self-sufficient; if third-party finance is needed for the life of the enterprise, a reserve fund is formed.

Formula for calculating the wage fund at an enterprise.

Formula for calculating the wage fund at an enterprise. Social benefits included in the payroll

These payments relate to:

- Severance pay upon expiration of a fixed-term contract;

- Amounts to provide workers in connection with the reorganization of the company;

- Incentive payments upon retirement;

- Additional payment to employees of retirement age;

- Insurance payments of any nature in favor of employees;

- Insurance payments under a voluntary insurance contract;

- Payments to medical institutions that provide health improvement to workers;

- Payment for travel packages;

- Compensation and benefits;

- Payment for subscriptions to sports and entertainment complexes, subscription to correspondence and others.

Tax fund calculation

This calculation applies:

- Salary;

- Piece rate;

- Tariff rate;

- Additional payments and bonuses.

In this case, it is necessary to know the data of the statements, the number of employees and the average working day.

The calculation is performed using the formula:

Payroll = Salary * (Salary + Bonus + Regional coefficient)

Calculation examples:

If the company employs 475 people, the fund is 175,768.5 rubles.

Employees work in divisions, 100 of them work in the 1st division, then the salary index for it is 1.074 shares of a unit.

It turns out that the payroll for this unit is 39,738 rubles.

Contributions to the Pension Fund

Such deductions are made for employees at a rate of 22%; if the threshold of 711,000 is exceeded, the rate is 10%; employees working in conditions of increased danger or harmfulness to work are entitled to increased rates of 9% and 6%, respectively, for these categories.

The issue of determining the wage fund, the calculation formula is given below, occupies a primary place among employers among the expenditure indicators of financial and economic activity. There is no strict formulation of such a concept in the legislation, and when calculating, planning and subsequent analysis of the payroll, it is necessary to take into account the specifics of the organization’s work and individual categories of employees. Also, the amount of tax charges to the budget and extra-budgetary funds depends on the size of the fund.

The total amount of funds allocated for settlements with personnel for the performance of official duties constitutes labor costs (payroll). The form of payment of earnings, cash or in kind, does not matter. The billing period is recognized as a year, month, quarter, day or hour.

The main components of the payroll structure:

- Salary in monetary terms.

- Salary in kind in the form of the cost of production.

- Additional payments and allowances for working on weekends, holidays, overtime/night time, paid time off.

- Bonuses, incentives for length of service, continuous employment with one employer.

- Compensation in the process of dismissal, for unused vacation, for harmfulness, dangerous/difficult working conditions.

- Vacation pay, including additional, social, educational; business trips, sick leave.

- Consulting fees, payments for one-time services.

- Reimbursement of the cost of health insurance for employees of transport enterprises.

- Various incentive payments, for example, gifts and incentives, bonuses or promotions.

- Special types of pension accruals.

- Social benefits, including maternity benefits.

- Payment for downtime caused by no fault of the staff.

- Compensation for the cost of food, housing and communal services, accommodation.

What is not included in the payroll:

- One-time annual bonuses based on performance results.

- Prizes, the source of which are special funds of the enterprise.

- Dividends.

- Material and social assistance.

- Cost of vouchers, benefits.

- Compensation for travel, except for rotational work.

- Free loans to staff.

Difference from FZP

The wording of the payroll and payroll is very similar, but they have an important difference. The size of the wage fund consists of the amount of wages accrued to employees for a specific period and social benefits. The components of the wage fund are the amount of earnings minus social, advance and other payments for the same period of time. For example, the company accrued 450,000 rubles for October; and payments for the month amounted to: 220,000 rubles - salary for the 2nd half of September and 150,000 rubles - advance payment for October. As a result, payroll for October = 450,000 rubles, and wages for October = 370,000 rubles.

The coincidence of the results of payroll and wages is possible in companies where an incentive approach to settlements with personnel is not used and only “bare” wages are paid. When planning expenses and profitability of an organization, the payroll value is used.

How to calculate payroll, also known as wage fund

The algorithm for calculating the wage fund depends on the characteristics of the business entity. Methods of salary payments, piece rates or wage tariffication can be used. The final amount consists of the number of employees of the organization (full-time and part-time), average prices for labor, estimated social costs and the billing period.

You will need salary slips, time sheets, and staffing schedules. There are 2 main methods of calculation.

The first uses the formula:

Payroll = Average monthly earnings x Average number of personnel x Billing period (for a year 12 months)

Example. Let’s assume that at the Yugneftemash enterprise the total salary per month = 485 thousand rubles, the average number of employees = 15 employees, then the annual payroll = 485 x 15 x 12 = 87,300 thousand rubles.

The second method uses a different formula:

Payroll = (Annual salary + annual allowances) x RK - this is the regional coefficient established for certain categories of enterprises

Example. Let's say the company "Stimul" is located in a special climatic territory - the Magadan region. Total annual salary = 15 million rubles, allowances for the year = 3.5 million rubles, RK for the territorial zone - 1.7. Then payroll for the year = (15 + 3.5) x 1.7 = 31.45 million rubles.

Note! When determining the monthly/quarterly payroll, you should change the value of the calculation period in the above formulas, and take the average number, salary and allowances for the required period of time.

How to calculate payroll

The calculation of the wage depends on the adopted in-house methodology and local regulations on remuneration. The payroll structure usually consists of the following types of remuneration:

- Salary.

- Payment for downtime, vacations and other unworked time.

- Various incentives, for example, bonuses, bonuses for length of service.

- Reimbursement of personnel costs for housing and communal services, food, accommodation, etc.

The calculation is carried out according to the same principles and formulas that are used when calculating payroll.

If you find an error, please highlight a piece of text and click Ctrl+Enter.

The wage fund is the amount of funds of a business entity intended to pay wages.

Calculation

When carrying out any production process, various costs must be taken into account in order to formulate a reliable cost of production. One of the significant cost items is employee salaries. It is from the funds that directly go to pay for this item of expenditure that the wage fund is formed. This indicator can be represented as a formula:

FOT = OZ + DZ + OS, where:

- OZ - the basic salary of the company's employees;

- DZ - additional salary;

- OS - contributions to various social funds.

Based on the division of wages into basic and additional, there are various funds for its payment.

The basic salary fund is calculated based on the sum of prices for finished products multiplied by the planned volume. We must not forget about the bonus due to key employees, which is calculated based on 60% of wages.

Thus, the basic salary should be equal to the sum of accruals and bonuses. This may also include additional payments such as financial assistance, a bonus for special merits, etc.

When calculating the salaries of employees, the monthly salary, the number of employees according to the staffing table, the number of months in which they worked, and the standard bonus due are taken into account.

Payroll charges

In accordance with current legislation, appropriate charges are made on wage amounts in the amount of 39.5%. From the amount received, amounts in the following amounts are transferred to various insurance funds:

29% - Pension Fund;

3.6% - health insurance;

5.4% - social insurance;

1.5% - employment fund.

The main purpose of the payroll

Economists use this term quite successfully when planning production, as well as in the process of implementing management functions in the financial sphere of a business entity. In fact, they determine the total amount of personnel costs that an enterprise may incur in the current month, quarter or year. In this case, the corresponding actual indicators of the previous period are taken into account and the validity of their payment is analyzed. Thus, in the process of carrying out such monitoring, one-time payments are identified that can be avoided during this period, but other expenses must also be taken into account, for example, with the retirement of employees (additional benefits may be paid), or with increased financial assistance (for high labor results).

Based on practice, the wage fund is formed according to the average indicator. The relevant parameters for at least three previous periods are taken into account.

Features of determining payroll

If we are talking about enterprises in the trade sector, then the wage fund is formed based on projected sales. This is due to the fact that enterprises in this area operate a piece-rate payment system, and employees are paid wages as a percentage based on the volume of products sold. A similar principle applies in the manufacturing sector of the economy.

In the service sector, there is mainly a time-based system, which provides for the calculation of wages for hours actually worked.

Thus, the wage fund in the forecasted amounts is included in the structure of planned expenses. This indicator is reflected in the cash flow, as well as in the formation of the enterprise budget.

Differences in the amount of payroll when setting costs and paying wages

To hear the terms about the actual payment of wages and the expenses of the business entity itself for this item are quite similar, but it is necessary to remember their fundamental differences. When calculating the cost of finished products, the accrual principle must be used (accounts are kept of payments due to employees). Sometimes the actual payment differs slightly from the accruals due to the transfer of part of the salary to the next month. Thus, payment is often made in two stages: advance payment and final payment for the month. And it is the second part that can be paid in the first ten days of the next month.

Sample of fund formation

For example, in May, employees at the enterprise formed a wage fund in the amount of 7 million rubles. In the same month, at the very beginning, the balance of the April salary in the amount of 1.5 million was paid. An advance payment for May in the amount of 3.5 million was also issued. Therefore, actual salary payments amounted to 5.0 million rubles (1.5 + 3.5), and the wage fund - 7 million rubles.

Conclusion

Summarizing the material presented, we can formulate the following conclusions:

The wage fund must include absolutely all accruals that are due to employees for the performance of their functional duties during the month in which this accrual was made. The result obtained cannot be taken into account in any other reporting period.

The amount of financial resources intended for payment of wages must include the volume of all cash payments, based on the obligations of the business entity for settlements with employees whose due date has already come. Therefore, the indicated amount may include liabilities for both current and previous periods.

The wage fund is a convenient tool for planning personnel costs. Read about what is included in it, how to calculate and plan, download samples of the necessary documents

Read our article:

Payroll and wage fund: differences

Although the concepts of payroll and wage fund (WF) are somewhat similar, there are still differences. When we talk about wages, we are talking only about those amounts that are due to the staff for the time worked. Payroll is the same amount for wages plus social benefits and compensation. Forecasting its value plays an important role in annual budgeting, because it makes it possible to analyze salary expenses both for the organization as a whole and in the context of individual structural divisions and departments.

Parts of the payroll are not legally prescribed, so its composition may vary in different sources. Some employers add into the calculation the costs of recruiting, training and adaptation of personnel, but this is not true. The indicator itself can be calculated either monthly or for the whole year.

What does payroll include?

So, what does the wage fund consist of:

- accrued wages for the analyzed period (including bonuses);

- the amount of earnings given in kind;

- incentive payments;

- compensation payments for special labor conditions;

- vacation pay (for annual, additional vacations);

- compensation for missed vacations;

- payment of sick leave;

- payment for forced downtime;

- amounts paid under construction contracts;

- payment for medical services;

- severance pay;

- present.

Since the legislation does not contain a list of costs included in the payroll, this list may vary. There is no clear opinion about the possibility or impossibility of including costs for sports activities, tourist trips, annual bonuses, and financial assistance. Therefore, the employer can base this issue on the objectives that he pursues when analyzing this indicator.

Most often, in analysis and forecasting, employers use the annual payroll indicator. It can be calculated both for the past year to analyze the completed period, and for the next year to predict future costs and draw up an annual budget. The monthly average is less commonly used. The goals of its calculation are the same, but with a shorter forecast time.

Calculation formula

There are 2 methods for calculating payroll. One is used for accounting purposes, calculated from the balance sheet and used in accounting and statistical reporting.

The second is used to calculate the indicator when analyzing financial and economic activities and budgeting expenses for future periods. The general formula might look like this:

Payroll = Sum of wages + incentives and compensation payments.

The balance sheet calculation is based on the balance sheet items.

The indicator is determined by adding the credit of account 70 “Settlements with personnel for wages” and the debit of the accounts:

- 20 “Main production”;

- 25 “General production expenses”;

- 26 “General business expenses”;

- 08 “Investments in non-current assets”;

- 91 “Other income and expenses”, etc.

To calculate the indicator for future periods, it is worth taking into account not only the accumulated data for the past period, but also:

- indexation of salaries (tariff rates) in the future;

- planned change in the number of staff, both upward and downward;

- planned introduction of new bonuses and incentive payments;

- introduction of new social benefits.

Otherwise, the calculated value will not reflect the forecasted indicator, but will be an indicator of the previous period.

Annual fund

The methodology for calculating the indicator may be different. For analysis, a specialist must first arm himself with payslips for each month and a staffing table.

There is no single formula for calculating the annual payroll. Therefore, in practice, 2 approaches are used.

The first approach is based on a preliminary calculation of the average monthly salary and average headcount. The formula looks like this:

FOTyear=ZPSm*Hsm*12, where

Payroll year - annual wage fund;

ZPSm - average monthly salary;

Chsm - average number of personnel;

12 is the number of months in a year.

This approach involves the calculation of several additional indicators, which certainly does not make it optimal.

The second formula looks like this:

Payroll year=Salary year+Dyear+Kyear, where

ZPyear - accrued wages for the year;

Ngod - allowances for the year.

All indicators should be entered with a regional coefficient if it is used in your territory.

How to calculate the average monthly payroll

Depending on the goals pursued, the average monthly wage fund can be calculated in two ways.

- On an annual basis.

- Based on data from the past month.

The average monthly payroll for a calendar year is calculated by dividing the annual payroll by 12 months. With an existing annual indicator, the procedure is not difficult. Whereas calculations of the indicator for the past month require the addition of all costs for the analyzed period.

Certificate of monthly payroll

During a tax audit, employers are often asked to provide a certificate of monthly payroll. It includes data on the issuance of funds to personnel in terms of wages, incentives and compensation payments.

The document is requested not only by tax authorities, but also by bankers when applying for a loan, and can also be used for forecasting within an enterprise.

For companies financed from the budget, such a certificate is required.

It states:

- name of the enterprise;

- billing period;

- carryover balance of the previous period;

- amounts accrued (payment for time worked, bonuses, vacation pay, sick leave, compensation payments, etc.);

- amounts transferred.

Most often, such a certificate is presented in the form of a table detailing cost items. There is no unified form; the document must be prepared in accordance with the requirements of the requesting organization. Often banks have a specially created template.

Analysis of indicators

Analysis of the calculated wage fund allows us to identify discrepancies between planned values and what actually happened. Based on the analysis, the strengths and weaknesses of the company are determined, and based on its results, the company develops an action plan to increase operational efficiency.

For a more detailed assessment, indicators for departments, structural units, the constant part of wages and the variable part (work under civil contracts) are considered separately. To identify the period in which actual indicators deviated from the planned ones, payroll analysis is carried out monthly or quarterly.

A positive indicator is considered to be an increase in labor productivity at a faster rate than the level of wages.